Answered step by step

Verified Expert Solution

Question

1 Approved Answer

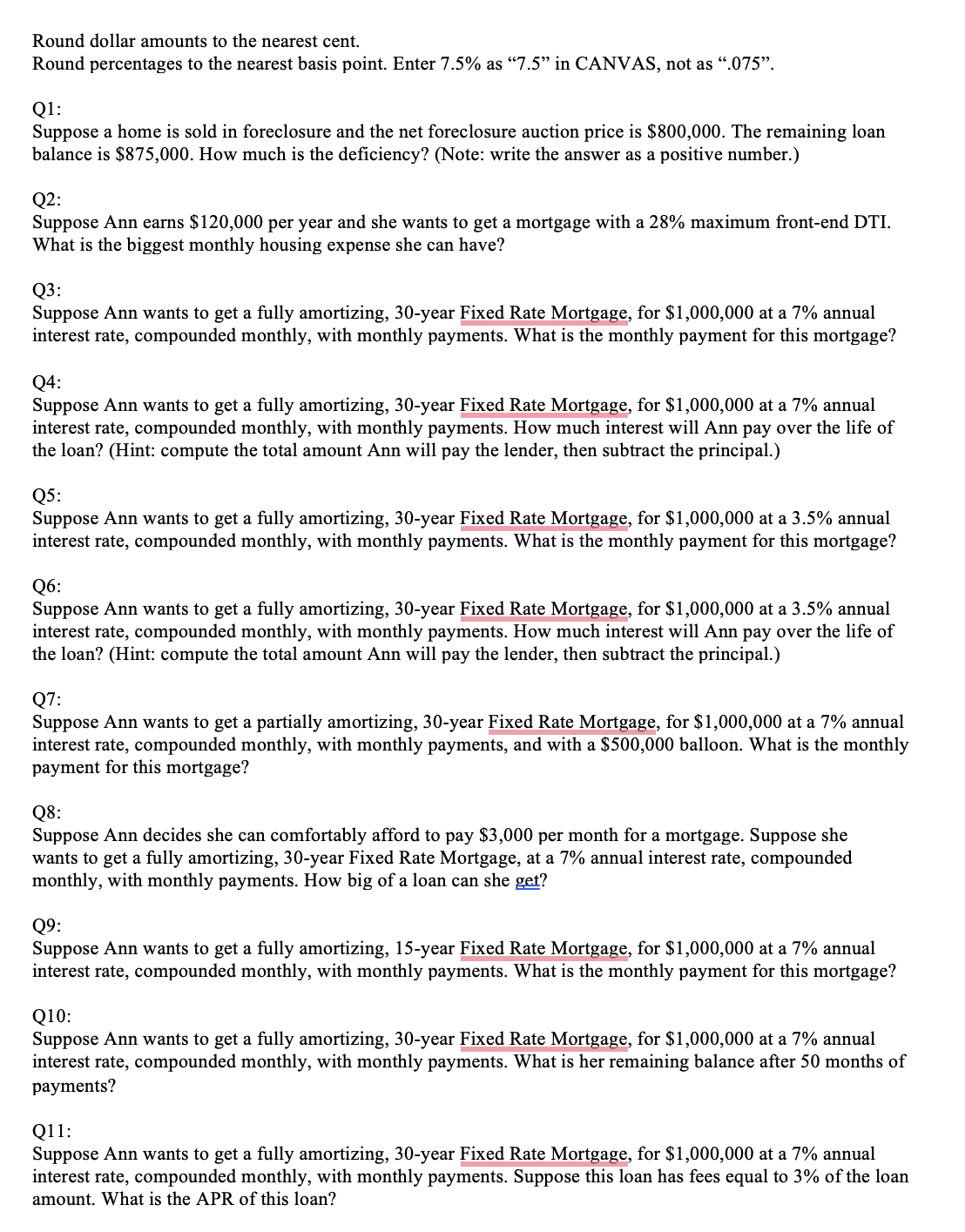

show work please Round dollar amounts to the nearest cent. Round percentages to the nearest basis point. Enter 7.5% as 7.5 in CANVAS, not as

show work please

Round dollar amounts to the nearest cent. Round percentages to the nearest basis point. Enter 7.5% as "7.5" in CANVAS, not as ".075". Suppose a home is sold in foreclosure and the net foreclosure auction price is $800,000. The remaining loan balance is $875,000. How much is the deficiency? (Note: write the answer as a positive number.) Suppose Ann earns $ 120,000 per year and she wants to get a mortgage with a 28% maximum front-end DTI. What is the biggest monthly housing expense she can have? Suppose Ann wants to get a fully amortizing, 30-year Fixed Rate Mort a e for $1,000,000 at a 7% annual interest rate, compounded monthly, with monthly payments. What is the monthly payment for this mortgage? Suppose Ann wants to get a fully amortizing, 30-year Fixed Rate Mort a e for $1,000,000 at a 7% annual interest rate, compounded monthly, with monthly payments. How much interest will Ann pay over the life of the loan? (Hint: compute the total amount Ann will pay the lender, then subtract the principal.) Suppose Ann wants to get a fully amortizing, 30-year Fixed Rate Mortgage, for $1,000,000 at a 3.5% annual interest rate, compounded monthly, with monthly payments. What is the monthly payment for this mortgage? Suppose Ann wants to get a fully amortizing, 30-year Fixed Rate Mortgagg, for $1,000,000 at a 3.5% annual interest rate, compounded monthly, with monthly payments. How much interest will Ann pay over the life of the loan? (Hint: compute the total amount Ann will pay the lender, then subtract the principal.) (27 : Suppose Ann wants to get a partially amortizing, 30-year Fixed Rate Mortgage, for $1,000,000 at a 7% annual interest rate, compounded monthly, with monthly payments, and with a $500,000 balloon. What is the monthly payment for this mortgage? Suppose Ann decides she can comfortably afford to pay $3,000 per month for a mortgage. Suppose she wants to get a fully amortizing, 30-year Fixed Rate Mortgage, at a 7% annual interest rate, compounded monthly, with monthly payments. How big of a loan can she get? Suppose Ann wants to get a fully amortizing, 15-year Fixed Rate Mort a e for $1,000,000 at a 7% annual interest rate, compounded monthly, with monthly payments. What is the monthly payment for this mortgage? Q10: Suppose Ann wants to get a fully amortizing, 30-year Fixed Rate Mort a e for $1,000,000 at a 7% annual interest rate, compounded monthly, with monthly payments. What is her remaining balance after 50 months of payments? Qli Suppose Ann wants to get a fully amortizing, 30-year Fixed Rate Mortgage, for $1,000,000 at a 7% annual interest rate, compounded monthly, with monthly payments. Suppose this loan has fees equal to 3% of the loan amount. What is the APR of this loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started