Show work please

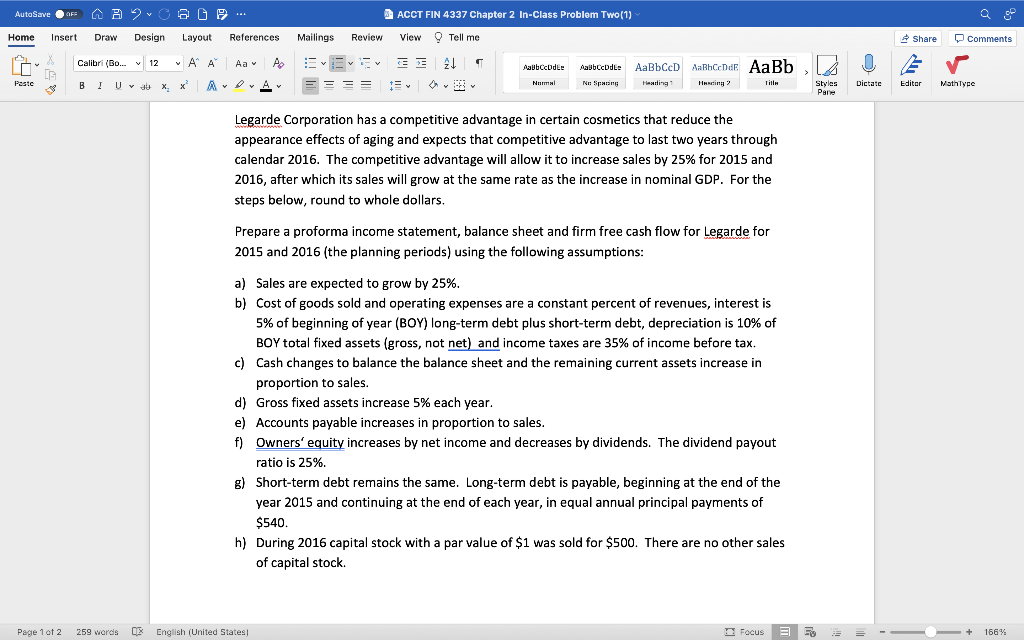

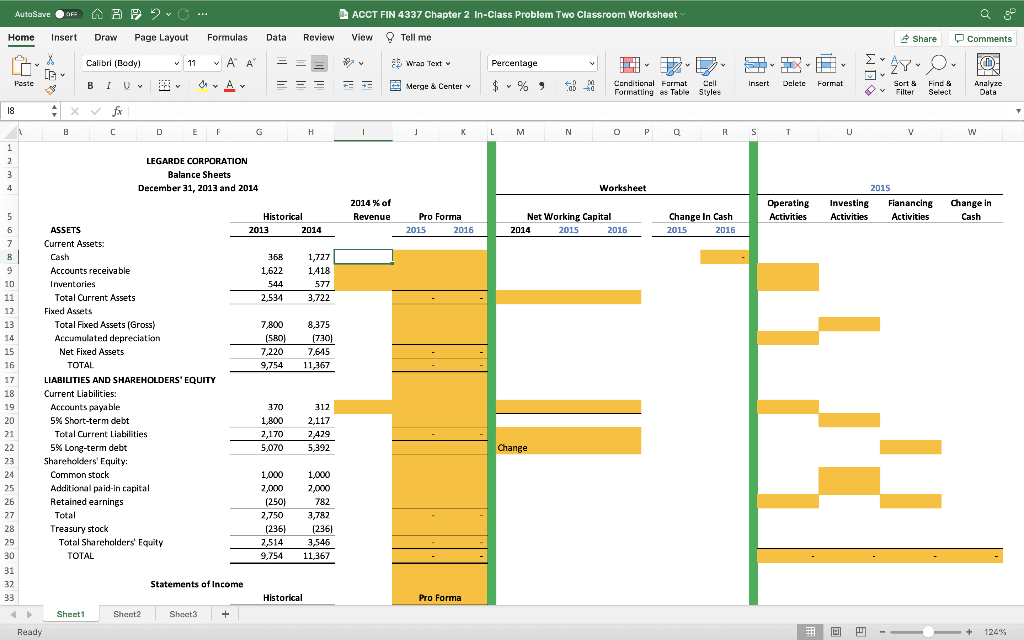

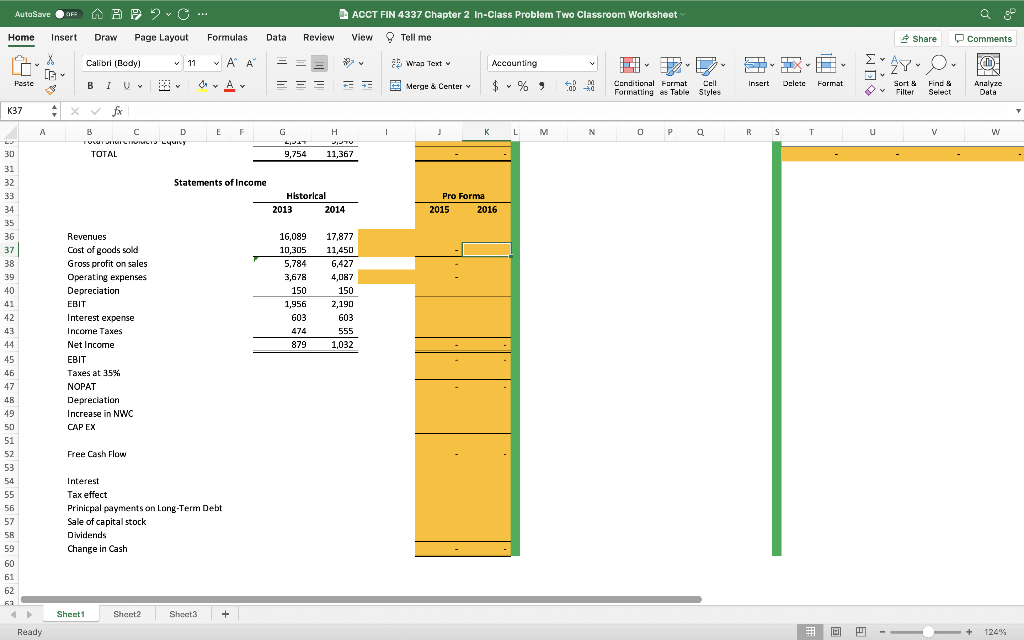

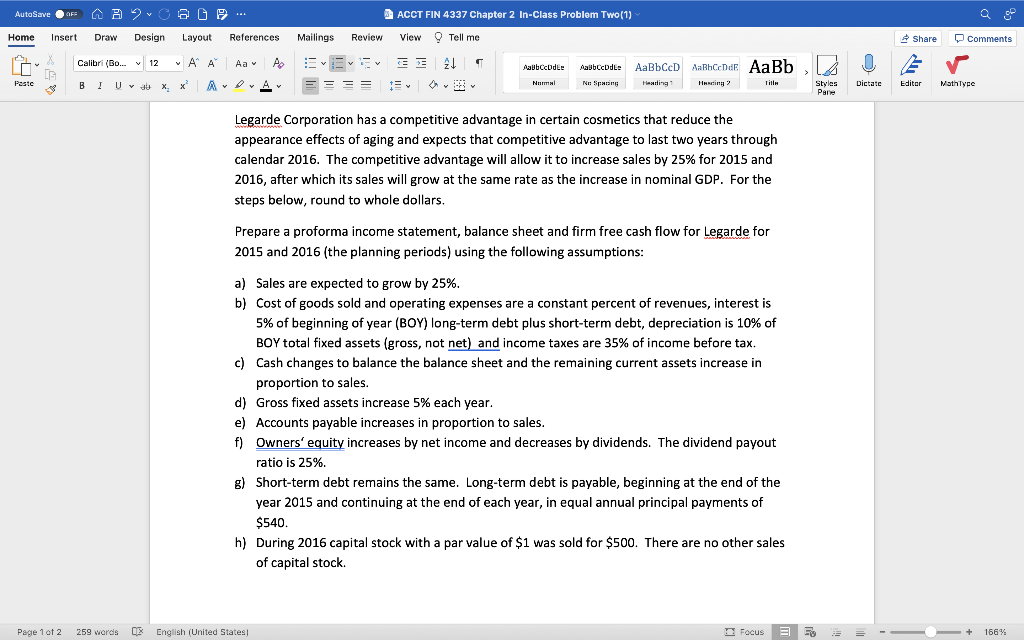

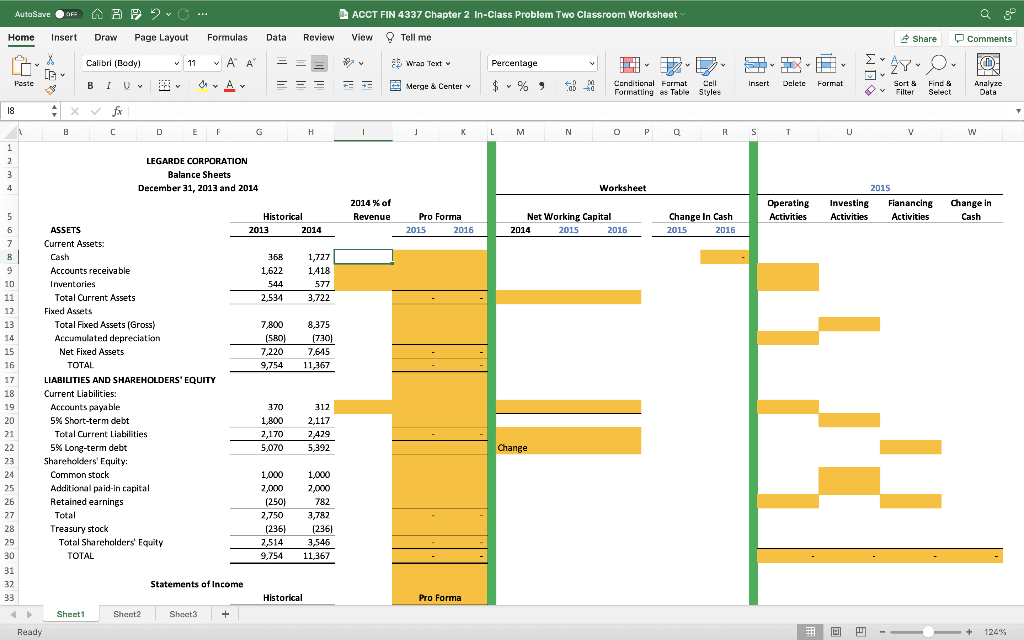

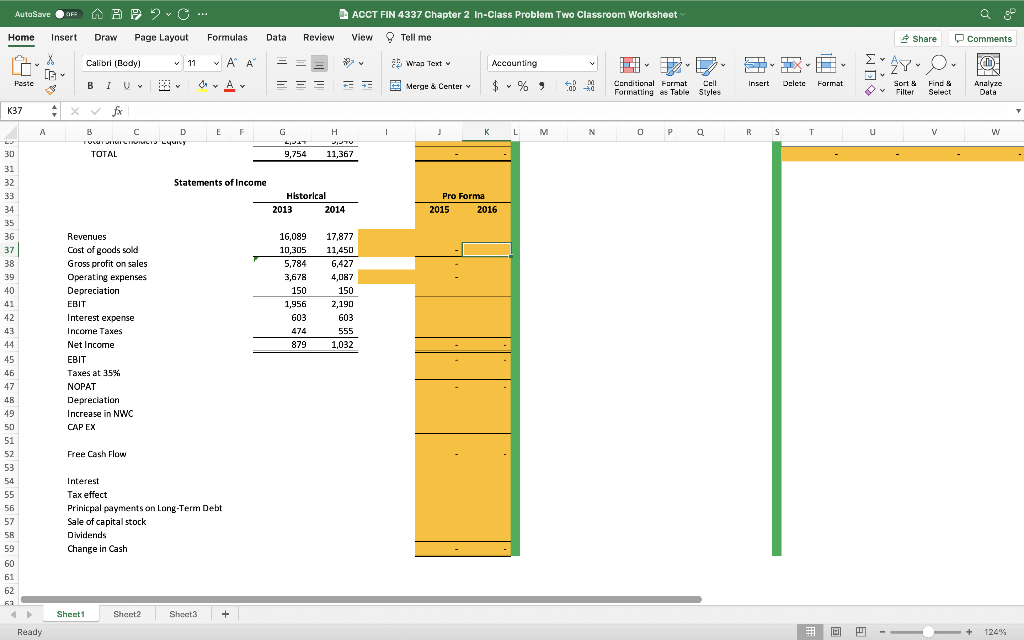

AutoSave OF AA OOG ACCT FIN 4337 Chapter 2 In-Class Problem Two(1) Home Insert Draw Design Layout References Mailings Review Share Comments View Tell me 21 LLE n Paste Calibri (Bo... 12 ~ A Aav A B ! | v 4 8 x ADAY AalbCeDdle Nu Sparing AaBbCD AaBbccdde AaBb Nam! Heating Hancing Title Dictate Editor Mathilyce Styles Pane $ Legarde Corporation has a competitive advantage in certain cosmetics that reduce the appearance effects of aging and expects that competitive advantage to last two years through calendar 2016. The competitive advantage will allow it to increase sales by 25% for 2015 and 2016, after which its sales will grow at the same rate as the increase in nominal GDP. For the steps below, round to whole dollars. Prepare a proforma income statement, balance sheet and firm free cash flow for Legarde for 2015 and 2016 (the planning periods) using the following assumptions: a) Sales are expected to grow by 25%. b) Cost of goods sold and operating expenses are a constant percent of revenues, interest is 5% of beginning of year (BOY) long-term debt plus short-term debt, depreciation is 10% of BOY total fixed assets (gross, not net) and income taxes are 35% of income before tax. c) Cash changes to balance the balance sheet and the remaining current assets increase in proportion to sales. d) Gross fixed assets increase 5% each year. e) Accounts payable increases in proportion to sales. f) Owners' equity increases by net income and decreases by dividends. The dividend payout ratio is 25%. g) Short-term debt remains the same. Long-term debt is payable, beginning at the end of the year 2015 and continuing at the end of each year, in equal annual principal payments of $540. h) During 2016 capital stock with a par value of $1 was sold for $500. There are no other sales of capital stock Page 1 of 2 259 wards OX English (United States Focus + 156% ACCT FIN 4337 Chapter 2 In-Class Problem Two Classroom Worksheet View Tell me Data Review Share Comments AutaSave a C l = 3 x ... OF AP2 Home Insert Draw Page Layout Formulas - X Calibri (Body) v 11 v P A [G Paste BIU OA ah Wraa Text Percentage v SR V LIX V () v = = - Merge & Center $ % , Insert Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select Analyze Data 18 . x fx T B C C E F G H 1 K L M N O P 0 R S T U V w w 1 2 3 4 LEGARDE CORPORATION Balance Sheets December 31, 2013 and 2014 Worksheet 2014% of Revenue Operating Activities 2015 Investing Fianancing Activities Activities Change in Cash Historical 2013 2014 Pro Forma 2015 2016 Net Working Capital 2014 2015 2016 Change In Cash 2015 2016 368 1,622 544 1,727 1,418 577 3,722 2,534 7,800 (580) 7,220 9,754 8,375 (730) 7,615 11,367 5 6 7 B 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 ASSETS Current Assets Cash Accounts receivable Inventories Total Current Assets Fixed Assets Total Fixed Assets (Gross) Accumulated depreciation Net Fixed Assets TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable 5% Short-term debt Total Current Liabilities 5% Long-term debt Shareholders' Equity: Common stock Additional paid-in capital Retained earnings Total Treasury stock Total Shareholders' Equity TOTAL 370 1.800 2,170 5,070 312 2,117 2,429 5,392 Change 1,000 2,000 (250) 2,750 (2361 2,514 9,754 1,000 2,000 782 3,782 (236) 3,546 11,367 Statements of income Historical Pro Forma Sheet1 Sheet2 Sheet3 + Ready S: 124% AutoSaver P... ACCT FIN 4337 Chapter 2 In-Class Problem Two Classroom Worksheet 2 - View Tell me Insert Draw Page Layout Formulas Home - Data Review Share Comments Calibri (Body) v 11 v P A ah Wraa Text Accounting v SE V LIX X [G V () Paste B 1 - OA = = -- Merge & Center $ %, Insert Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select Analyze Data K37 fx A E F G I K L M N 0 P R S T U V w TUNTURI LILIS LYMISY TOTAL H UTV 11,367 9,754 - Statements of Income Historical 2013 2014 Pro Forma 2015 2016 Revenues Cost of goods sold Gross profit on sales Operating expenses Depreciation EBIT Interest expense Income Taxes Net Income EBIT Taxes at 35% NOPAT Depreciation Increase in NWC CAP EX 16,089 10,305 5,784 3,678 150 1,956 603 474 879 3D 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 5B 59 60 61 62 67 17,877 11,450 6,427 4,087 150 2,190 603 555 1,032 Free Cash Flow Interest Tax effect Prinicpal payments on Long-Term Debt Sale of capital stock Dividends Change in Cash Sheet1 Sheet2 Shect3 + Ready S: 124% AutoSave OF AA OOG ACCT FIN 4337 Chapter 2 In-Class Problem Two(1) Home Insert Draw Design Layout References Mailings Review Share Comments View Tell me 21 LLE n Paste Calibri (Bo... 12 ~ A Aav A B ! | v 4 8 x ADAY AalbCeDdle Nu Sparing AaBbCD AaBbccdde AaBb Nam! Heating Hancing Title Dictate Editor Mathilyce Styles Pane $ Legarde Corporation has a competitive advantage in certain cosmetics that reduce the appearance effects of aging and expects that competitive advantage to last two years through calendar 2016. The competitive advantage will allow it to increase sales by 25% for 2015 and 2016, after which its sales will grow at the same rate as the increase in nominal GDP. For the steps below, round to whole dollars. Prepare a proforma income statement, balance sheet and firm free cash flow for Legarde for 2015 and 2016 (the planning periods) using the following assumptions: a) Sales are expected to grow by 25%. b) Cost of goods sold and operating expenses are a constant percent of revenues, interest is 5% of beginning of year (BOY) long-term debt plus short-term debt, depreciation is 10% of BOY total fixed assets (gross, not net) and income taxes are 35% of income before tax. c) Cash changes to balance the balance sheet and the remaining current assets increase in proportion to sales. d) Gross fixed assets increase 5% each year. e) Accounts payable increases in proportion to sales. f) Owners' equity increases by net income and decreases by dividends. The dividend payout ratio is 25%. g) Short-term debt remains the same. Long-term debt is payable, beginning at the end of the year 2015 and continuing at the end of each year, in equal annual principal payments of $540. h) During 2016 capital stock with a par value of $1 was sold for $500. There are no other sales of capital stock Page 1 of 2 259 wards OX English (United States Focus + 156% ACCT FIN 4337 Chapter 2 In-Class Problem Two Classroom Worksheet View Tell me Data Review Share Comments AutaSave a C l = 3 x ... OF AP2 Home Insert Draw Page Layout Formulas - X Calibri (Body) v 11 v P A [G Paste BIU OA ah Wraa Text Percentage v SR V LIX V () v = = - Merge & Center $ % , Insert Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select Analyze Data 18 . x fx T B C C E F G H 1 K L M N O P 0 R S T U V w w 1 2 3 4 LEGARDE CORPORATION Balance Sheets December 31, 2013 and 2014 Worksheet 2014% of Revenue Operating Activities 2015 Investing Fianancing Activities Activities Change in Cash Historical 2013 2014 Pro Forma 2015 2016 Net Working Capital 2014 2015 2016 Change In Cash 2015 2016 368 1,622 544 1,727 1,418 577 3,722 2,534 7,800 (580) 7,220 9,754 8,375 (730) 7,615 11,367 5 6 7 B 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 ASSETS Current Assets Cash Accounts receivable Inventories Total Current Assets Fixed Assets Total Fixed Assets (Gross) Accumulated depreciation Net Fixed Assets TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable 5% Short-term debt Total Current Liabilities 5% Long-term debt Shareholders' Equity: Common stock Additional paid-in capital Retained earnings Total Treasury stock Total Shareholders' Equity TOTAL 370 1.800 2,170 5,070 312 2,117 2,429 5,392 Change 1,000 2,000 (250) 2,750 (2361 2,514 9,754 1,000 2,000 782 3,782 (236) 3,546 11,367 Statements of income Historical Pro Forma Sheet1 Sheet2 Sheet3 + Ready S: 124% AutoSaver P... ACCT FIN 4337 Chapter 2 In-Class Problem Two Classroom Worksheet 2 - View Tell me Insert Draw Page Layout Formulas Home - Data Review Share Comments Calibri (Body) v 11 v P A ah Wraa Text Accounting v SE V LIX X [G V () Paste B 1 - OA = = -- Merge & Center $ %, Insert Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select Analyze Data K37 fx A E F G I K L M N 0 P R S T U V w TUNTURI LILIS LYMISY TOTAL H UTV 11,367 9,754 - Statements of Income Historical 2013 2014 Pro Forma 2015 2016 Revenues Cost of goods sold Gross profit on sales Operating expenses Depreciation EBIT Interest expense Income Taxes Net Income EBIT Taxes at 35% NOPAT Depreciation Increase in NWC CAP EX 16,089 10,305 5,784 3,678 150 1,956 603 474 879 3D 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 5B 59 60 61 62 67 17,877 11,450 6,427 4,087 150 2,190 603 555 1,032 Free Cash Flow Interest Tax effect Prinicpal payments on Long-Term Debt Sale of capital stock Dividends Change in Cash Sheet1 Sheet2 Shect3 + Ready S: 124%