Answered step by step

Verified Expert Solution

Question

1 Approved Answer

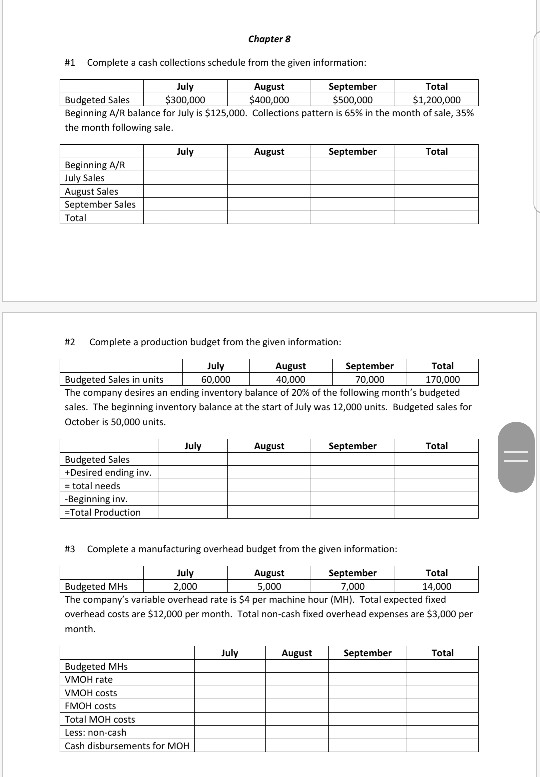

show work please Chapter 8 #1 Complete a cash collections schedule from the given information: July August September Total Budgeted Sales $300,000 $400,000 $500,000 $1,200,000

show work please

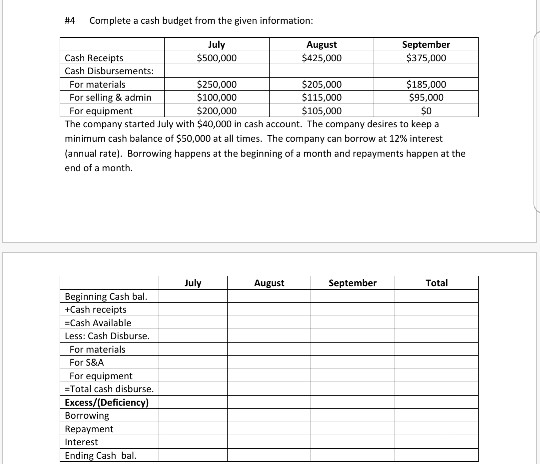

Chapter 8 #1 Complete a cash collections schedule from the given information: July August September Total Budgeted Sales $300,000 $400,000 $500,000 $1,200,000 Beginning A/R balance for July is $125,000. Collections pattern is 65% in the month of sale, 35% the month following sale. August September Beginning A/R July Sales August Sales September Sales Total #2 Complete a production budget from the given information: | July August September Total Budgeted Sales in units 60,000 40,000 70,000 170,000 The company desires an ending inventory balance of 20% of the following month's budgeted sales. The beginning inventory balance at the start of July was 12,000 units. Budgeted sales for October is 50,000 units. July August September Total Budgeted Sales +Desired ending inv. total needs - Beginning inv. Total Production #3 Complete a manufacturing overhead budget from the given information: July August September Total Budgeted MHS 2,000 5,000 7.000 14.000 The company's variable overhead rate is $4 per machine hour (MH). Total expected fixed overhead costs are $12,000 per month. Total non-cash fixed overhead expenses are $3,000 per month. July August September Total Budgeted MHS VMOH rate VMOH costs FMOH costs Total MOH costs Less: non-cash Cash disbursements for MOH #4 Complete a cash budget from the given information: July August September Cash Receipts $500,000 $425,000 $375,000 Cash Disbursements: For materials $250,000 $ 205,000 $185.000 For selling & admin $100,000 $115.000 $95,000 For equipment $200,000 $105,000 The company started July with $40,000 in cash account. The company desires to keep a minimum cash balance of $50,000 at all times. The company can borrow at 12% interest (annual rate). Borrowing happens at the beginning of a month and repayments happen at the end of a month. $0 July August September Total Beginning Cash bal. Cash receipts Cash Available Less: Cash Disburse. For materials For S&A For equipment Total cash disburse. Excess/(Deficiency) Borrowing Repayment Interest Ending Cash balStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started