Answered step by step

Verified Expert Solution

Question

1 Approved Answer

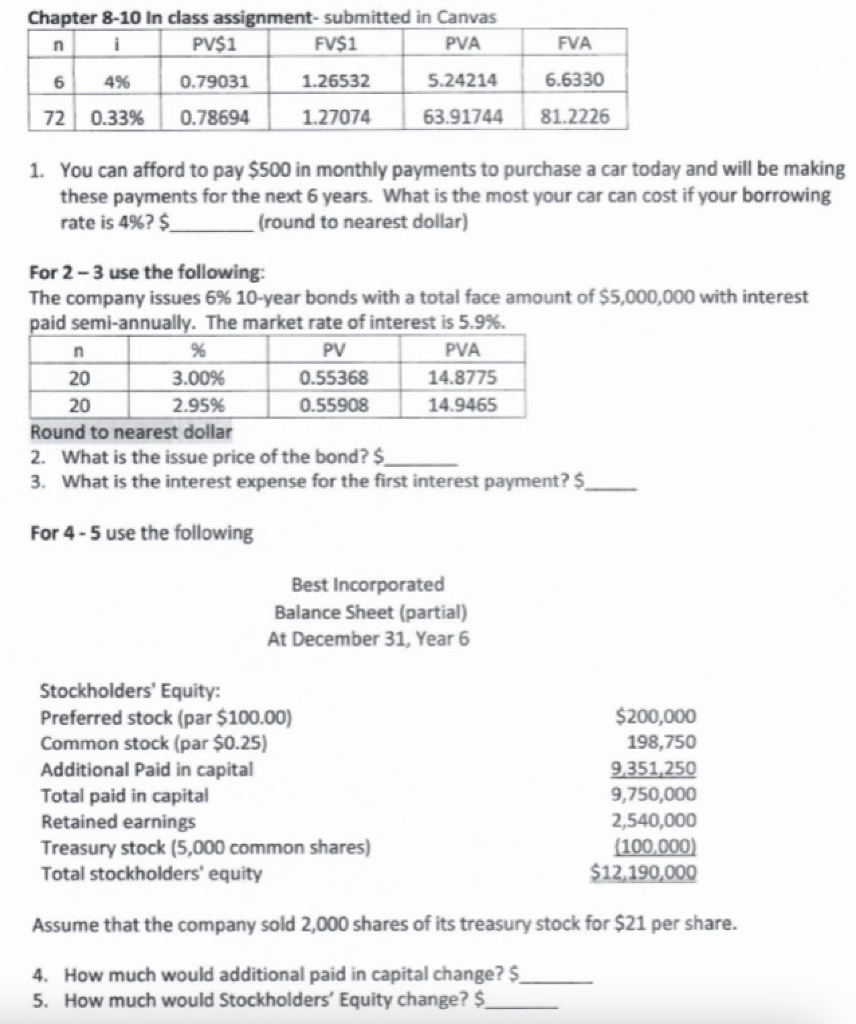

show work please Chapter 8-10 In class assignment-submitted in Canvas n i PV$1 FV$1 PVA FVA 6 4% 0.79031 1.26532 5.24214 6.6330 72 0.33% 0.78694

show work please

Chapter 8-10 In class assignment-submitted in Canvas n i PV$1 FV$1 PVA FVA 6 4% 0.79031 1.26532 5.24214 6.6330 72 0.33% 0.78694 1.27074 63.91744 81.2226 1. You can afford to pay $500 in monthly payments to purchase a car today and will be making these payments for the next 6 years. What is the most your car can cost if your borrowing rate is 4%? $_ (round to nearest dollar) For 2-3 use the following: The company issues 6% 10-year bonds with a total face amount of $5,000,000 with interest paid semi-annually. The market rate of interest is 5.9%. n PV PVA 20 3.00% 0.55368 14.8775 20 2.95% 0.55908 14.9465 Round to nearest dollar 2. What is the issue price of the bond? $_ 3. What is the interest expense for the first interest payment? $ For 4-5 use the following Best Incorporated Balance Sheet (partial) At December 31, Year 6 Stockholders' Equity: Preferred stock (par $100.00) $200,000 198,750 Common stock (par $0.25) Additional Paid in capital 9,351,250 Total paid in capital 9,750,000 Retained earnings 2,540,000 Treasury stock (5,000 common shares) (100,000) Total stockholders' equity $12,190,000 Assume that the company sold 2,000 shares of its treasury stock for $21 per share. 4. How much would additional paid in capital change? $_ 5. How much would Stockholders' Equity change? $_Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started