Answered step by step

Verified Expert Solution

Question

1 Approved Answer

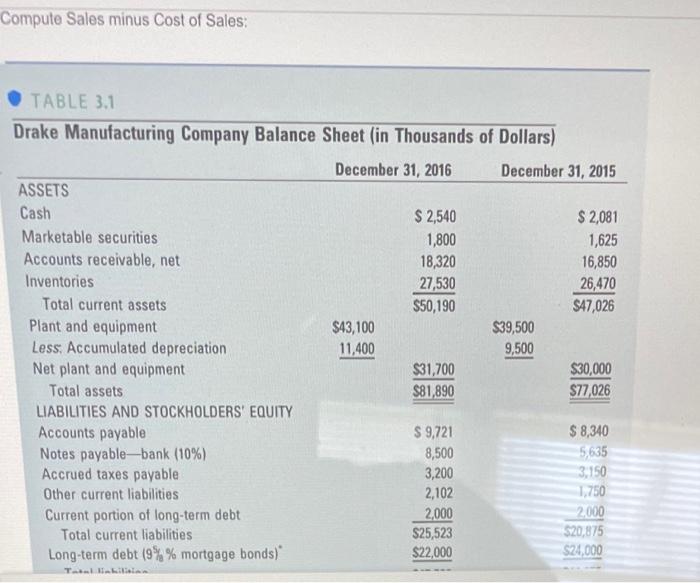

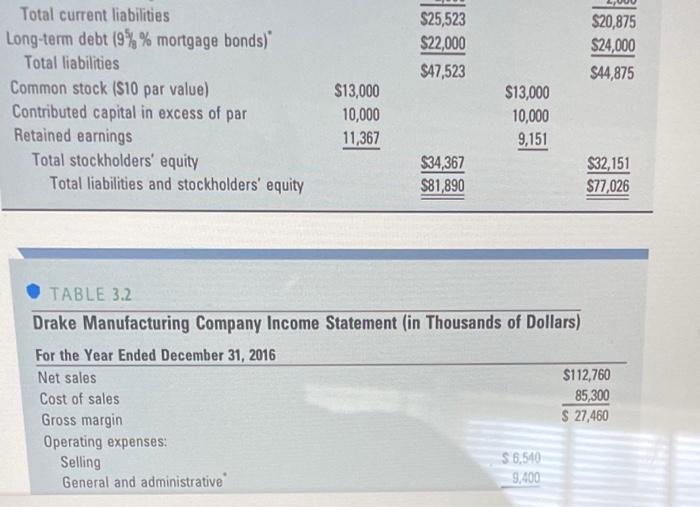

show work please Compute Sales minus Cost of Sales: TABLE 3.1 Drake Manufacturing Company Balance Sheet (in Thousands of Dollars) December 31, 2016 ASSETS Cash

show work please

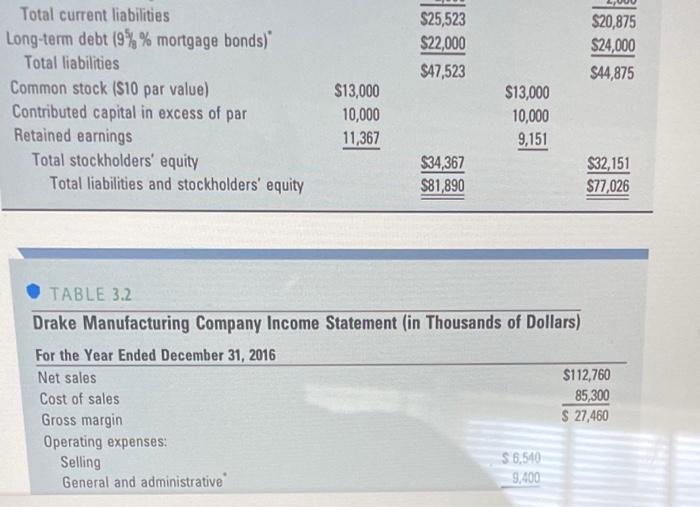

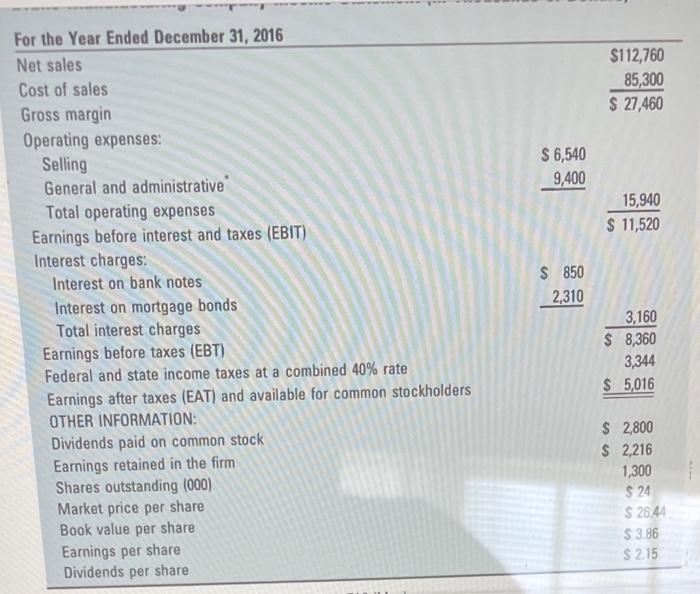

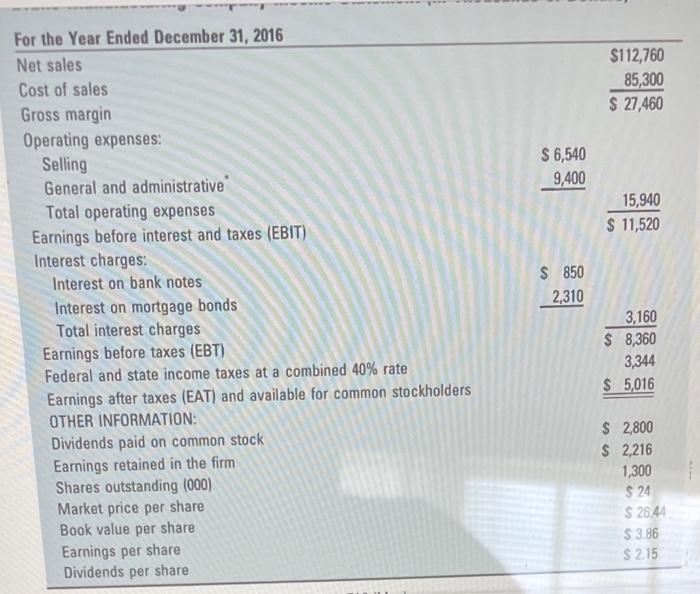

Compute Sales minus Cost of Sales: TABLE 3.1 Drake Manufacturing Company Balance Sheet (in Thousands of Dollars) December 31, 2016 ASSETS Cash $ 2,540 Marketable securities 1,800 18,320 Accounts receivable, net Inventories 27,530 Total current assets $50,190 Plant and equipment $43,100 Less: Accumulated depreciation 11,400 Net plant and equipment $31,700 Total assets $81,890 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable $ 9,721 Notes payable-bank (10%) 8,500 Accrued taxes payable 3,200 Other current liabilities 2,102 2,000 Current portion of long-term debt Total current liabilities $25,523 Long-term debt (9%% mortgage bonds) $22,000 Tatal liabilition December 31, 2015 $ 2,081 1,625 16,850 26,470 $47,026 $30,000 $77,026 $ 8,340 5,635 3,150 1,750 2,000 $20,875 $24,000 $39,500 9,500 $25,523 $20,875 Total current liabilities Long-term debt (9% % mortgage bonds) Total liabilities $22,000 $24,000 $47,523 $44,875 Common stock ($10 par value) Contributed capital in excess of par Retained earnings Total stockholders' equity $34,367 $32,151 Total liabilities and stockholders' equity $81,890 $77,026 TABLE 3.2 Drake Manufacturing Company Income Statement (in Thousands of Dollars) For the Year Ended December 31, 2016 Net sales $112,760 85,300 Cost of sales $ 27,460 Gross margin Operating expenses: Selling $6.540 9,400 General and administrative" $13,000 10,000 11,367 $13,000 10,000 9,151 For the Year Ended December 31, 2016 Net sales Cost of sales. Gross margin Operating expenses: Selling General and administrative Total operating expenses Earnings before interest and taxes (EBIT) Interest charges: Interest on bank notes Interest on mortgage bonds Total interest charges Earnings before taxes (EBT) Federal and state income taxes at a combined 40% rate Earnings after taxes (EAT) and available for common stockholders OTHER INFORMATION: Dividends paid on common stock Earnings retained in the firm Shares outstanding (000) Market price per share Book value per share Earnings per share Dividends per share $ 6,540 9,400 S850 2,310 $112,760 85,300 $ 27,460 15,940 $ 11,520 3,160 $ 8,360 3,344 $ 5,016 $ 2,800 $ 2,216 1,300 $24 $26.44 $ 3.86 $2.15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started