Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SHOW WORK PLEASE!! MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Mullee Corporation produces a single product

SHOW WORK PLEASE!!

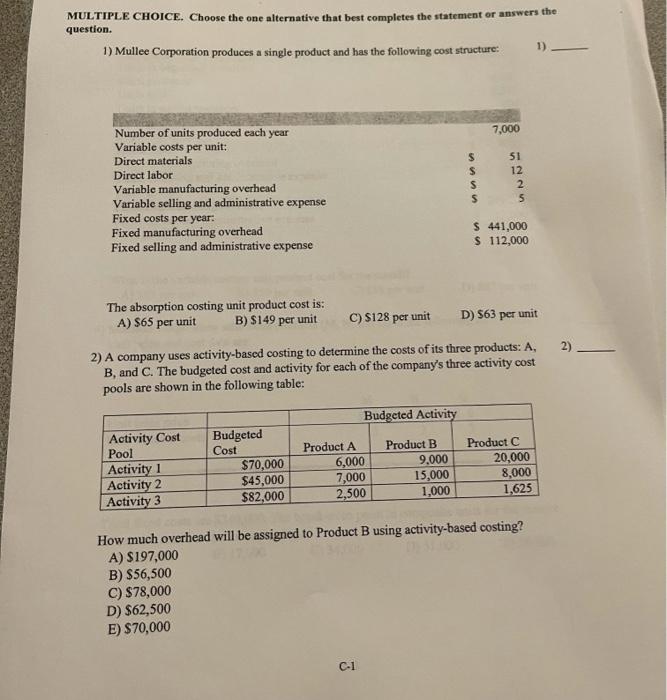

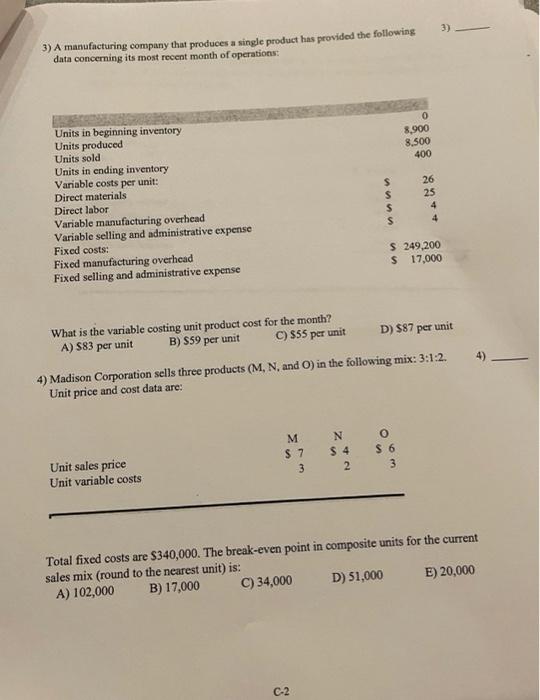

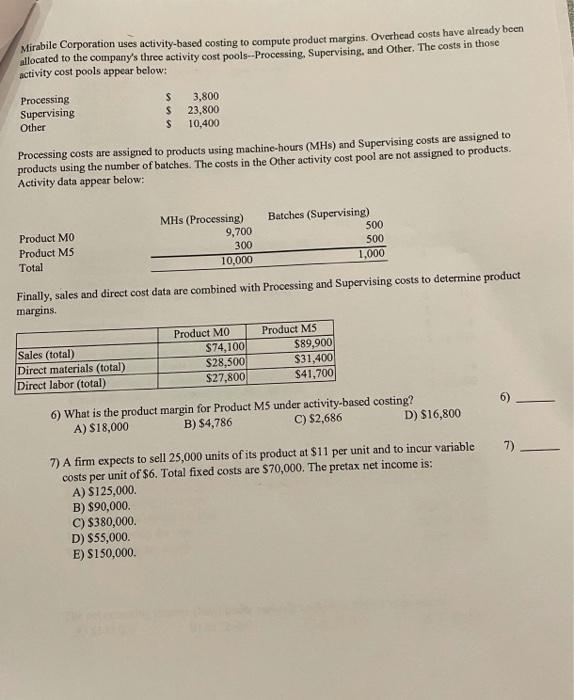

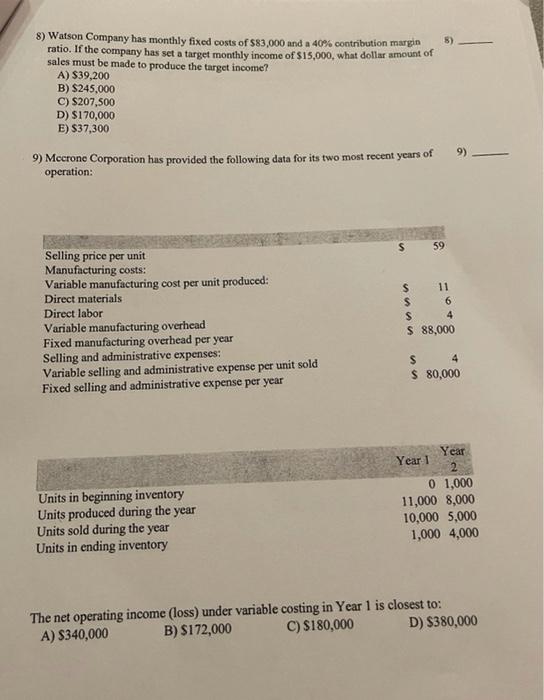

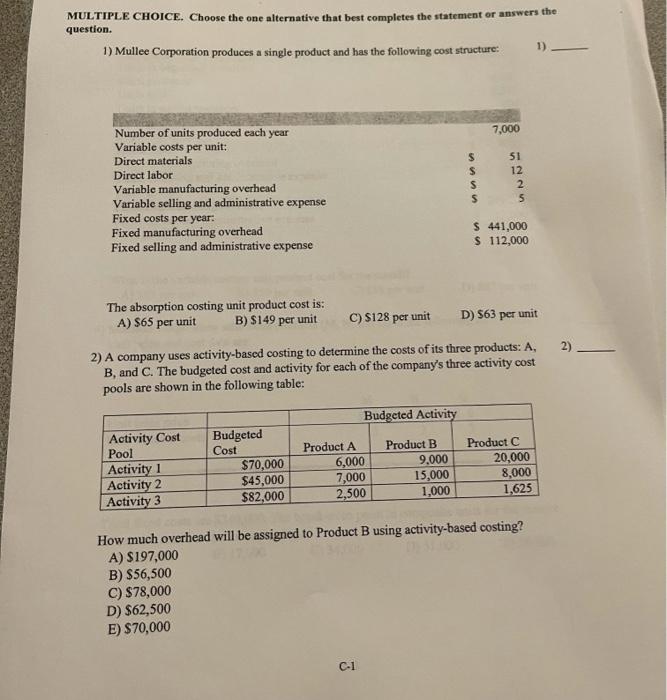

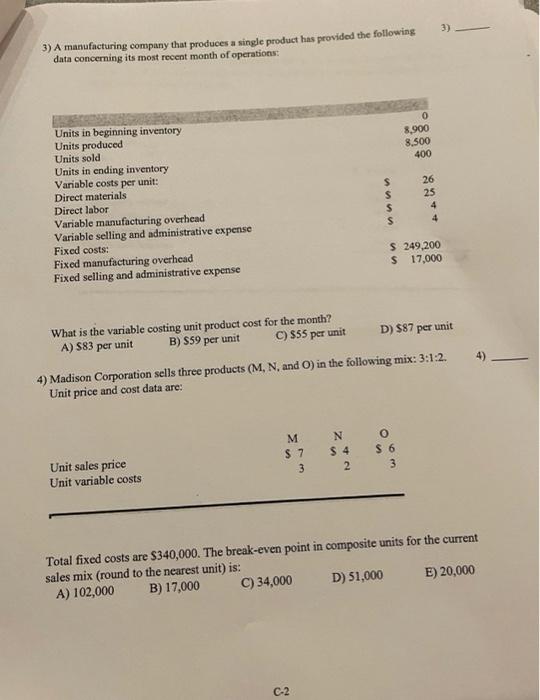

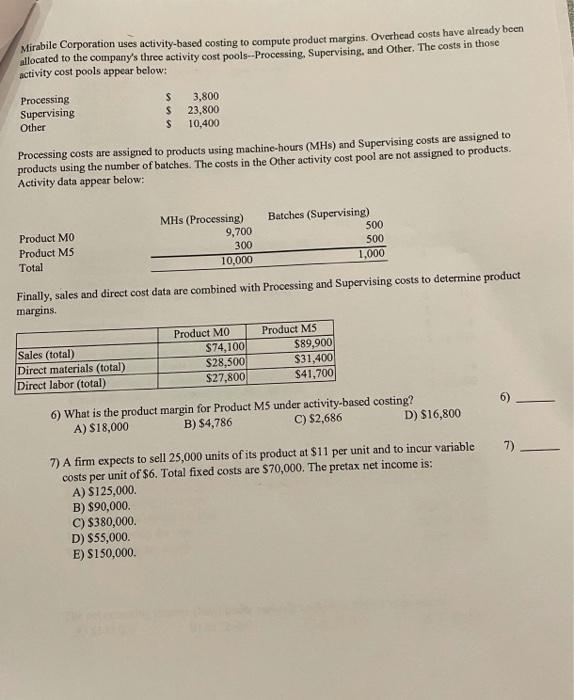

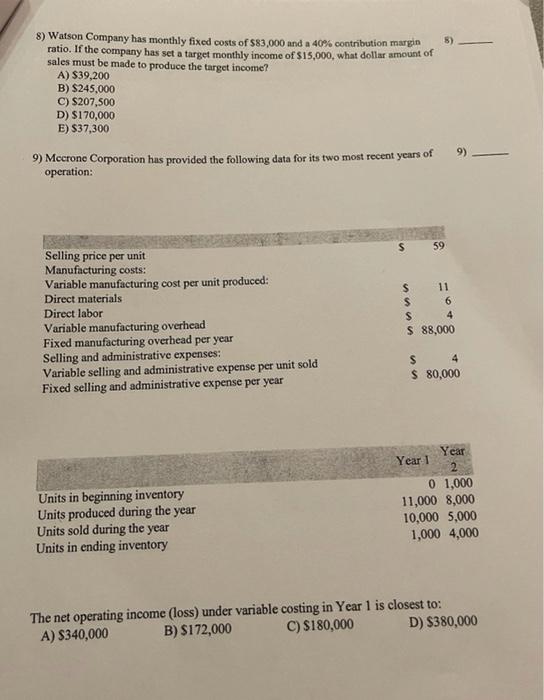

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Mullee Corporation produces a single product and has the following cost structure: 1) 7,000 Number of units produced each year Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $ S $ $ UNNY 51 12 2 5 $441,000 $ 112,000 The absorption costing unit product cost is: A) $65 per unit B) $149 per unit C) 5128 per unit D) 563 per unit 2) 2) A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table: Budgeted Activity Activity Cost Pool Activity 1 Activity 2 Activity 3 Budgeted Cost $70,000 $45,000 $82,000 Product A 6,000 7,000 2,500 Product B 9,000 15,000 1,000 Product C 20,000 8,000 1,625 How much overhead will be assigned to Product B using activity-based costing? A) S197,000 B) $56,500 C) $78,000 D) $62,500 E) $70,000 C-1 3) 3) A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations 0 8.900 8.500 400 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense s $ $ s 26 25 4 4 A $ 249,200 $ 17,000 What is the variable costing unit product cost for the month? A) 583 per unit B) S59 per unit C) $55 per unit D) $87 per unit 4) Madison Corporation sells three products (M, N, and O) in the following mix: 3:1:2. Unit price and cost data are: M $7 3 $ 4 $ 6 2 3 Unit sales price Unit variable costs Total fixed costs are $340,000. The break-even point in composite units for the current sales mix (round to the nearest unit) is: A) 102,000 B) 17,000 C) 34,000 D) 51,000 E) 20,000 C-2 Mirabile Corporation uses activity-based costing to compute product margins Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and other. The costs in those activity cost pools appear below: Processing 3,800 Supervising $ 23.800 $ 10,400 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the other activity cost pool are not assigned to products. Activity data appear below: Other MHs (Processing) Batches (Supervising) Product MO 9,700 500 Product MS 300 500 Total 10,000 1,000 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Sales (total) Direct materials (total) Direct labor (total) Product MO $74,100 $28,500 $27.800 Product MS $89,900 $31,400 S41,700 6) What is the product margin for Product M5 under activity-based costing? A) $18,000 B) $4,786 C) $2,686 D) $16,800 7) 7) A firm expects to sell 25,000 units of its product at $11 per unit and to incur variable costs per unit of $6. Total fixed costs are $70,000. The pretax net income is: A) S125,000 B) $90,000 C) $380,000. D) $55,000. E) $150,000 8) 8) Watson Company has monthly fixed costs of $83,000 and a 40% contribution margin ratio. If the company has set a target monthly income of $15,000, what dollar amount of sales must be made to produce the target income? A) $39,200 B) $245,000 C) $207,500 D) $170,000 E) $37,300 9) Mccrono Corporation has provided the following data for its two most recent years of operation: 9) 59 Selling price per unit Manufacturing costs: Variable manufacturing cost per unit produced: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead per year Selling and administrative expenses: Variable selling and administrative expense per unit sold Fixed selling and administrative expense per year s 11 S 6 s 4 $ 88,000 S 4 $ 80,000 Year Year 1 Units in beginning inventory Units produced during the year Units sold during the year Units in ending inventory 0 1,000 11,000 8,000 10,000 5,000 1,000 4,000 The net operating income (loss) under variable costing in Year 1 is closest to: A) $340,000 B) $172,000 C) $180,000 D) $380,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started