Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work please thanks! This is an Enterprise-Value type of question ....only it moves in reverse of the questions in the notes. Ron has valued

show work please thanks!

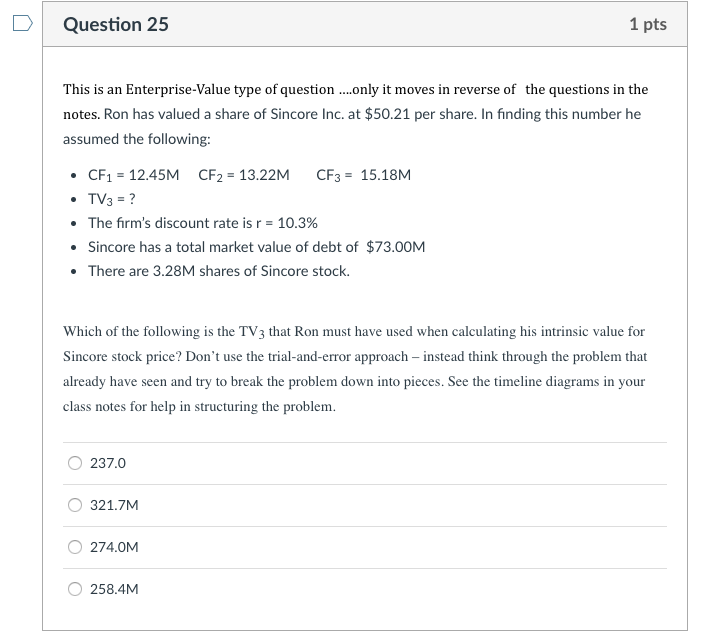

This is an Enterprise-Value type of question ....only it moves in reverse of the questions in the notes. Ron has valued a share of Sincore Inc. at $50.21 per share. In finding this number he assumed the following: CF_1 = 12.45M CF_2 = 13.22M CF_3 = 15.18M TV_3 = ? The firm's discount rate is r = 10.3% Sincore has a total market value of debt of $73.00M There are 3.28M shares of Sincore stock. Which of the following is the TV_3 that Ron must have used when calculating his intrinsic value for Sincore stock price? Don't use the trial-and-error approach - instead think through the problem that already have seen and try to break the problem down into pieces. See the timeline diagrams in your class notes for help in structuring the problem. 237.0 321.7M 274.0M 258.4MStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started