Answered step by step

Verified Expert Solution

Question

1 Approved Answer

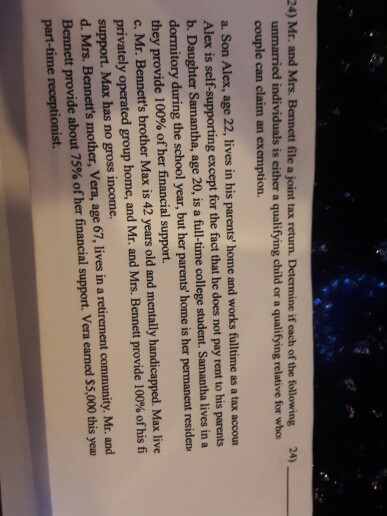

Show work please, thankw 24) Mr. and Mrs. Bennett file a joint tax return. Determine if each of the following unmarried individuals is either a

Show work please, thankw

24) Mr. and Mrs. Bennett file a joint tax return. Determine if each of the following unmarried individuals is either a qualifying child or a qualifying relative for who. couple can claim an exemption. 24) a. Son Alex, age 22, lives in his parents' home and works fulltime as a tax accou Alex is self-supporting except for the fact that he does not pay rent to his parents b. Daughter Samantha, age 20, is a full-time college student. Samantha lives in a dormitory during the school year, but her parents' home is her permanent residen they provide 100% of her financial support. c. Mr. Bennett's brother Max is 42 years old and mentally handicapped. Max live privately operated group home, and Mr. and Mrs. Bennett provide 100% of his fi support. Max has no gross income. d. Mrs. Bennett's mother, Vera, age 67, lives in a retirement community. Mr. and Bennett provide about 75% of her financial part-time receptionist. support. Vera earned $5,000 this yeaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started