Show work please

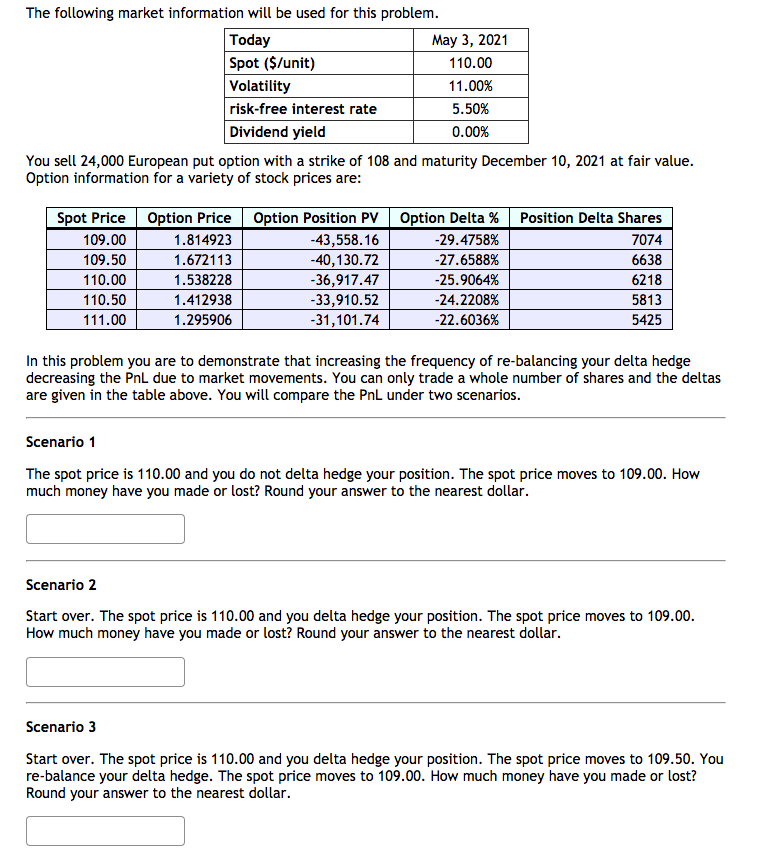

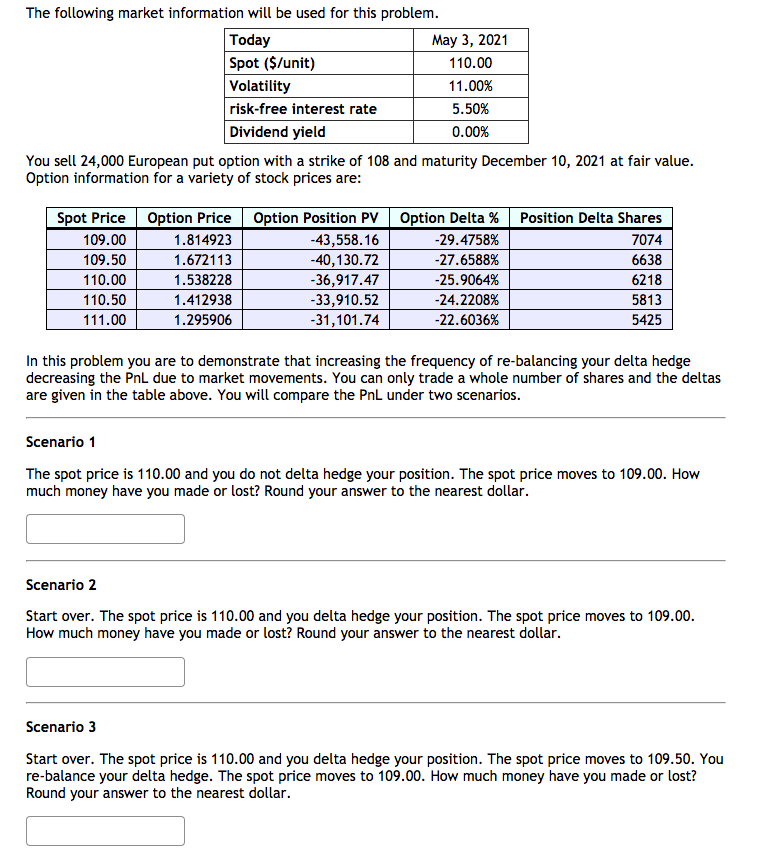

The following market information will be used for this problem. Today May 3, 2021 Spot ($/unit) 110.00 Volatility 11.00% risk-free interest rate 5.50% Dividend yield 0.00% You sell 24,000 European put option with a strike of 108 and maturity December 10, 2021 at fair value. Option information for a variety of stock prices are: Spot Price 109.00 109.50 110.00 110.50 111.00 Option Price Option Position PV Option Delta % Position Delta Shares 1.814923 -43,558.16 -29.4758% 7074 1.672113 -40,130.72 -27.6588% 6638 1.538228 -36,917.47 -25.9064% 6218 1.412938 -33,910.52 -24.2208% 5813 1.295906 -31,101.74 -22.6036% 5425 In this problem you are to demonstrate that increasing the frequency of re-balancing your delta hedge decreasing the PnL due to market movements. You can only trade a whole number of shares and the deltas are given in the table above. You will compare the PnL under two scenarios. Scenario 1 The spot price is 110.00 and you do not delta hedge your position. The spot price moves to 109.00. How much money have you made or lost? Round your answer to the nearest dollar. Scenario 2 Start over. The spot price is 110.00 and you delta hedge your position. The spot price moves to 109.00. How much money have you made or lost? Round your answer to the nearest dollar. Scenario 3 Start over. The spot price is 110.00 and you delta hedge your position. The spot price moves to 109.50. You re-balance your delta hedge. The spot price moves to 109.00. How much money have you made or lost? Round your answer to the nearest dollar. The following market information will be used for this problem. Today May 3, 2021 Spot ($/unit) 110.00 Volatility 11.00% risk-free interest rate 5.50% Dividend yield 0.00% You sell 24,000 European put option with a strike of 108 and maturity December 10, 2021 at fair value. Option information for a variety of stock prices are: Spot Price 109.00 109.50 110.00 110.50 111.00 Option Price Option Position PV Option Delta % Position Delta Shares 1.814923 -43,558.16 -29.4758% 7074 1.672113 -40,130.72 -27.6588% 6638 1.538228 -36,917.47 -25.9064% 6218 1.412938 -33,910.52 -24.2208% 5813 1.295906 -31,101.74 -22.6036% 5425 In this problem you are to demonstrate that increasing the frequency of re-balancing your delta hedge decreasing the PnL due to market movements. You can only trade a whole number of shares and the deltas are given in the table above. You will compare the PnL under two scenarios. Scenario 1 The spot price is 110.00 and you do not delta hedge your position. The spot price moves to 109.00. How much money have you made or lost? Round your answer to the nearest dollar. Scenario 2 Start over. The spot price is 110.00 and you delta hedge your position. The spot price moves to 109.00. How much money have you made or lost? Round your answer to the nearest dollar. Scenario 3 Start over. The spot price is 110.00 and you delta hedge your position. The spot price moves to 109.50. You re-balance your delta hedge. The spot price moves to 109.00. How much money have you made or lost? Round your answer to the nearest dollar