show work please to understand

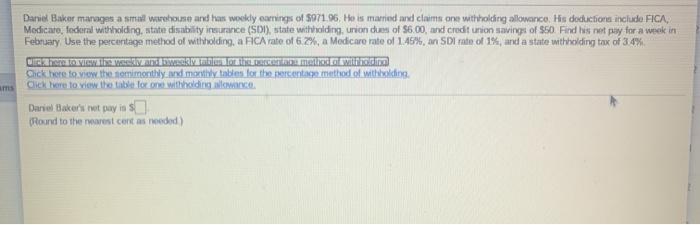

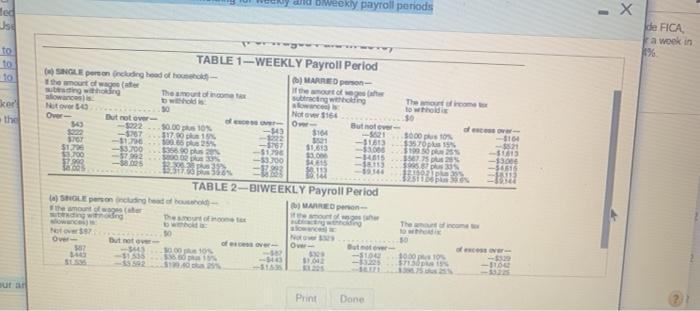

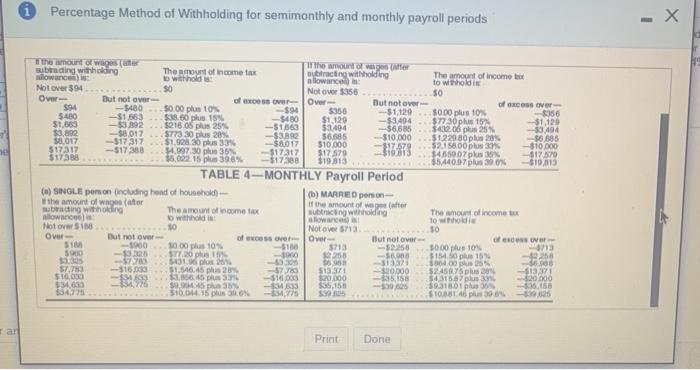

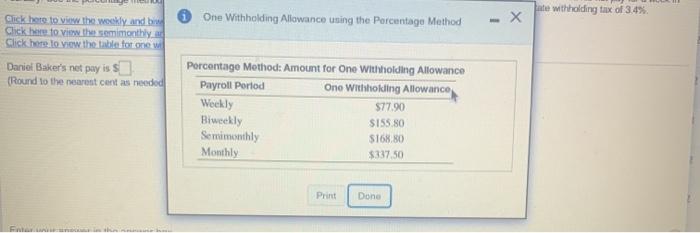

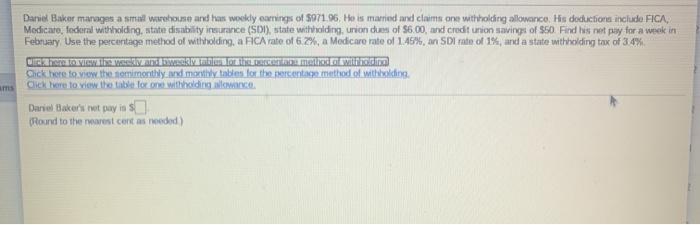

Daniel Baker marages a small warehouse and has wokely earnings of $971.96. He is maried and claims one withholding allowance. His deductions include FCA, Medicato, fodern withholding, state disability insurance (SDI), state withholding, union dues of $6.00, and credit union savings of $50 Find his net pay for a week in February Use the percentage method of withholding a RCA rate of 6.7%, a Medicare rate of 1.45%, an SDI rate of 1%, and a state wthholding tax of 3 4% Click here to view the orimonthly and mainly tables for the percentage method of withholding Click ere to view the table for one withholding Nice Daniel Baker's not pay in Round to the nearest cent as needed) Ny and weekly payroll periods - led US He FICA a week in 0% to to kerl the Theoricom so TABLE 1-WEEKLY Payroll Period SINGLE oncluding head of - MARED- the amount of wages singing The mountain the out allowances acting withholding Novo 50 Nota 1160 But motor 50.00 101 But now 943 3164 -621 -17 3121 122 370 270 50 plus 25 5767 1963 $1.29 -3.700 -51 3700 130 -5702 -9.700 - 10 36% TABLE 2-BIWEEKLY Payroll Period () SHOLE pointing of MERED amount ting remont mong These 3000 plus tos $95 Toplus $10025 39822 plus Theme O But not of Ow 10 --$100 -59538 S5592 -10 -S1 10010 5713 - BU Print Done Percentage Method of Withholding for semimonthly and monthly payroll periods 3430 3:04 the amount of Wester the amount of wages subrading withholding The amount of income tax Dubracting witholding The amount of income tax wilowance) to withhold allowance : to withholdi Not over $94 Not over $356 50 O But not over of Over But not over of CSSON $94 -5480 50.00 plus 10% -594 $356 -$1,120 $0.00 plus 10% $356 -31663 $18.0 pkus 15% -5480 $1.120 -$3494 $7730 plis 15% $1,120 $1.650 $216 05 plus 25% -51.363 $3494 $6,685 $412.06 plus 25% $3.02 -$8.017 $773 30 plus 20% - $3892 56,685 -$10.000 $1229 80 plus 20% -SS 0.017 -S17317 $1.928 30 plus 33% -$8.017 $10.000 $17.579 $2.15800plus -$10.000 517317 -517388 207.30 pl --$17317 $17579 $4.650.0Z plus -617.870 $17388 $5.002.15 plus 3969 -$1730 $19.813 $5,440.97plus 30.0 -51013 TABLE 4-MONTHLY Payroll Period (*) SINGLE ponon including head of household) - (b) MARRIED person the amount of wages (ator of the amount of water bring withholding The amount of income tax ubicing withholding The amount of income to allow) with How to whole Not over 18 10 Note5713 50 Over ut not over of Dove Over But not over ofessor SIM -1000 10.00 plus 10 --- 3713 -52258 000 plus 10% 13 3900 125 720plus --3000 2258 - $184. 15 --9250 35305 0316 plos 25% -95 -13 S77 - $16.000 51.546.45 plus 28 -57.760 513 371 20.000 32505201 --51337 $10.00 45 -100 $20,000 18 $4.31587 plus - 520000 $54.630 30 --- $35.15 --5005 393180 9.156 $347 $16.04.16 plus 30.6% -477 STOBB plus Print Done ate withholding tax of 3.4% One Withholding Allowance using the Porcentage Method Click here to view the weekly and Click here to view the semimoothly a Click here to view the table for one wi Daniel Baker's net pay is s (Round to the nearest cant as needed Porcentage Method: Amount for One Withholding Allowance Payroll Portod One Withholding Allowance Weekly $77.90 Biweekly SI55.80 Semimonthly $168.80 Monthly $337.50 Print Done