Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work plz 7) Will a higher discount rate increase or decrease the present value? 8) Ann buys a $300,000 house, with 20% down and

show work plz

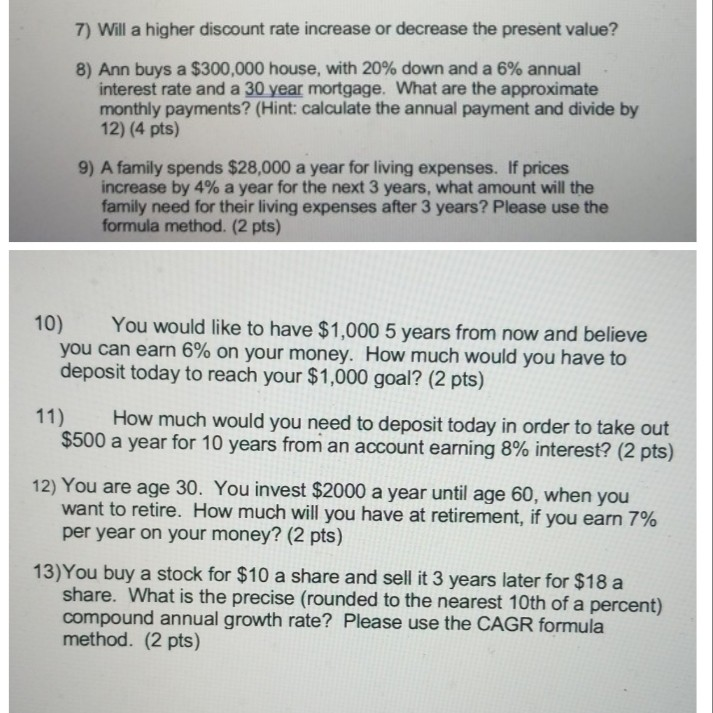

7) Will a higher discount rate increase or decrease the present value? 8) Ann buys a $300,000 house, with 20% down and a 6% annual interest rate and a 30 year mortgage. What are the approximate monthly payments? (Hint: calculate the annual payment and divide by 12) (4 pts) 9) A family spends $28,000 a year for living expenses. If prices increase by 4% a year for the next 3 years, what amount will the family need for their living expenses after 3 years? Please use the formula method. (2 pts) 10) You would like to have $1,000 5 years from now and believe you can earn 6% on your money. How much would you have to deposit today to reach your $1,000 goal? (2 pts) 11) How much would you need to deposit today in order to take out $500 a year for 10 years from an account earning 8% interest? (2 pts) 12) You are age 30. You invest $2000 a year until age 60, when you want to retire. How much will you have at retirement, if you earn 7% per year on your money? (2 pts) 13)You buy a stock for $10 a share and sell it 3 years later for $18 a share. What is the precise (rounded to the nearest 10th of a percent) compound annual growth rate? Please use the CAGR formula method. (2 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started