Answered step by step

Verified Expert Solution

Question

1 Approved Answer

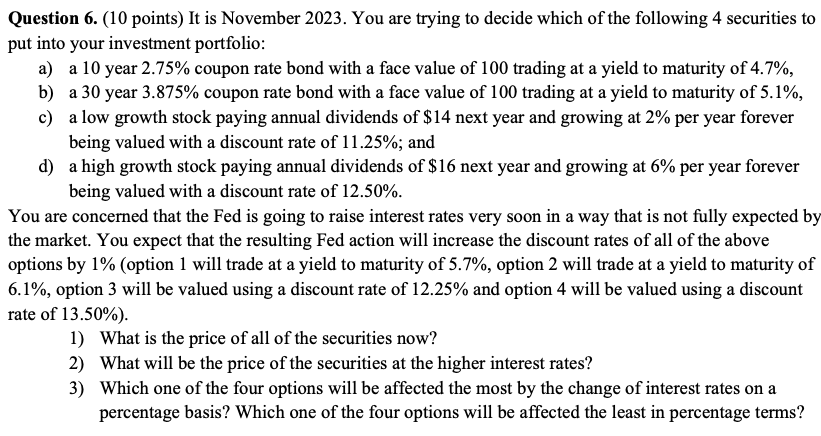

show work/formulas in excel. Question 6. (10 points) It is November 2023. You are trying to decide which of the following 4 securities to put

show work/formulas in excel.

Question 6. (10 points) It is November 2023. You are trying to decide which of the following 4 securities to put into your investment portfolio: a) a 10 year 2.75% coupon rate bond with a face value of 100 trading at a yield to maturity of 4.7%, b) a 30 year 3.875% coupon rate bond with a face value of 100 trading at a yield to maturity of 5.1%, c) a low growth stock paying annual dividends of $14 next year and growing at 2% per year forever being valued with a discount rate of 11.25%; and d) a high growth stock paying annual dividends of $16 next year and growing at 6% per year forever being valued with a discount rate of 12.50%. You are concerned that the Fed is going to raise interest rates very soon in a way that is not fully expected by the market. You expect that the resulting Fed action will increase the discount rates of all of the above options by 1% (option 1 will trade at a yield to maturity of 5.7%, option 2 will trade at a yield to maturity of 6.1%, option 3 will be valued using a discount rate of 12.25% and option 4 will be valued using a discount rate of 13.50%). 1) What is the price of all of the securities now? 2) What will be the price of the securities at the higher interest rates? 3) Which one of the four options will be affected the most by the change of interest rates on a percentage basis? Which one of the four options will be affected the least in percentage termsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started