Question: show work/formulas please Suppose the IRS has instituted a new MACRS-GDS property class of only 2 years. It will follow the usual depreciation conventions, determined

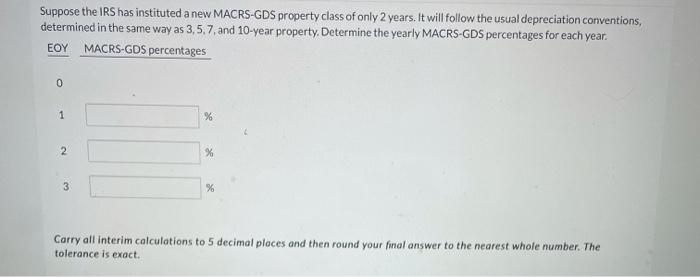

Suppose the IRS has instituted a new MACRS-GDS property class of only 2 years. It will follow the usual depreciation conventions, determined in the same way as 3,5,7, and 10-year property. Determine the yearly MACRS-GDS percentages for each year. EOY MACRS-GDS percentages 0 1 % 2 % 3 % Carry all interim calculations to 5 decimal places and then round your final answer to the nearest whole number. The tolerance is exact

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts