Answered step by step

Verified Expert Solution

Question

1 Approved Answer

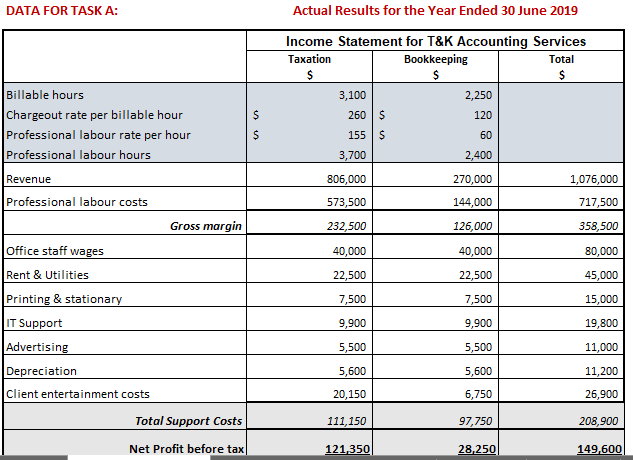

***SHOW WORKING OUT DATA FOR TASK A: Actual Results for the Year Ended 30 June 2019 Income Statement for T&K Accounting Services Taxation Bookkeeping Total

***SHOW WORKING OUT

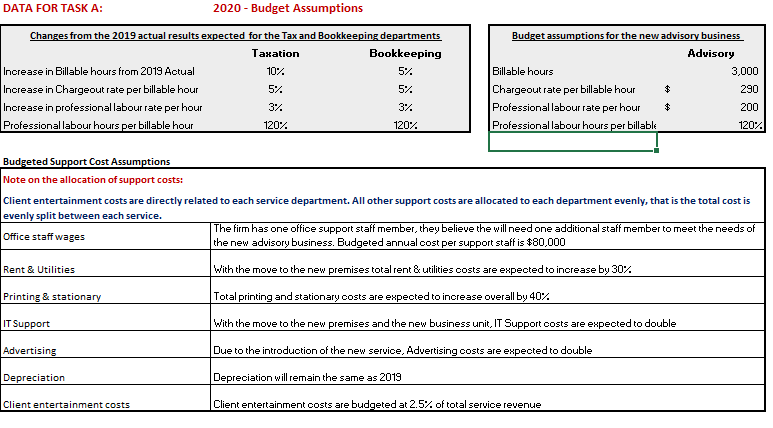

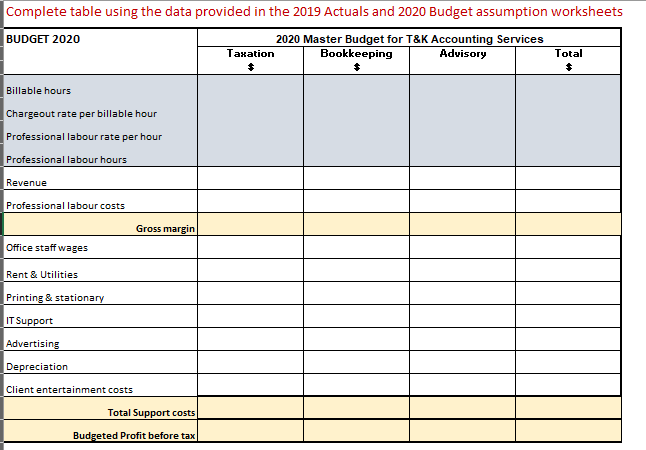

DATA FOR TASK A: Actual Results for the Year Ended 30 June 2019 Income Statement for T&K Accounting Services Taxation Bookkeeping Total 2,250 120 Billable hours Chargeout rate per billable hour Professional labour rate per hour Professional labour hours 3,100 260 155 3,700 $ Revenue 2,400 270,000 144,000 126,000 806,000 573,500 232,500 Professional labour costs 1,076,000 717,500 358,500 Gross margin Office staff wages 40,000 80,000 40,000 22,500 Rent & Utilities 22,500 45,000 Printing & stationary 7,500 7,500 15,000 IT Support 9,900 9,900 19,800 Advertising 5,500 11,000 5,500 5,600 20,150 5,600 11,200 26,900 6,750 Depreciation Client entertainment costs Total Support Costs Net Profit before tax 111,150 97,750 208,900 121,350 28,250 149,600 DATA FOR TASKA: 2020 - Budget Assumptions Changes from the 2019 actual results expected for the Tax and Bookkeeping departments Taxation Bookkeeping Increase in Billable hours from 2019 Actual 10% 5%. Increase in Chargeout rate per billable hour 5%. Increase in professional labour rate per hour 32 Professional labour hours per billable hour 1202 Budget assumptions for the new advisory business Advisory Billable hours 3,000 Chargeout rate per billable hour $ 290 Professional labour rate per hour $ 200 Professional labour hours per billable 1202 3%. Budgeted Support Cost Assumptions Note on the allocation of support costs: Client entertainment costs are directly related to each service department. All other support costs are allocated to each department evenly, that is the total cost is evenly split between each service. The firm has one office support staff member, they believe the will need one additional staff member to meet the needs of Office staff wages the new advisory business. Budgeted annual cost per support staff is $80,000 Rent & Utilities With the move to the new premises totalrent & utilities costs are expected to increase by 30% Printing & stationary Total printing and stationary costs are expected to increase overall by 40% IT Support With the move to the new premises and the new business unit, IT Support costs are expected to double Advertising Due to the introduction of the new service, Advertising costs are expected to double Depreciation Depreciation will remain the same as 2019 Client entertainment costs rtainment costs Client entertainment costs are budgeted at 2.5% of total service revenue Complete table using the data provided in the 2019 Actuals and 2020 Budget assumption worksheets BUDGET 2020 2020 Master Budget for T&K Accounting Services Bookkeeping Advisory Taxation Total Billable hours Chargeout rate per billable hour Professional labour rate per hour Professional labour hours Revenue Professional labour costs Gross margin Office staff wages Rent & Utilities Printing & stationary IT Support Advertising Depreciation Client entertainment costs Total Support costs Budgeted Profit before taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started