Answered step by step

Verified Expert Solution

Question

1 Approved Answer

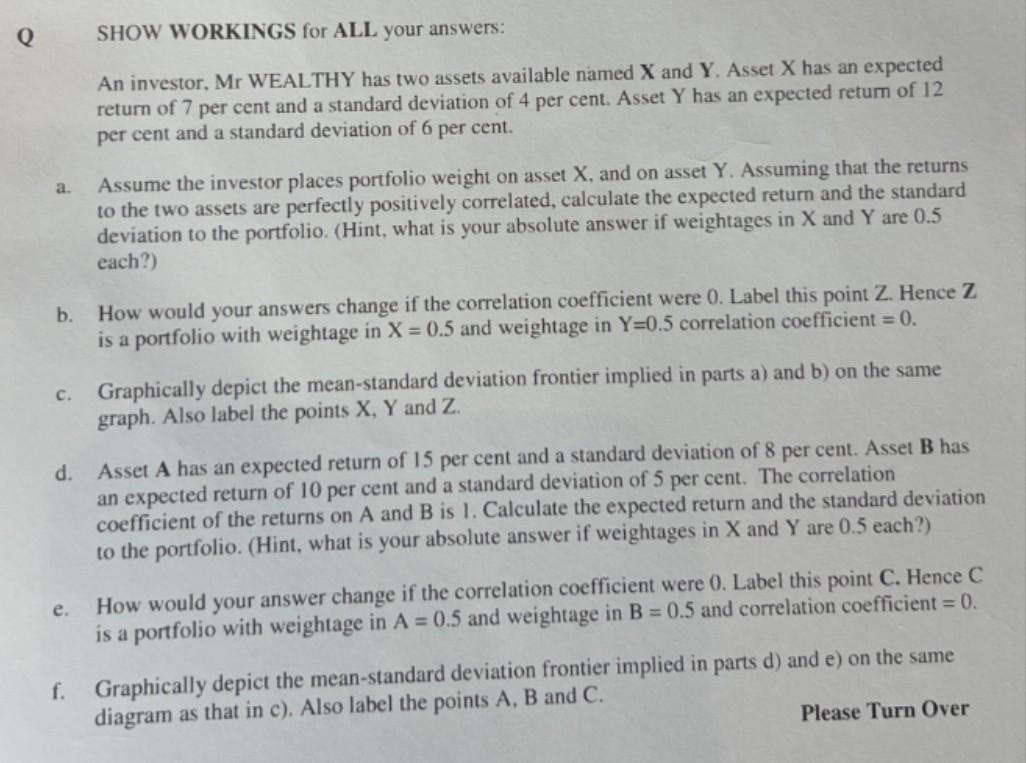

SHOW WORKINGS for ALL your answers: An investor, Mr WEALTHY has two assets available named X and Y. Asset X has an expected return of

SHOW WORKINGS for ALL your answers: An investor, Mr WEALTHY has two assets available named X and Y. Asset X has an expected return of 7 per cent and a standard deviation of 4 per cent. Asset Y has an expected return of 12 per cent and a standard deviation of 6 per cent. a. Assume the investor places portfolio weight on asset X, and on asset Y. Assuming that the returns to the two assets are perfectly positively correlated, calculate the expected return and the standard deviation to the portfolio. (Hint, what is your absolute answer if weightages in X and Y are 0.5 each?) b. How would your answers change if the correlation coefficient were 0 . Label this point Z. Hence Z is a portfolio with weightage in X=0.5 and weightage in Y=0.5 correlation coefficient =0. c. Graphically depict the mean-standard deviation frontier implied in parts a) and b) on the same graph. Also label the points X,Y and Z. d. Asset A has an expected return of 15 per cent and a standard deviation of 8 per cent. Asset B has an expected return of 10 per cent and a standard deviation of 5 per cent. The correlation coefficient of the returns on A and B is 1 . Calculate the expected return and the standard deviation to the portfolio. (Hint, what is your absolute answer if weightages in X and Y are 0.5 each?) e. How would your answer change if the correlation coefficient were 0 . Label this point C. Hence C is a portfolio with weightage in A=0.5 and weightage in B=0.5 and correlation coefficient =0. f. Graphically depict the mean-standard deviation frontier implied in parts d) and e) on the same diagram as that in c). Also label the points A,B and C. Please Turn Over

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started