Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show written work if possible please Steele Insulators is analyzing a new type of insulation for interior walls. Management has compiled the following information to

Show written work if possible please

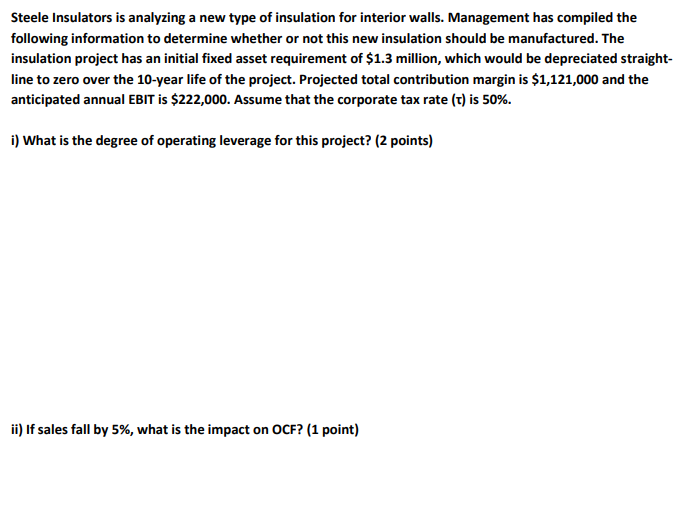

Steele Insulators is analyzing a new type of insulation for interior walls. Management has compiled the following information to determine whether or not this new insulation should be manufactured. The insulation project has an initial fixed asset requirement of $1.3 million, which would be depreciated straight- line to zero over the 10-year life of the project. Projected total contribution margin is $1,121,000 and the anticipated annual EBIT is $222,000. Assume that the corporate tax rate (t) is 50%. i) What is the degree of operating leverage for this project? (2 points) ii) If sales fall by 5%, what is the impact on OCF? (1 point)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started