Question

Show your ability to draw up a value chain (or a part of a value chain) and indicate from the case study which value chain

Show your ability to draw up a value chain (or a part of a value chain) and indicate from the case study which value chain components fit where.

Apart from this, you may also be expected to argue your point around a possible weakest link in the value chain - again from information from the case study.

You could be required to critically evaluate the market segmentation choices made in the case study. OR suggest market segments that could be appropriate for the circumstances in the case study. In both cases, you should be able to motivate/defend your suggestions with practical and plausible arguments.

You could also expect to formulate a positioning statement for each of the market segments that you have proposed. Remember that a positioning statement goes hand in hand with a message that communicate the positioning statement.

You may also be expected to speculate on the types on innovations that you want to suggest to the management of the case study company. Again, you must be able to provide a plausible motivation for the suggested innovation.

Last, but not least, you could be expected to create balanced scorecard for the case study company. The balance scorecard could include at least 3 strategies from any of the perspectives (Financial, customer or internal business process perspective). For each strategy, you should be able to state a CSF and be able to develop a KPI with a target for each CSF. When the target is not achieved, you should be able to suggest corrective action (s).

In your answer to the balanced scorecard, you may choose to use a table, a graphic or subordinated bullet list to guide your answer.

Case Study:

The lipstick effect: turning around XT Beauty

Tatiana Khvatova and Sarbani Bublu Thakur-Weigold

At a crossroads Olga B. sank into her chair, exhausted, after yet another 14 h day in the St. Petersburg store. This evening, she was more than just tired; she was actually considering submitting her resignation to the company she had helped to build. Olga had joined XT Beauty seven years ago as a beautician and sales associate and worked her way up to become the retail director for all shops in the St. Petersburg area. The pressure and increasing uncertainty in the company were beginning to erode her loyalty to a company, which had given her so many opportunities. She still loved the industry, especially the confidence that beauty products gave women in Russia. These days, however, she barely had time to spend with her clients, to say nothing of her staff. Firefighting had become a daily routine at XT Beauty, as they struggled to deal with problems in sales, operations and personnel management. Thinking back on the events of the past three years, Olga tried to understand how her growing business could have come under pressure in this way

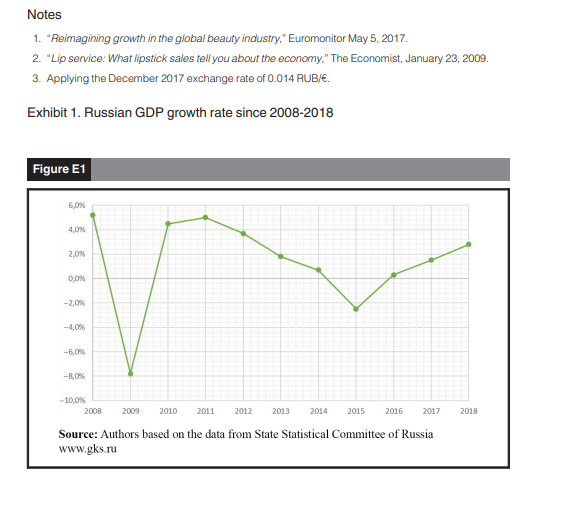

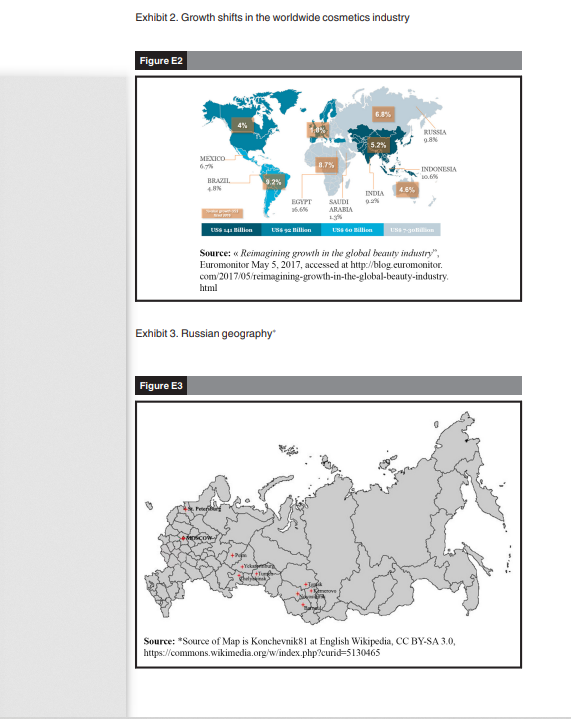

Russian economic conditions It did not help that economic conditions had changed (Exhibit 1). Since 2014, the Russian economy has been affected by declining oil prices and international sanctions. Between 2014 and 2016, the GDP of the Russian Federation fell by 1.5 per cent per year on average, which caused private consumption to shrink annually by 7.1 per cent. Recently, there have been signs of recovery, partly because oil prices started to inch up and partly because of growing trade with China. In 2017, however, GDP growth is expected to be only 1.5 per cent, far below the close to 10 per cent growth rate of its boom years. Today, consumer purchasing power remains weak, due to the devaluation of the ruble and consumer spending well below pre-crisis levels. Nevertheless, even in times of trouble, beauty is important in Russia. Growth in the country's beauty market had reached 9.8 per cent in 2016[1], ranking its market expansion third in the world (after Egypt at 16.6 per cent, and Indonesia, which had grown at 10.6 per cent, Exhibit 2). Brand loyalty is also high, and Russian brands such as Natura Siberica and Faberlic have successfully established themselves in the domestic market. Consumers have begun to cope with the new economic situation by changing their behavior. They have become choosier. In a recent consumer survey, the majority of respondents (57 per cent) said they were shopping around to get the best deals. They still buy their preferred brands, but in smaller quantities. Only 17 per cent of Russian consumers said they traded down to cheaper options. To get their preferred brands at the best prices, more than one-third of the respondents said they have changed where they shop. For example, the weak Ruble has compelled many wealthy consumers to reduce their shopping trips abroad and return to the domestic high streets.

The cosmetic industry and the lipstick effect According to economic theory, recessions usually mean that belts tighten and the sale of luxury products plummets as consumers re-allocate their reduced means to essential items. However, restricting the definition of essentials to food and shelter may be inaccurate. Ronald Lauder, the chairman of Estee Lauder Corporation famously coined the term "lipstick index" after he measured an 11 per cent increase in lipstick sales during the 2001 economic downturn in the USA. This suggests that recessions can actually offer growth opportunities for the beauty industry, even as the sellers of other consumer goods suffer. According to the economist "in hard times, women buy more of it, as it is an affordable indulgence[2]."

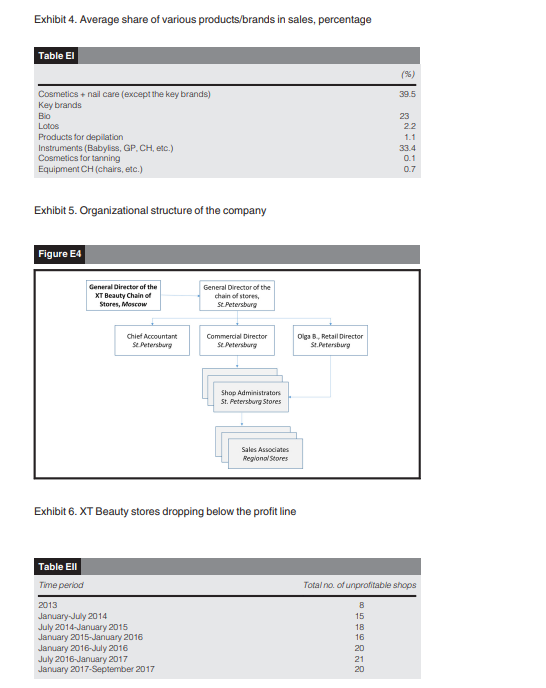

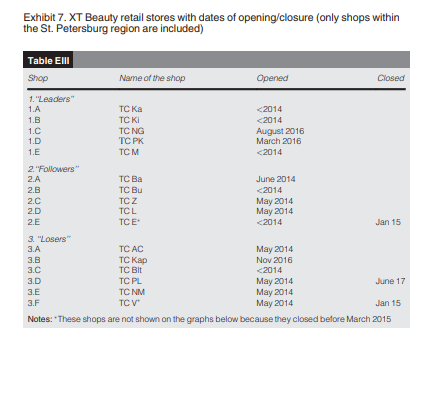

XT Beauty's business model and development The company "XT Beauty" was founded in 1992 in Moscow, where the headquarters (HQ) of the company is still located. It all began in 2005 when an office and store with a display of beauty parlor equipment and professional cosmetics opened in St. Petersburg. Today, there are 20 retail shops in St. Petersburg, 13 of which are located in the city itself, and 7 in St. Petersburg region (Exhibit 3). Note that although Moscow is marked on the map, XT Beauty maintains only its HQ, but no shops in the capital city. With its expansion into the regions, the company focused on becoming a wholesale supplier of professional cosmetics and equipment for beauty parlors with a retail presence. Their multi-channel strategy also sells products directly to individual consumers. This means that beyond the St. Petersburg region, the XT Beauty name is present in individual shops, salons and tanning studios in 8 other cities of the Russian Federation as follows: Novosibirsk, Kemerovo, Barnaul, Tyumen, Yekaterinburg, Perm, Chelyabinsk and Tomsk. The company's large flagship outlets are maintained exclusively in the St. Petersburg and Novosibirsk areas. The company has no product development or production of its own but has successfully established itself as a reseller, with an extensive portfolio of respected domestic and international brands. As a consequence, it maintains contractual relationships with a large number of suppliers and distributors. XT Beauty is the official distributor of Lotos (Spanish hair care products) and Bio (Italian skincare and cosmetics). For the Russian hair care brands Estel and Olen, as well as DSpa (a Russian cosmetic brand produced in Israel for the Russian market), XT Beauty buys directly from a local supplier. The other US brands Joico, Sexy Hair and Macadamia are sourced from their distributors in the Russian territories. The German brands Londa, Wella and Schwarzkopf are procured from another set of outside suppliers. Coral from Italy is a recently added brand, which is now prioritized for selling after Lotos. Because XT Beauty is in the business of wholesale professional cosmetics, its products are distinct from those sold on the mass market in terms of price, prestige and quality. To imagine the contrast to everyday drugstore brands, consider that a 250 mL bottle of shampoo in the XT Beauty portfolio sells for an average of RUR 1,800- 2,000, the equivalent of e25[3], while the average 250 mL shampoo bottle on the mass market retails for e3-4. To put these prices into perspective, in 2017 consumers in St. Petersburg earned an average salary of RUR 42,000 or e590 per month. XT Beauty's assortment of beauty salon equipment is equally broad, covering a range of international brands, customer needs and price points. The Ch brand of hair accessories (including brushes, combs, hairdryers, curlers, etc.), are produced in China exclusively for XT Beauty. The Italian-made Babyliss Pro line is also displayed on their shelves. XT Beauty buys Oster, Moser and Panasonic hair clippers from a variety of distributors, and has managed to secure exclusive rights to distribute electrical equipment for the Italian brand GP. The company maintains inventory and product lines for depilation and manicure supply. The furniture and special equipment they supply to beauty salons and solariums are sold exclusively online and not in their retail outlets. Exhibit 4 for a breakdown of the share of sales of the most important brands and product types.

Behind the scenes: how operations are running Its diverse portfolio of products necessarily means that the company must negotiate with multiple suppliers. One of their domestic partners is Charm Rus distribution, which buys goods directly from brand manufacturers and resells them in Russia. XT Beauty has entered into long-term contracts, which specify the immediate transfer of ownership upon goods receipt at the warehouse. This means that the unsold inventory must be paid for in advance, regardless of their actual sales performance. Contract conditions like these have caused XT Beauty to become heavily in debt to distributors like Charm Rus. The company's logistics strategy is oriented toward customer service and the rapid replenishment of their retail points. To enable this, they set up a central distribution center (DC) and warehouse in the south of St. Petersburg, where stocks of Lotos, Bio, electric equipment and accessories are consolidated. Stores receive replenishment stocks by courier from this DC or from each brand's proprietary warehouses. The conditions in Russia's vast territory create challenges for transport and security of goods. For example, Lotos and Bio products are delivered by trucks from Italy, which must traverse most of Europe before arriving in Russia. The freight is hard to protect and track on its long journey, with trucks breaking down along the way or dropping off the radar altogether. The replenishment orders for individual stores are managed centrally online by office staff at HQ, who monitor consumption levels in the retail stores. As these purchasing staff rarely enter a store and depend entirely upon the online data in the inventory management system, stockouts or incorrect orders are frequent events. As it is defined today, XT Beauty's replenishment process does not analyze consumption patterns at individual stores. When re-ordering, the purchasing manager reacts to snapshots of aggregated inventory levels. She receives no reports of sales patterns broken down by individual product numbers or even product line. Her decisions do not take current trends, bestsellers or aging inventory into account. XT Beauty has also signed contracts with third-party logistics providers who provide technical after-sales service at the warehouse itself. The customers appreciate this convenience because it spares them the trouble of seeking out each brand's authorized repair centers should they need parts or service.

Organizational structure and company culture Russian business culture is traditionally authoritative and rule-based. This is changing slowly, as a generation of Millennials enters the workforce with a more open, networked style of interaction. Especially qualified women are advancing their careers, which they see as a form of self-determination. They look to employers like XT Beauty for opportunities to grow. Natalia, who is 27 years old recalls: "I came to St. Petersburg from another city of Russia. It was not easy to find a job and I was happy to become a salesperson here. I liked what we were selling. I cannot say that I particularly like sales, but when I was interviewed I got the feeling that if you worked hard, it would be possible to become a manager. I have a college degree, and I believe I can do it!" The company has a simple, four-tier hierarchy extending from the General Director to the sales assistants in individual stores (Exhibit 5). Olga B. is the Retail Director responsible for all shops in the important St. Petersburg region and reports to the General Director of St. Petersburg. Her bosses keep an eye on the store performances as well, intervening in her decisions when they see fit. The top management of the company comprised of its General Director, Chief Accountant, Commercial and other Retail Directors are all located in the HQ of XT Beauty in Moscow. As Moscow is 400 miles (approx. 630 km), away from St. Petersburg, these executives rarely make the 4 h journey by high-speed train and prefer to use email, which they feel is fast and cheap. Every shop is staffed by one administrator, one senior sales associate and one junior sales associate. Every Monday the administrators of all shops are required to attend a weekly review meeting in person to receive instructions. These are the only face-to-face interactions within the management layer. The General Director in the Moscow HQ never communicates directly with staff. One employee commented "during the three years I worked here, I have almost never seen a single message from the General Director. He does not even send his best wishes for Christmas or other public holidays. He never communicates with employees". Stores are typically staffed by young women of approximately the same age, where they work in shifts of 12 h. The working relationships are friendly, at least on the surface. They communicate freely with one another and sometimes meet after work for a drink. Most managers, however, do not encourage friendships within the teams. They prefer that employees observe one another and even "squeal" or report on one another's infractions like tardiness or theft of merchandise. Olga has tried to modernize this traditional authoritarian management style, which she felt breeds distrust and reduces productivity. Instead, she encouraged her teams to work together to improve service and share ideas to market their products. Even as she introduced a more collaborative approach in her stores, Olga was wary of antagonizing her own boss, who continued to apply pressure to improve sales, while demanding who was to blame for the growing problems. She was struggling to minimize the penalties that employees had to pay for missing their performance targets. On the other hand, both the general director and commercial director were notorious for making promises that were never fulfilled. The managerial style in the organization can, therefore, be roughly divided into two categories as follows: those store managers whose priority is to please the retail director and those who superficially appease his unreasonable demands, but are genuinely oriented to the needs of the business and the teams. Olga B. preferred this latter category of manager, focused on authentic communications, and a more cooperative style at work. In spite of all her efforts, she was saddened to watch her well-qualified staff degenerating into the Russian stereotype for all-women teams: "a nest of vipers."

Customer base The customer base of XT Beauty is broad, targeting both men and women of all age groups and purchasing power. According to their commercial director, "anybody can buy in our shops - from students to pensioners. It does not matter what they buy. The most important question for us is how much." The proportion of regular customers vary from store to store. For example, the shop 1.B (Exhibit 7 for shop names and numbers) has dozens of repeat and regular customers, while in the shop 2.B there are only 20. It all depends on the store location and on relationships with the sales associates. When a sales associate quits, she typically takes all her best customers with her. The behavior of regular hair stylists is even more volatile. In shop 2.B there were only 5 of these customers, while in shop 1.B there were ten times as many because of the density of hair salons in the vicinity. XT Beauty realized, however, that the many promotions and discount cards (15 per cent discount!), had little impact on the purchasing behavior of the salons, which did not buy in the stores, occasionally they dropped by for daily supplies or a few electric appliances for working at home, but they did not stock their salons with equipment from the XT assortment. What was becoming clear is that the key criterion for purchase remained low prices, and the final decision to buy depended on the persuasive power of the sales associate in the store. Before the economic recession, it was still possible to convince the shopper to try out a higher-end and pricier product. Times had changed, and in spite of all efforts, this conversion was becoming less and less common. Seasonality remained a feature of the beauty market, with the main shopping season being December as people prepared for Russia's big New Year celebrations, September when customers stocked up after their summer holidays and were paying more attention to their appearance again, as well as the period between the 15th of February and 15th of March. These patterns were last observed in 2016, after which the company realized, with chagrin that September 2017 had not been a seasonal peak

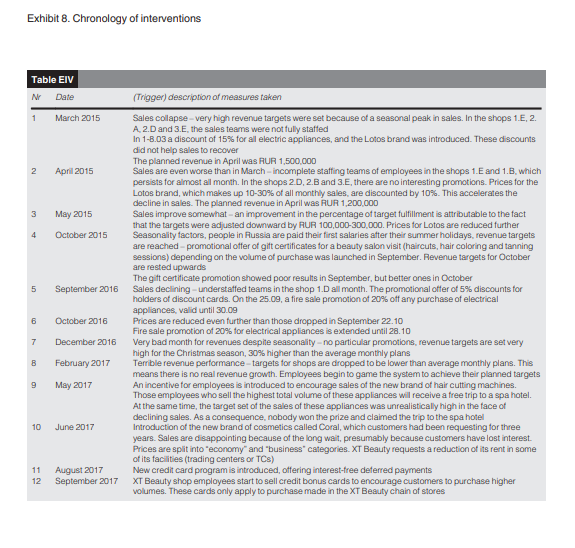

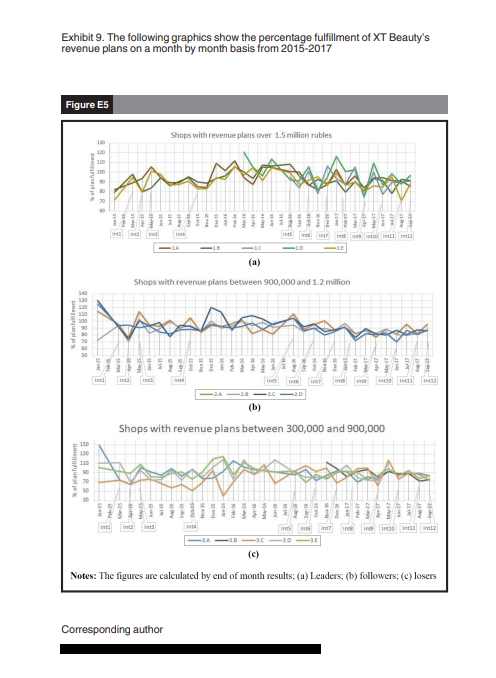

XT Beauty's performance challenge In spite of this broad market coverage and popular brand portfolio, XT Beauty has seen its sales decline since the middle of 2015. A growing number of their shops have become unprofitable (Exhibits 6 and 7). If sales do not pick up by the end of 2017, the company will have to close down more stores. The decline in profitability has been accompanied by higher employee turnover. This personnel drain began in early 2015. Another employee, Elena reflected "why are people quitting? The payment scheme is perceived as unfair. There are no personal sales quotas. No matter how hard you work, now there is just one bonus pool, which is divided equally among all employees of a shop. In effect, one could sell just cheap products without putting in any effort, while another sales associate would invest a lot of energy into selling more expensive brands. At the end of the day, everybody gets the same bonus." The reason for attrition is the lack of career prospects. Consider again Natalia, 27 years of age, who became a sales assistant three years ago. She has a college degree and good sales records. She has always worked hard and is the kind of person who has never shown up even 5 min late for work. In spite of her performance, Natalia has not made the smallest promotion to senior sales assistant. With bitterness she admits that "it is clear that not everybody around here wants career growth. A lot of people are content to stay sales assistants because it is less hassle and carries less responsibility. However, some of us do need it! Promotion from within the company is a good motivation for employees. However, that does not happen around here [...]. In the past 6 years almost nobody (with rare exceptions, i.e. 3-5 internal promotions out of a staff of 150), moved up the career ladder from shop assistant to a higher administrative role. Management is always hired externally. The reasons are not transparent." By May of that year, the company had lost most of its experienced (those who had worked for the company for two years and more) sales associates, who were replaced with novices. In that same period of time, XT Beauty lost over 50 per cent of its managerial staff. The company reacted to the drop in sales and margin by introducing a number of programs. These included XT Branded credit cards, which accumulated points for shoppers that led to rebates. These were originally designed to bind their customers who were now shopping around for the best deals. What originally seemed like a good idea eventually backfired after the already overworked sales associates were given quotas for the credit cards on top of their regular beauty products. The overall sales performance of these employees dropped. Trained as beauticians, they had little expertize and no interest in financial instruments. In the stores, a climate of frustration and exhaustion began to spread, which soon became apparent to the customers they were facing. As 2018 began, plans were on the table for layoffs, which would leave only a single person in stores, making it impossible to take breaks, while reducing security. The pressure on XT Beauty and its managers was rising. Although the economic crisis meant that product availability would be critical to prevent shoppers from switching to other brands or retail locations, XT Beauty's service levels were far from optimal. The cash crunch had resulted in unpaid invoices to suppliers, who retaliated by withholding replenishment deliveries to XT Beauty's stores. Stock planning had become increasingly unreliable. Individual shops reacted to stockouts by triggering replenishments from nearby stores instead of from the local DC. This usually was not enough to satisfy the customer's request, yet caused stockouts in other locations. Customers were beginning to complain that the products that they had come in for were not on the shelves and that competitors like Prof Beauty Market or Shpilka were better stocked. The budget provided by company HQ for product and business development was being regularly diverted to cover short-term liabilities and trigger replenishment deliveries. To summarize, the company, which had managed to establish itself successfully in Russia's resilient personal care market, had found itself in a fire-fighting mode, which increased the pressure on all functions such as sales, supply management and logistics, human resources (HRs) and not least company culture. It was no wonder that Olga B. and her shrinking, frustrated team felt at the end of their rope. She decided that she must either submit her resignation or approach her executive team with a proposal for a turnaround, based on all she knew of what was happening on the ground. This narrative is based on a real company operating in Russia. Their managers have provided the following data for this case study: Exhibit 8 describes all interventions made by XT Beauty in chronjlogical order. The impact of these programs are visible in Exhibits 9 (a), 9(b) and 9(c), which depict the percentage of fulfillment of revenue targets, month by month in 2015-2017; percentage is calculated by end of month results. The retail shops are grouped according to the size of revenue plan, as described below. Exhibit 9(a) depicts what XT Beauty considers to be its "leaders." These are bigger shops, which sell more, and are situated in better locations. Their planned revenue targets tend to be higher. Exhibit 9(b) shows the so-called "followers." These shops do not typically sell, as well as the "leaders." Their revenue targets are average in size. Exhibit 9(c) is the "losers." These shops are located in less popular places and are assigned lower revenue targets. On the x-axis of each Exhibits 9(a), 9(b) and 9(c) are marked the interventions described in Exhibit 8. The date of each intervention is marked to demonstrate the effect it had (if any), on the fulfillment of revenue plans.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started