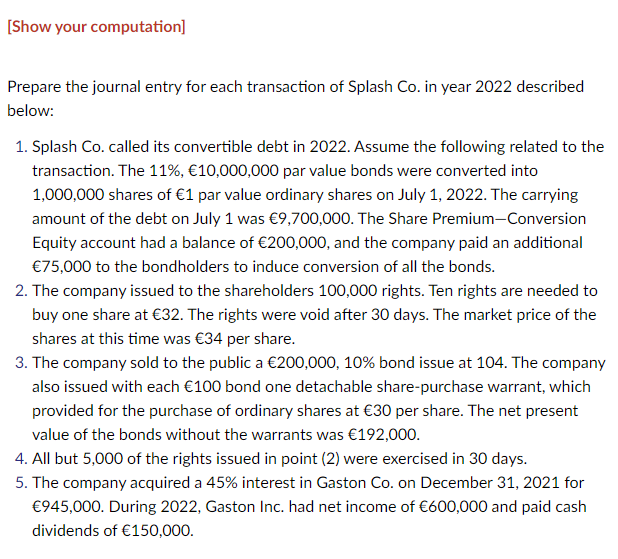

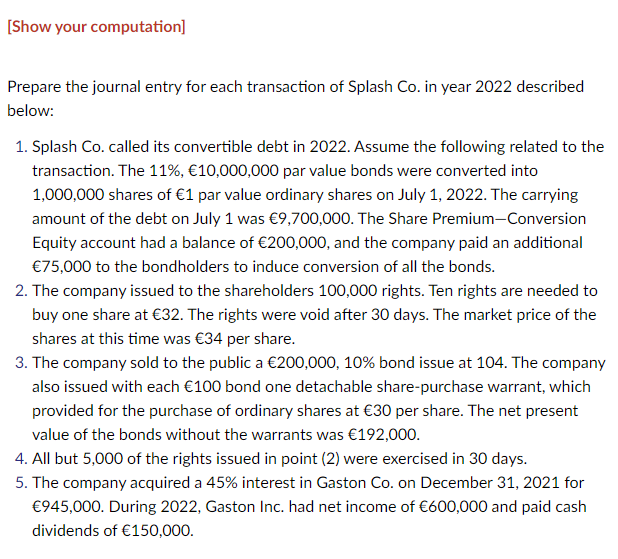

[Show your computation] Prepare the journal entry for each transaction of Splash Co. in year 2022 described below: 1. Splash Co. called its convertible debt in 2022. Assume the following related to the transaction. The 11%, 10,000,000 par value bonds were converted into 1,000,000 shares of 1 par value ordinary shares on July 1, 2022. The carrying amount of the debt on July 1 was 9,700,000. The Share Premium-Conversion Equity account had a balance of 200,000, and the company paid an additional 75,000 to the bondholders to induce conversion of all the bonds. 2. The company issued to the shareholders 100,000 rights. Ten rights are needed to buy one share at 32. The rights were void after 30 days. The market price of the shares at this time was 34 per share. 3. The company sold to the public a 200,000, 10% bond issue at 104. The company also issued with each 100 bond one detachable share-purchase warrant, which provided for the purchase of ordinary shares at 30 per share. The net present value of the bonds without the warrants was 192,000. 4. All but 5,000 of the rights issued in point (2) were exercised in 30 days. 5. The company acquired a 45% interest in Gaston Co. on December 31, 2021 for 945,000. During 2022, Gaston Inc. had net income of 600,000 and paid cash dividends of 150,000. [Show your computation] Prepare the journal entry for each transaction of Splash Co. in year 2022 described below: 1. Splash Co. called its convertible debt in 2022. Assume the following related to the transaction. The 11%, 10,000,000 par value bonds were converted into 1,000,000 shares of 1 par value ordinary shares on July 1, 2022. The carrying amount of the debt on July 1 was 9,700,000. The Share Premium-Conversion Equity account had a balance of 200,000, and the company paid an additional 75,000 to the bondholders to induce conversion of all the bonds. 2. The company issued to the shareholders 100,000 rights. Ten rights are needed to buy one share at 32. The rights were void after 30 days. The market price of the shares at this time was 34 per share. 3. The company sold to the public a 200,000, 10% bond issue at 104. The company also issued with each 100 bond one detachable share-purchase warrant, which provided for the purchase of ordinary shares at 30 per share. The net present value of the bonds without the warrants was 192,000. 4. All but 5,000 of the rights issued in point (2) were exercised in 30 days. 5. The company acquired a 45% interest in Gaston Co. on December 31, 2021 for 945,000. During 2022, Gaston Inc. had net income of 600,000 and paid cash dividends of 150,000