Answered step by step

Verified Expert Solution

Question

1 Approved Answer

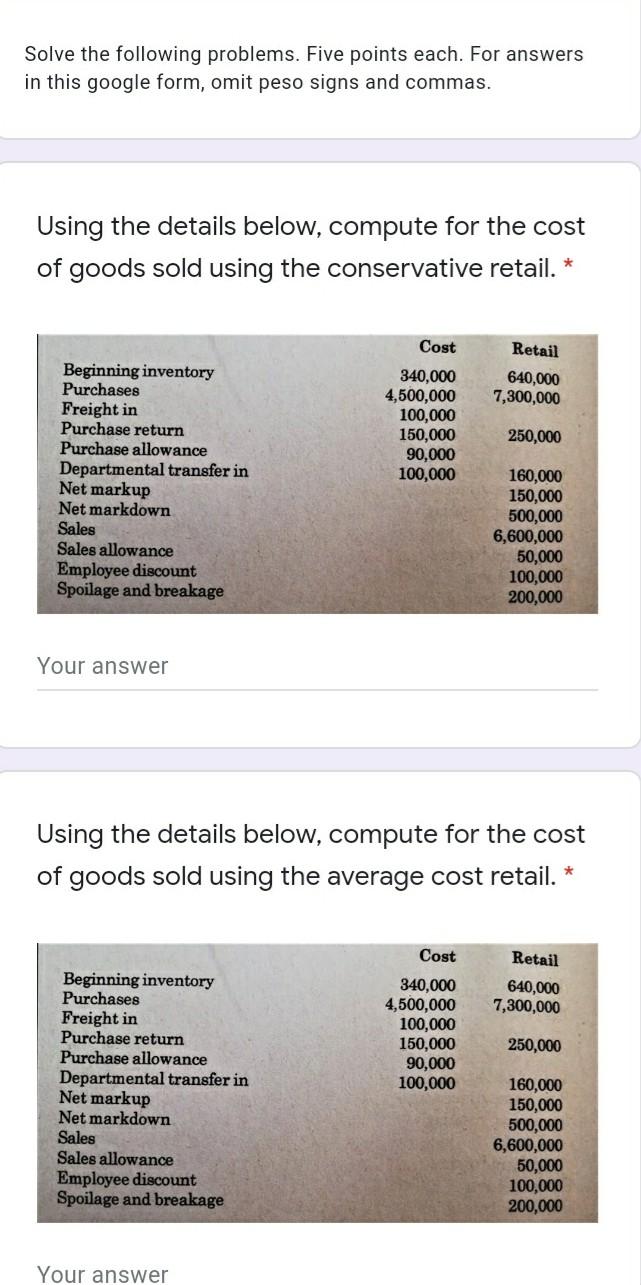

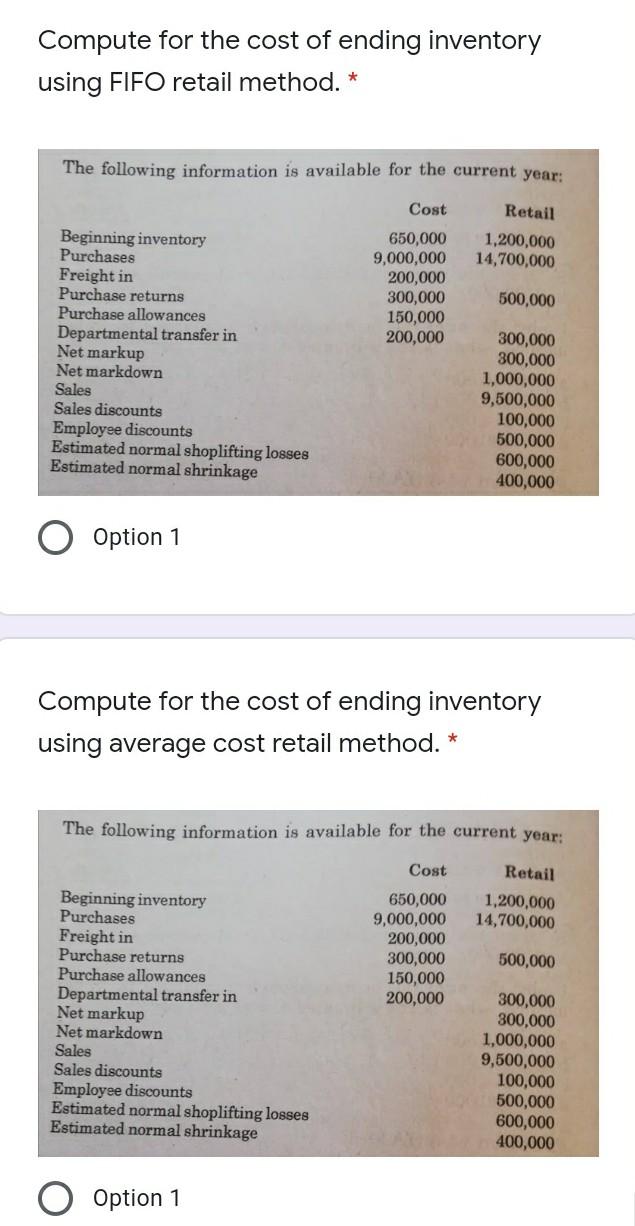

SHOW YOUR SOLUTION IN GOOD ACCOUNTING FORM Solve the following problems. Five points each. For answers in this google form, omit peso signs and commas.

SHOW YOUR SOLUTION IN GOOD ACCOUNTING FORM

Solve the following problems. Five points each. For answers in this google form, omit peso signs and commas. Using the details below, compute for the cost of goods sold using the conservative retail. * Cost Retail 640,000 7,300,000 Beginning inventory Purchases Freight in Purchase return Purchase allowance Departmental transfer in Net markup Net markdown Sales Sales allowance Employee discount Spoilage and breakage 340,000 4,500,000 100,000 150,000 90,000 100,000 250,000 160,000 150,000 500,000 6,600,000 50,000 100,000 200,000 Your answer Using the details below, compute for the cost of goods sold using the average cost retail. * Retail 640,000 7,300,000 Cost 340,000 4,500,000 100,000 150,000 90,000 100,000 Beginning inventory Purchases Freight in Purchase return Purchase allowance Departmental transfer in Net markup Net markdown Sales Sales allowance Employee discount Spoilage and breakage 250,000 160,000 150,000 500,000 6,600,000 50,000 100,000 200,000 Your answer Compute for the cost of ending inventory using FIFO retail method. * The following information is available for the current year: Retail 1,200,000 14,700,000 Cost 650,000 9,000,000 200,000 300,000 150,000 200,000 500,000 Beginning inventory Purchases Freight in Purchase returns Purchase allowances Departmental transfer in Net markup Net markdown Sales Sales discounts Employee discounts Estimated normal shoplifting losses Estimated normal shrinkage 300,000 300,000 1,000,000 9,500,000 100,000 500,000 600,000 400,000 Option 1 Compute for the cost of ending inventory using average cost retail method. * The following information is available for the current year: Retail 1,200,000 14,700,000 Cost 650,000 9,000,000 200,000 300,000 150,000 200,000 500,000 Beginning inventory Purchases Freight in Purchase returns Purchase allowances Departmental transfer in Net markup Net markdown Sales Sales discounts Employee discounts Estimated normal shoplifting losses Estimated normal shrinkage 300,000 300,000 1,000,000 9,500,000 100,000 500,000 600,000 400,000 O Option 1 Solve the following problems. Five points each. For answers in this google form, omit peso signs and commas. Using the details below, compute for the cost of goods sold using the conservative retail. * Cost Retail 640,000 7,300,000 Beginning inventory Purchases Freight in Purchase return Purchase allowance Departmental transfer in Net markup Net markdown Sales Sales allowance Employee discount Spoilage and breakage 340,000 4,500,000 100,000 150,000 90,000 100,000 250,000 160,000 150,000 500,000 6,600,000 50,000 100,000 200,000 Your answer Using the details below, compute for the cost of goods sold using the average cost retail. * Retail 640,000 7,300,000 Cost 340,000 4,500,000 100,000 150,000 90,000 100,000 Beginning inventory Purchases Freight in Purchase return Purchase allowance Departmental transfer in Net markup Net markdown Sales Sales allowance Employee discount Spoilage and breakage 250,000 160,000 150,000 500,000 6,600,000 50,000 100,000 200,000 Your answer Compute for the cost of ending inventory using FIFO retail method. * The following information is available for the current year: Retail 1,200,000 14,700,000 Cost 650,000 9,000,000 200,000 300,000 150,000 200,000 500,000 Beginning inventory Purchases Freight in Purchase returns Purchase allowances Departmental transfer in Net markup Net markdown Sales Sales discounts Employee discounts Estimated normal shoplifting losses Estimated normal shrinkage 300,000 300,000 1,000,000 9,500,000 100,000 500,000 600,000 400,000 Option 1 Compute for the cost of ending inventory using average cost retail method. * The following information is available for the current year: Retail 1,200,000 14,700,000 Cost 650,000 9,000,000 200,000 300,000 150,000 200,000 500,000 Beginning inventory Purchases Freight in Purchase returns Purchase allowances Departmental transfer in Net markup Net markdown Sales Sales discounts Employee discounts Estimated normal shoplifting losses Estimated normal shrinkage 300,000 300,000 1,000,000 9,500,000 100,000 500,000 600,000 400,000 O Option 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started