Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show your work 15. Consider the following hypothetical facts about Mexico. The peso recently lost over 40% of its value relative to the euro. There

Show your work

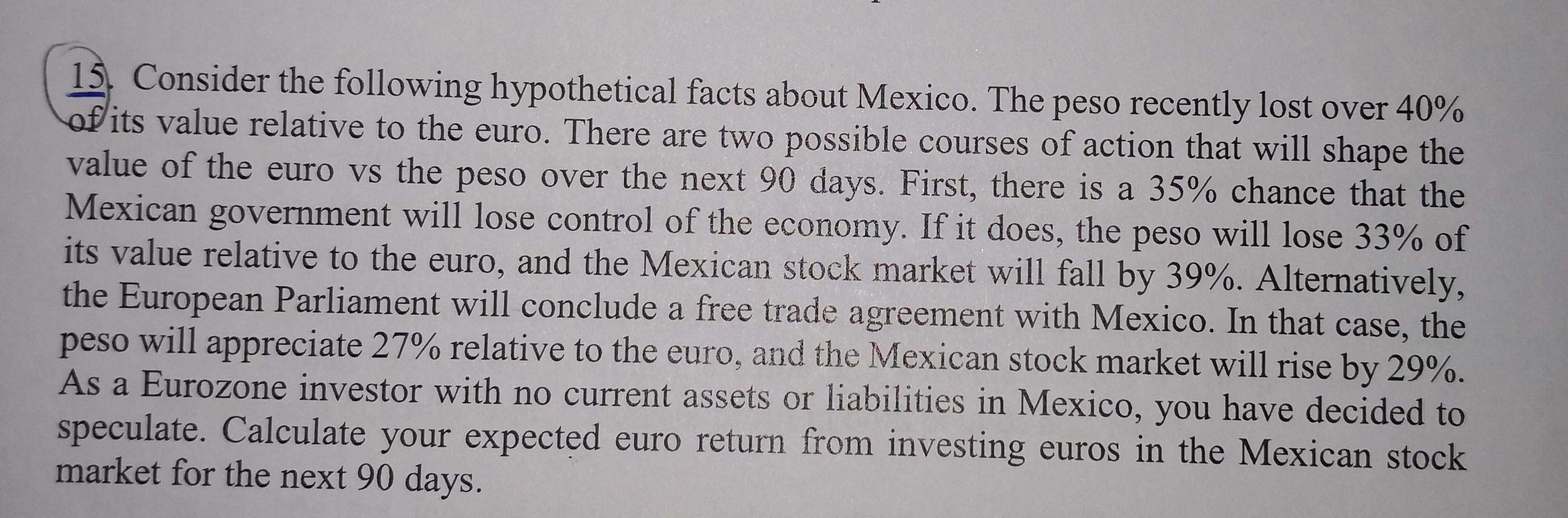

15. Consider the following hypothetical facts about Mexico. The peso recently lost over 40% of its value relative to the euro. There are two possible courses of action that will shape the value of the euro vs the peso over the next 90 days. First, there is a 35% chance that the Mexican government will lose control of the economy. If it does, the peso will lose 33% of its value relative to the euro, and the Mexican stock market will fall by 39%. Alternatively, the European Parliament will conclude a free trade agreement with Mexico. In that case, the peso will appreciate 27% relative to the euro, and the Mexican stock market will rise by 29%. As a Eurozone investor with no current assets or liabilities in Mexico, you have decided to speculate. Calculate your expected euro return from investing euros in the Mexican stock market for the next 90 days. a 15. Consider the following hypothetical facts about Mexico. The peso recently lost over 40% of its value relative to the euro. There are two possible courses of action that will shape the value of the euro vs the peso over the next 90 days. First, there is a 35% chance that the Mexican government will lose control of the economy. If it does, the peso will lose 33% of its value relative to the euro, and the Mexican stock market will fall by 39%. Alternatively, the European Parliament will conclude a free trade agreement with Mexico. In that case, the peso will appreciate 27% relative to the euro, and the Mexican stock market will rise by 29%. As a Eurozone investor with no current assets or liabilities in Mexico, you have decided to speculate. Calculate your expected euro return from investing euros in the Mexican stock market for the next 90 days. aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started