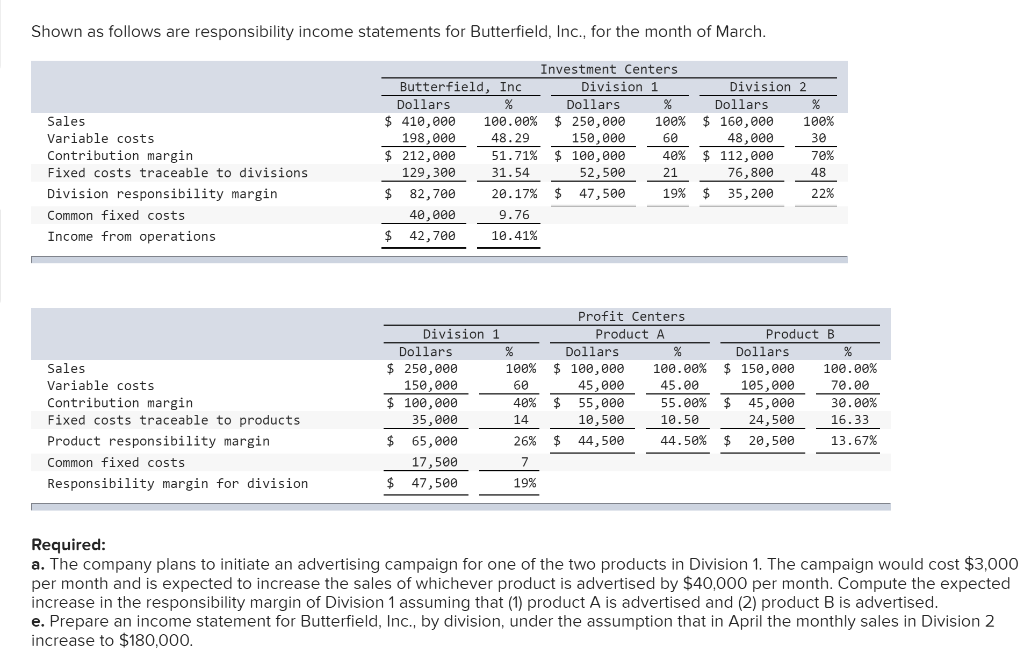

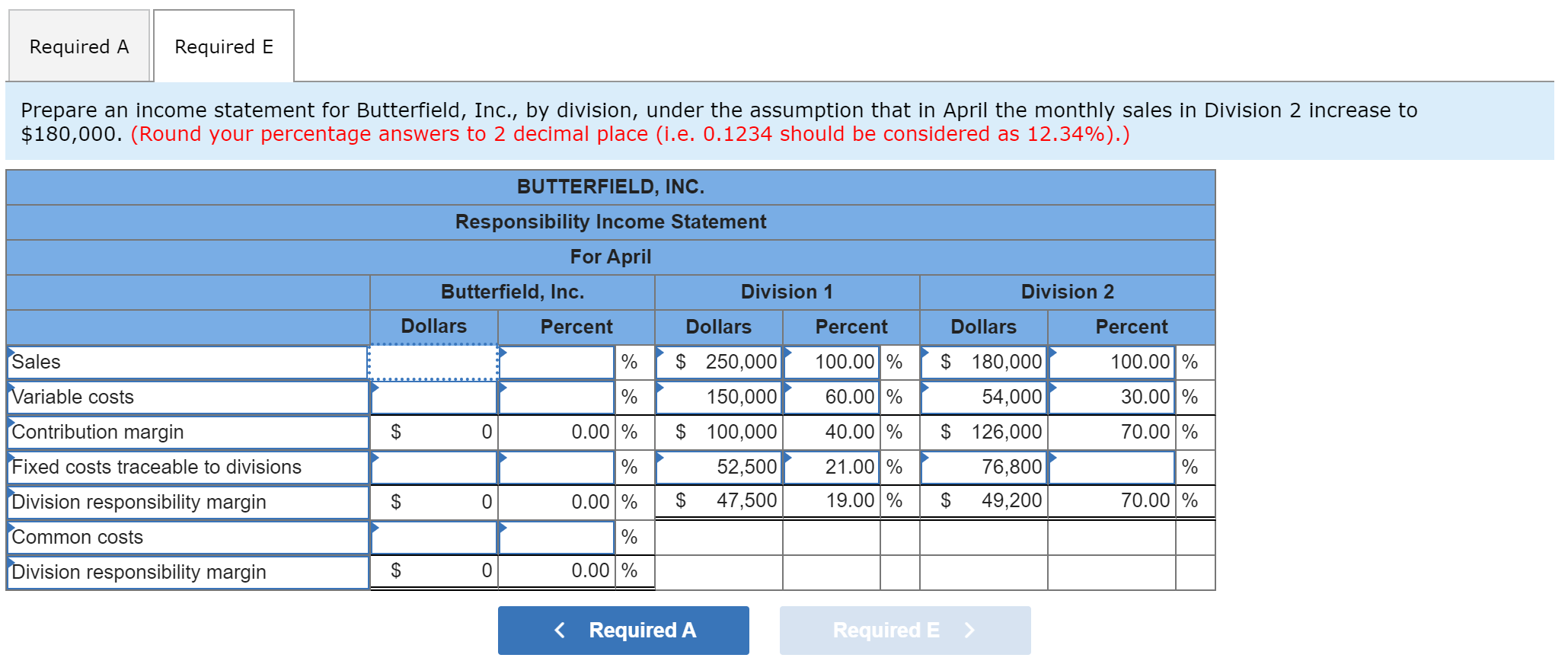

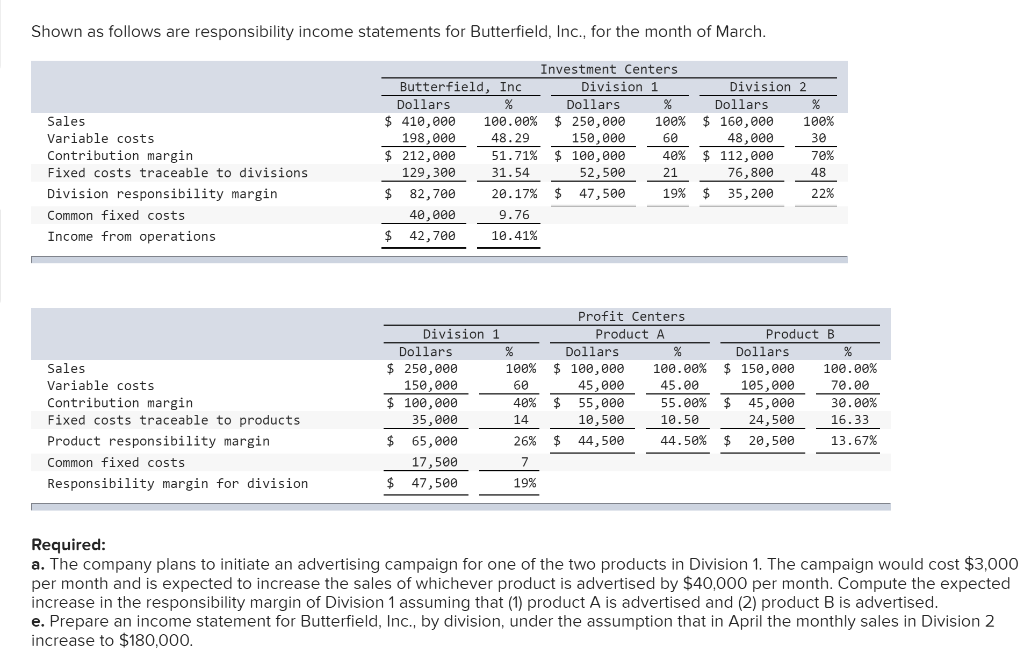

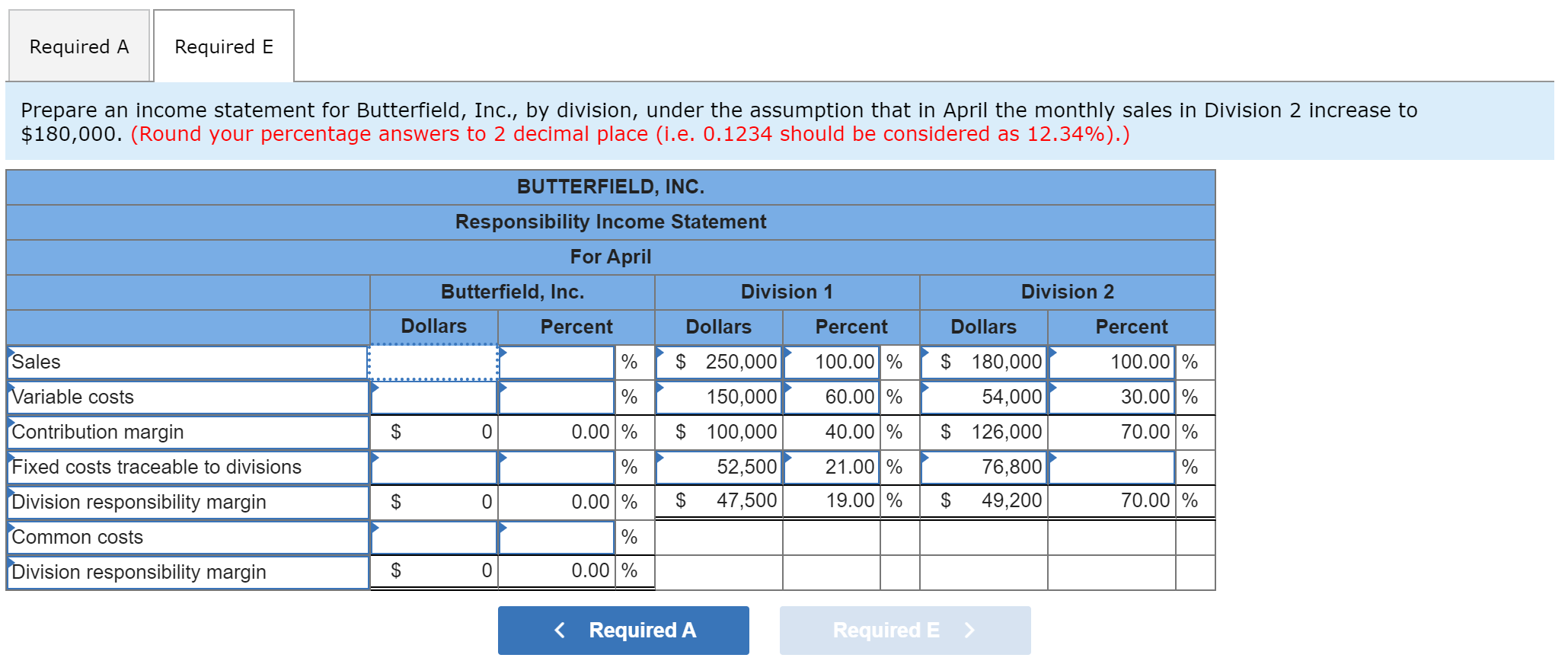

Shown as follows are responsibility income statements for Butterfield, Inc., for the month of March. Sales Variable costs Contribution margin Fixed costs traceable to divisions Division responsibility margin Common fixed costs Income from operations Investment Centers Butterfield, Inc Division 1 Division 2 Dollars Dollars % Dollars % $ 410,000 100.00% $ 250,000 100% $ 160,000 100% 198,000 48.29 150,000 60 48,000 30 $ 212,000 51.719 $ 100,000 40% $ 112,000 70% 129, 300 31.54 52,500 21 76,800 48 $ 82,700 20.17% $ 47,500 19% $ 22% 40,000 9.76 $ 42,700 10.41% 35,200 100% Sales Variable costs Contribution margin Fixed costs traceable to products Product responsibility margin Common fixed costs Responsibility margin for division Division 1 Dollars % $ 250,000 150,000 60 $ 100,000 40% 35,000 14 $ 65,000 26% 17,500 7 $ 47,500 19% Profit Centers Product A Dollars $ 100,000 100.00% 45,000 45.00 $ 55,000 55.00% 10,500 10.50 44,500 44.50% Product B Dollars % $ 150,000 100.00% 105,000 70.00 $ 45,000 30.00% 24,500 16.33 $ 20,500 13.67% Required: a. The company plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $3,000 per month and is expected to increase the sales of whichever product is advertised by $40,000 per month. Compute the expected increase in the responsibility margin of Division 1 assuming that (1) product A is advertised and (2) product B is advertised. e. Prepare an income statement for Butterfield, Inc., by division, under the assumption that in April the monthly sales in Division 2 increase to $180,000. Required A. Required E Prepare an income statement for Butterfield, Inc., by division, under the assumption that in April the monthly sales in Division 2 increase to $180,000. (Round your percentage answers to 2 decimal place (i.e. 0.1234 should be considered as 12.34%).) BUTTERFIELD, INC. Responsibility Income Statement For April Butterfield, Inc. Division 1 Dollars Percent Dollars Percent Division 2 Dollars Percent Sales % 100.00% 100.00% $ 180,000 54,000 Variable costs % 60.00% 30.001% Contribution margin $ 0 0.00 % $ 250,000 150,000 $ 100,000 52,500 $ 47,500 40.00% 70.00% Fixed costs traceable to divisions % 21.001% $ 126,000 76,800 $ 49,200 % Division responsibility margin $ 0 0.00 % 19.00 % 70.00% Common costs % Division responsibility margin $ 0 0.00%