Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shown below are the Machinery and Equipment and Delivery Equipment accounts of the KAYA MO YAN COMPANY. One-half year's depreciation is charged in the

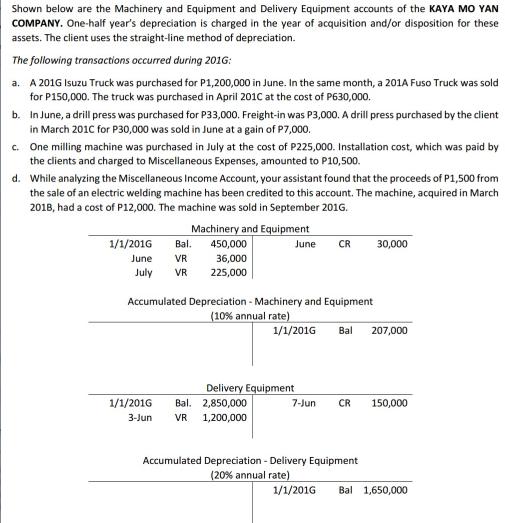

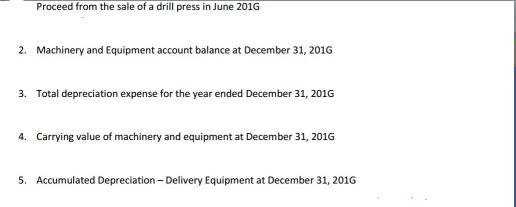

Shown below are the Machinery and Equipment and Delivery Equipment accounts of the KAYA MO YAN COMPANY. One-half year's depreciation is charged in the year of acquisition and/or disposition for these assets. The client uses the straight-line method of depreciation. The following transactions occurred during 201G: a. A 201G Isuzu Truck was purchased for P1,200,000 in June. In the same month, a 201A Fuso Truck was sold for P150,000. The truck was purchased in April 201C at the cost of P630,000. b. In June, a drill press was purchased for P33,000. Freight-in was P3,000. A drill press purchased by the client in March 201C for P30,000 was sold in June at a gain of P7,000. c. One milling machine was purchased in July at the cost of P225,000. Installation cost, which was paid by the clients and charged to Miscellaneous Expenses, amounted to P10,500. d. While analyzing the Miscellaneous Income Account, your assistant found that the proceeds of P1,500 from the sale of an electric welding machine has been credited to this account. The machine, acquired in March 2018, had a cost of P12,000. The machine was sold in September 2016. Machinery and Equipment 1/1/2016 June July Bal. 450,000 36,000 VR VR 225,000 June CR Accumulated Depreciation - Machinery and Equipment (10% annual rate) 1/1/2016 Bal. 2,850,000 3-Jun VR 1,200,000 Delivery Equipment 1/1/2016 Bal 207,000 30,000 7-Jun CR 150,000 Accumulated Depreciation - Delivery Equipment (20% annual rate) 1/1/2016 Bal 1,650,000 Proceed from the sale of a drill press in June 2016 2. Machinery and Equipment account balance at December 31, 2016 3. Total depreciation expense for the year ended December 31, 2016 4. Carrying value of machinery and equipment at December 31, 201G 5. Accumulated Depreciation - Delivery Equipment at December 31, 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is a revised and organized representation of the accounts and transactions for the KAYA MO YAN ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started