Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shown below is an excerpt from the repayment schedule for Ben Birnbaum's mortgage loan. It was originated on May 1. Interest is paid in

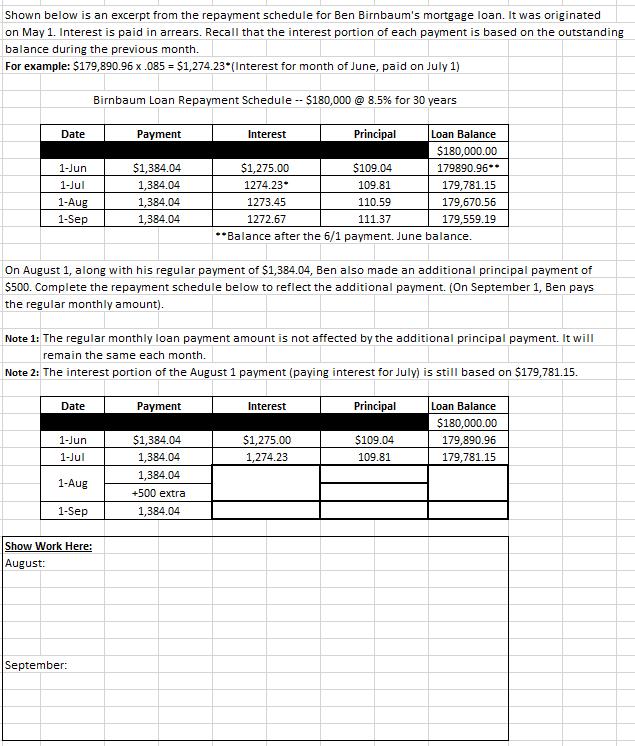

Shown below is an excerpt from the repayment schedule for Ben Birnbaum's mortgage loan. It was originated on May 1. Interest is paid in arrears. Recall that the interest portion of each payment is based on the outstanding balance during the previous month. For example: $179,890.96 x .085 = $1,274.23* (Interest for month of June, paid on July 1) Birnbaum Loan Repayment Schedule - $180,000 @ 8.5% for 30 years Date 1-Jun 1-Jul 1-Aug 1-Sep Date 1-Jun 1-Jul 1-Aug 1-Sep Payment Show Work Here: August: $1,384.04 1,384.04 1,384.04 1,384.04 September: On August 1, along with his regular payment of $1,384.04, Ben also made an additional principal payment of $500. Complete the repayment schedule below to reflect the additional payment. (On September 1, Ben pays the regular monthly amount). Interest Note 1: The regular monthly loan payment amount is not affected by the additional principal payment. It will remain the same each month. Note 2: The interest portion of the August 1 payment (paying interest for July) is still based on $179,781.15. Payment $1,275.00 1274.23* 1273.45 1272.67 $1,384.04 1,384.04 1,384.04 +500 extra 1,384.04 $109.04 109.81 110.59 111.37 **Balance after the 6/1 payment. June balance. Principal Interest $1,275.00 1,274.23 Loan Balance $180,000.00 179890.96** 179,781.15 179,670.56 179,559.19 Principal $109.04 109.81 Loan Balance $180,000.00 179,890.96 179,781.15

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To complete the repayment schedule for the month of August after the additional payment was made we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started