Answered step by step

Verified Expert Solution

Question

1 Approved Answer

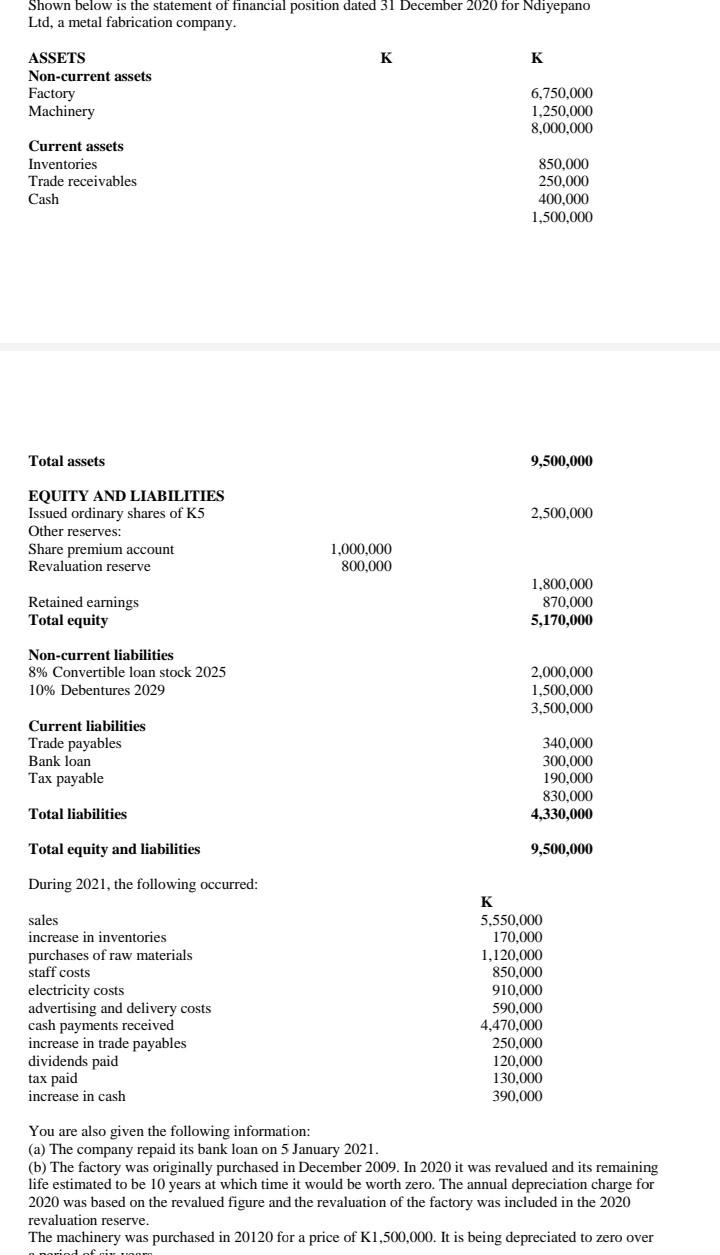

Shown below is the statement of financial position dated 31 December 2020 for Ndiyepano Ltd, a metal fabrication company. ASSETS K K Non-current assets Factory

Shown below is the statement of financial position dated 31 December 2020 for Ndiyepano Ltd, a metal fabrication company. ASSETS K K Non-current assets Factory 6,750,000 Machinery 1,250,000 8,000,000 Current assets Inventories 850.000 250,000 Trade receivables Cash 400,000 1,500,000 Total assets 9,500,000 EQUITY AND LIABILITIES Issued ordinary shares of K5 2,500,000 Other reserves: Share premium account Revaluation reserve 1,800,000 Retained earnings 870,000 Total equity 5,170,000 Non-current liabilities 8% Convertible loan stock 2025 2,000,000 10% Debentures 2029 1,500,000 3,500,000 Current liabilities Trade payables 340,000 Bank loan 300,000 Tax payable 190,000 830,000 Total liabilities 4,330,000 Total equity and liabilities 9,500,000 During 2021, the following occurred: K sales 5,550,000 increase in inventories. 170,000 1,120,000 purchases of raw materials staff costs 850,000 electricity costs 910,000 advertising and delivery costs 590,000 cash payments received 4,470,000 increase in trade payables 250,000 dividends paid 120,000 tax paid 130,000 390,000 increase in cash You are also given the following information: (a) The company repaid its bank loan on 5 January 2021. (b) The factory was originally purchased in December 2009. In 2020 it was revalued and its remaining life estimated to be 10 years at which time it would be worth zero. The annual depreciation charge for 2020 was based on the revalued figure and the revaluation of the factory was included in the 2020 revaluation reserve. The machinery was purchased in 20120 for a price of K1,500,000. It is being depreciated to zero over n norind of cir unor 1,000,000 800,000 Shown below is the statement of financial position dated 31 December 2020 for Ndiyepano Ltd, a metal fabrication company. ASSETS K K Non-current assets Factory 6,750,000 Machinery 1,250,000 8,000,000 Current assets Inventories 850.000 250,000 Trade receivables Cash 400,000 1,500,000 Total assets 9,500,000 EQUITY AND LIABILITIES Issued ordinary shares of K5 2,500,000 Other reserves: Share premium account Revaluation reserve 1,800,000 Retained earnings 870,000 Total equity 5,170,000 Non-current liabilities 8% Convertible loan stock 2025 2,000,000 10% Debentures 2029 1,500,000 3,500,000 Current liabilities Trade payables 340,000 Bank loan 300,000 Tax payable 190,000 830,000 Total liabilities 4,330,000 Total equity and liabilities 9,500,000 During 2021, the following occurred: K sales 5,550,000 increase in inventories. 170,000 1,120,000 purchases of raw materials staff costs 850,000 electricity costs 910,000 advertising and delivery costs 590,000 cash payments received 4,470,000 increase in trade payables 250,000 dividends paid 120,000 tax paid 130,000 390,000 increase in cash You are also given the following information: (a) The company repaid its bank loan on 5 January 2021. (b) The factory was originally purchased in December 2009. In 2020 it was revalued and its remaining life estimated to be 10 years at which time it would be worth zero. The annual depreciation charge for 2020 was based on the revalued figure and the revaluation of the factory was included in the 2020 revaluation reserve. The machinery was purchased in 20120 for a price of K1,500,000. It is being depreciated to zero over n norind of cir unor 1,000,000 800,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started