Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shows steps as the textbook example Mojito Mint Company has a debt-equity ratio of .35. The required return on the company's unlevered equity is 18

Shows steps as the textbook example

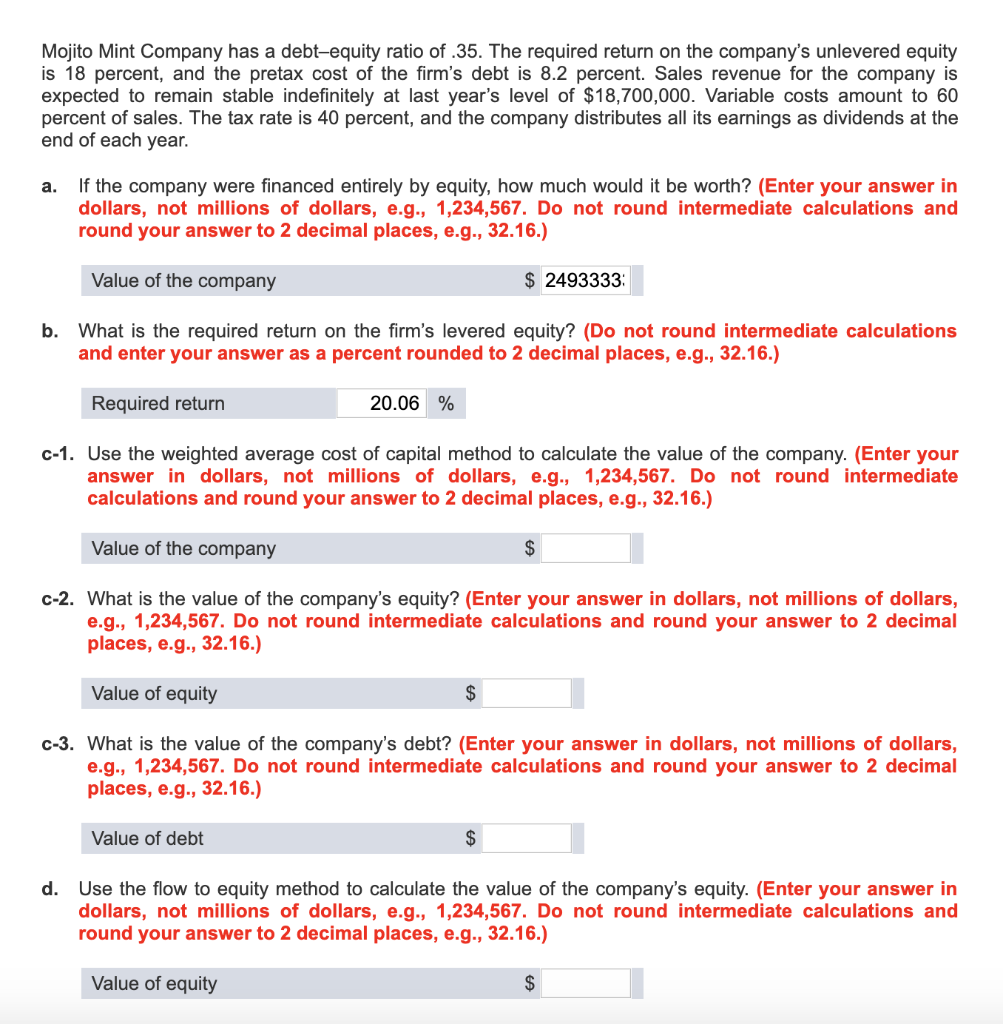

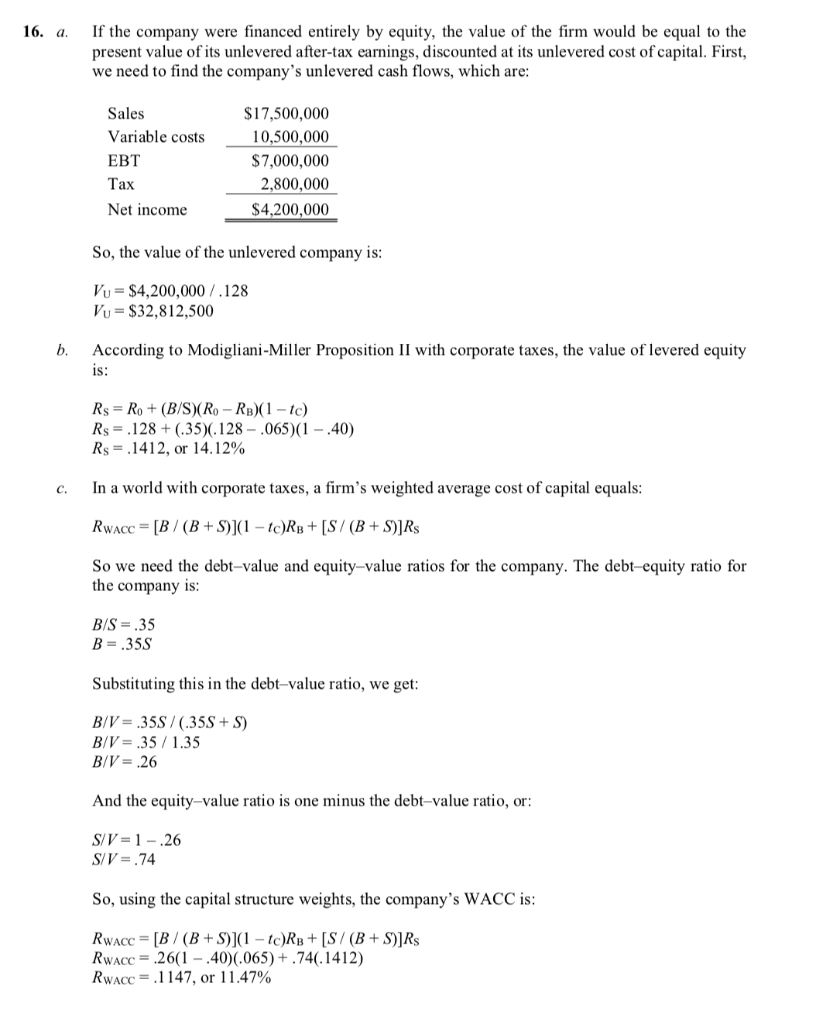

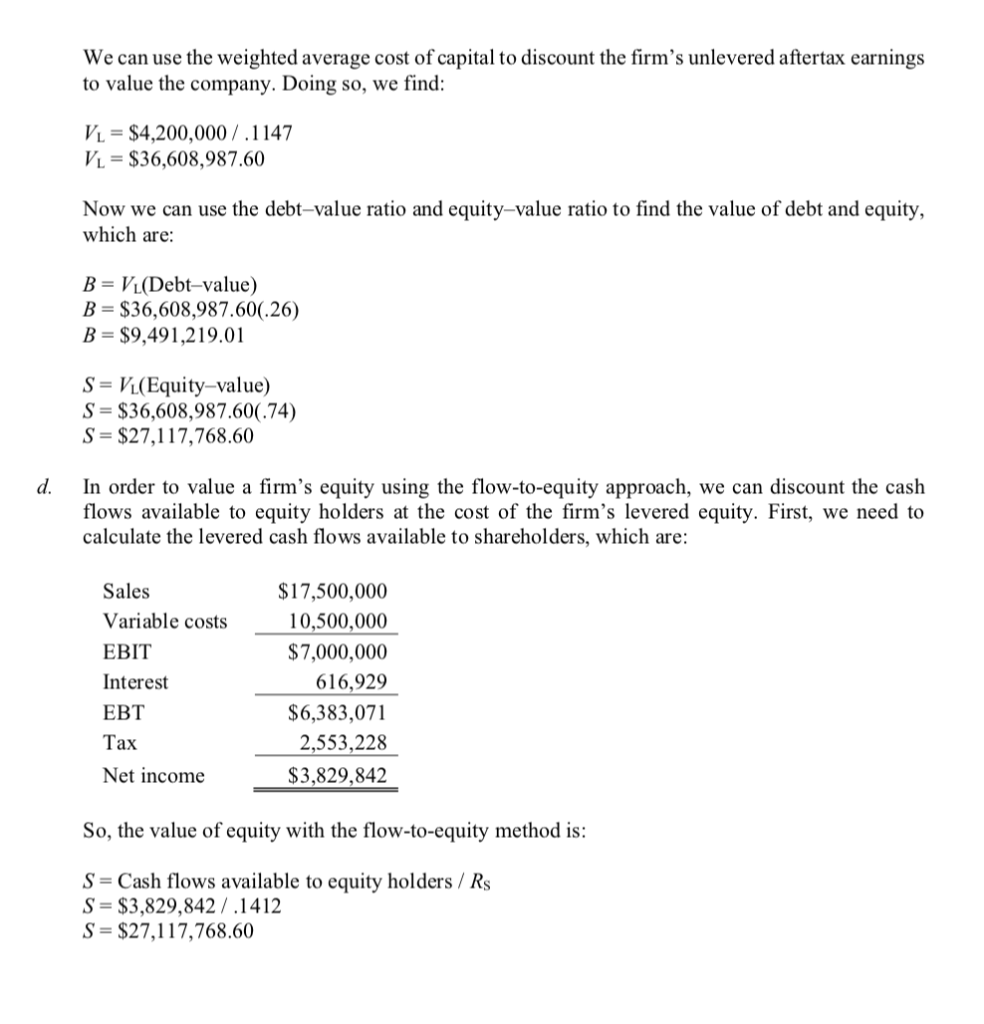

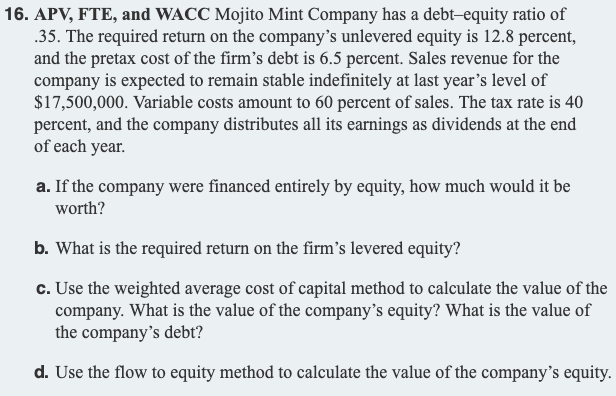

Mojito Mint Company has a debt-equity ratio of .35. The required return on the company's unlevered equity is 18 percent, and the pretax cost of the firm's debt is 8.2 percent. Sales revenue for the company is expected to remain stable indefinitely at last year's level of $18,700,000. Variable costs amount to 60 percent of sales. The tax rate is 40 percent, and the company distributes all its earnings as dividends at the end of each year If the company were financed entirely by equity, how much would it be worth? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. $2493333 Value of the company b. What is the required return on the firm's levered equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Required return 20.06 % c-1. Use the weighted average cost of capital method to calculate the value of the company. (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of the company c-2. What is the value of the company's equity? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of equity c-3. What is the value of the company's debt? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of debt d. Use the flow to equity method to calculate the value of the company's equity. (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of equity 16. a. If the company were financed entirely by equity, the value of the firm would be equal to the present value of its unlevered after-tax earnings, discounted at its unlevered cost of capital. First, we need to find the company's unlevered cash flows, which are S17,500,000 Sales Variable costs 10,500,000 EBT Tax Net income $7,000,000 2,800,000 $4,200,000 So, the value of the unlevered company is: Ku = $4,200,000 / . 128 Vu $32,812,500 b. According to Modigliani-Miller Propostion II with corporate taxes, the value of levered equity iS: Rs 128+(.35).128- .065)(1 R,-. 14 12, or 14. 1290 - .40) c. In a world with corporate taxes, a firm's weighted average cost of capital equals So we need the debt-value and equity-value ratios for the company. The debt-equity ratio for the company is B/S-35 Substituting this in the debt-value ratio, we get BIV-35S/(.35S+ S) B/V= .35 / 1.35 B/V-.26 And the equity-value ratio is one minus the debt-value ratio, or: SV-.74 So, using the capital structure weights, the company's WACC is: RwAcc 261 - 40)(065) +.74(.1412) RWACC = .1 147, or 1 1.47% We can use the weighted average cost of capital to discount the firm's unlevered aftertax earnings to value the company. Doing so, we find Vi- $4,200,000/.1147 VL $36,608,987.60 Now we can use the debt-value ratio and equity-value ratio to find the value of debt and equity, which are: B- VL(Debt-value) B $36,608,987.60(.26) B- $9,491,219.01 S- Vi(Equity-value) S $36,608,987.60(74) S- $27,117,768.60 d. In order to value a firm's equity using the flow-to-equity approach, we can discount the cash flows available to equity holders at the cost of the firm's levered equity. First, we need to calculate the levered cash flows available to shareholders, which are Sales Variable costs EBIT Interest EBT Tax Net income $17,500,000 0,500,000 $7,000,000 616,929 $6,383,071 2,553,228 $3,829,842 So, the value of equity with the flow-to-equity method is: S- Cash flows available to equity holders / Rs S- $3,829,842/.1412 S= $27,1 17,768.60 16. APV, FTE, and WACC Mojito Mint Company has a debt-equity ratio of 35. The required return on the company's unlevered equity is 12.8 percent, and the pretax cost of the firm's debt is 6.5 percent. Sales revenue for the company is expected to remain stable indefinitely at last year's level of $17,500,000. Variable costs amount to 60 percent of sales. The tax rate is 40 percent, and the company distributes all its earnings as dividends at the end of each year a. If the company were financed entirely by equity, how much would it be worth? b. What is the required return on the firm's levered equity? c. Use the weighted average cost of capital method to calculate the value of the company. What is the value of the company's equity? What is the value of the company's debt? d. Use the flow to equity method to calculate the value of the company's equity Mojito Mint Company has a debt-equity ratio of .35. The required return on the company's unlevered equity is 18 percent, and the pretax cost of the firm's debt is 8.2 percent. Sales revenue for the company is expected to remain stable indefinitely at last year's level of $18,700,000. Variable costs amount to 60 percent of sales. The tax rate is 40 percent, and the company distributes all its earnings as dividends at the end of each year If the company were financed entirely by equity, how much would it be worth? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. $2493333 Value of the company b. What is the required return on the firm's levered equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Required return 20.06 % c-1. Use the weighted average cost of capital method to calculate the value of the company. (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of the company c-2. What is the value of the company's equity? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of equity c-3. What is the value of the company's debt? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of debt d. Use the flow to equity method to calculate the value of the company's equity. (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of equity 16. a. If the company were financed entirely by equity, the value of the firm would be equal to the present value of its unlevered after-tax earnings, discounted at its unlevered cost of capital. First, we need to find the company's unlevered cash flows, which are S17,500,000 Sales Variable costs 10,500,000 EBT Tax Net income $7,000,000 2,800,000 $4,200,000 So, the value of the unlevered company is: Ku = $4,200,000 / . 128 Vu $32,812,500 b. According to Modigliani-Miller Propostion II with corporate taxes, the value of levered equity iS: Rs 128+(.35).128- .065)(1 R,-. 14 12, or 14. 1290 - .40) c. In a world with corporate taxes, a firm's weighted average cost of capital equals So we need the debt-value and equity-value ratios for the company. The debt-equity ratio for the company is B/S-35 Substituting this in the debt-value ratio, we get BIV-35S/(.35S+ S) B/V= .35 / 1.35 B/V-.26 And the equity-value ratio is one minus the debt-value ratio, or: SV-.74 So, using the capital structure weights, the company's WACC is: RwAcc 261 - 40)(065) +.74(.1412) RWACC = .1 147, or 1 1.47% We can use the weighted average cost of capital to discount the firm's unlevered aftertax earnings to value the company. Doing so, we find Vi- $4,200,000/.1147 VL $36,608,987.60 Now we can use the debt-value ratio and equity-value ratio to find the value of debt and equity, which are: B- VL(Debt-value) B $36,608,987.60(.26) B- $9,491,219.01 S- Vi(Equity-value) S $36,608,987.60(74) S- $27,117,768.60 d. In order to value a firm's equity using the flow-to-equity approach, we can discount the cash flows available to equity holders at the cost of the firm's levered equity. First, we need to calculate the levered cash flows available to shareholders, which are Sales Variable costs EBIT Interest EBT Tax Net income $17,500,000 0,500,000 $7,000,000 616,929 $6,383,071 2,553,228 $3,829,842 So, the value of equity with the flow-to-equity method is: S- Cash flows available to equity holders / Rs S- $3,829,842/.1412 S= $27,1 17,768.60 16. APV, FTE, and WACC Mojito Mint Company has a debt-equity ratio of 35. The required return on the company's unlevered equity is 12.8 percent, and the pretax cost of the firm's debt is 6.5 percent. Sales revenue for the company is expected to remain stable indefinitely at last year's level of $17,500,000. Variable costs amount to 60 percent of sales. The tax rate is 40 percent, and the company distributes all its earnings as dividends at the end of each year a. If the company were financed entirely by equity, how much would it be worth? b. What is the required return on the firm's levered equity? c. Use the weighted average cost of capital method to calculate the value of the company. What is the value of the company's equity? What is the value of the company's debt? d. Use the flow to equity method to calculate the value of the company's equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started