Answered step by step

Verified Expert Solution

Question

1 Approved Answer

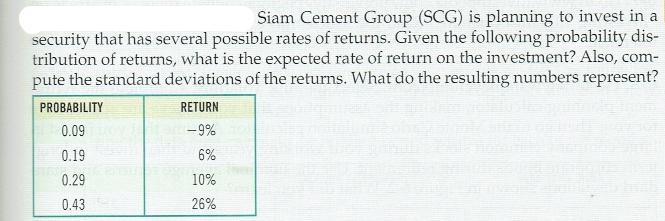

Siam Cement Group (SCG) is planning to invest in a security that has several possible rates of returns. Given the following probability dis- tribution

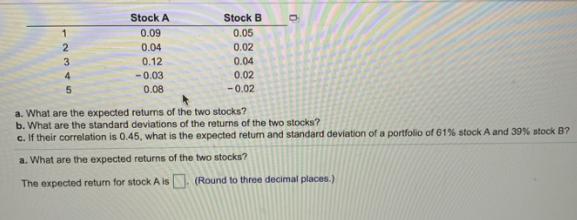

Siam Cement Group (SCG) is planning to invest in a security that has several possible rates of returns. Given the following probability dis- tribution of returns, what is the expected rate of return on the investment? Also, com- pute the standard deviations of the returns. What do the resulting numbers represent? RETURN Tam-9% PROBABILITY 0.09 0.19 STAPO 0.29 0.43 6% 10% 26% Your firm is 50% debt financed and your debt beta is 1.2. The remainder of the firm is financed with equity, which has a standard deviation of expected returns of 40%. The risk free rate is 5%, the market risk premium is 8%, and market returns have a standard deviation of 14%. The correlation between the market returns and your debt and equity are 0.8 and 0.7, respectively. Assuming the MM theorem holds, what is the expected returns on your firms assets? 4. A discrete-time financial market has two risky assets. The returns of assets are denoted by K and K, respectively. Suppose that the returns of assets follow the scenarios: Scenario W W2 W3 Probability K 0.3 -15% 0.4 0.3 (a) Find the expected returns and variance of K. (b) Find the expected returns and variance of K. (c) Find the covariance of the returns. 15% 20% K 10% 20% -10% (d) If the expected return of a portfolio consisting of these two assets is E(Ky) = 10.6%, find the weights of asset 1 and asset 2 held in this portfolio. (e) If a portfolio has weights w = 80% and W = 20%, find its risk. 12345 5 Stock A 0.09 0.04 0.12 -0.03 0.08 Stock B 0.05 0.02 0.04 0.02 -0.02 O a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.45, what is the expected return and standard deviation of a portfolio of 61% stock A and 39% stock B? a. What are the expected returns of the two stocks? The expected return for stock A is. (Round to three decimal places.)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer So the expected ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started