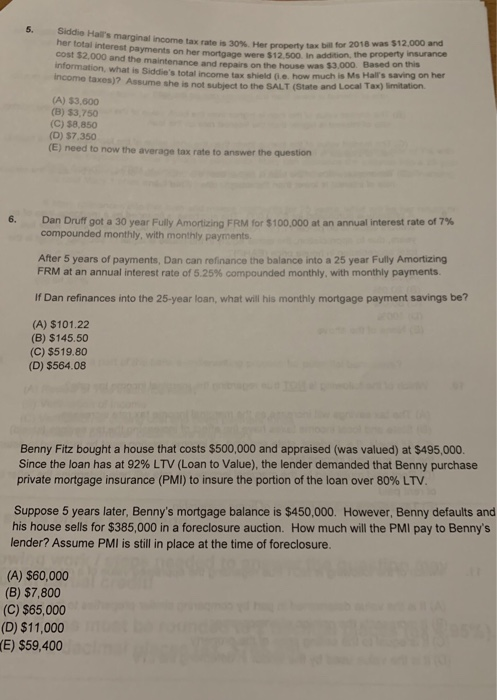

Sidi Hair's marginal income tax rate is her total interest payments on her mortgage were $12.500 al income tax rate is 30 for 2018 was $12.000 and Payments on her mortgage were 512 500 in on the property insurance 2000 and the maintenance and rece the house was $3.000Based om on what is Siddia's totalment e ho much is Ms H aving on her come taxes)Assume shent SALT ( and Local Tax ation (A) 53.600 (B) 53.750 (C) 58,850 (D) 57350 (E) need to now the average tax rate to answer the question Dan Druff got a 30 year Fully Amortizing FRM for $100.000 at an annual interest rate of 7% compounded monthly, with monthly payments. After 5 years of payments, Dan can refinance the balance into a 25 year Fully Amortizing FRM at an annual interest rate of 5.25% compounded monthly, with monthly payments ir Dan refinances into the 25-year loan, what will his monthly mortgage payment savings be? (A) $101.22 (B) $145.50 (C) $519.80 (D) $564.08 Benny Fitz bought a house that costs $500,000 and appraised (was valued) at $495,000 Since the loan has at 92% LTV (Loan to Value), the lender demanded that Benny purchase private mortgage insurance (PMI) to insure the portion of the loan over 80% LTV. Suppose 5 years later, Benny's mortgage balance is $450,000. However, Benny defaults and his house sells for $385,000 in a foreclosure auction. How much will the PMI pay to Benny's lender? Assume PMI is still in place at the time of foreclosure. (A) $60,000 (B) $7,800 (C) $65,000 (D) $11,000 E) $59,400 Sidi Hair's marginal income tax rate is her total interest payments on her mortgage were $12.500 al income tax rate is 30 for 2018 was $12.000 and Payments on her mortgage were 512 500 in on the property insurance 2000 and the maintenance and rece the house was $3.000Based om on what is Siddia's totalment e ho much is Ms H aving on her come taxes)Assume shent SALT ( and Local Tax ation (A) 53.600 (B) 53.750 (C) 58,850 (D) 57350 (E) need to now the average tax rate to answer the question Dan Druff got a 30 year Fully Amortizing FRM for $100.000 at an annual interest rate of 7% compounded monthly, with monthly payments. After 5 years of payments, Dan can refinance the balance into a 25 year Fully Amortizing FRM at an annual interest rate of 5.25% compounded monthly, with monthly payments ir Dan refinances into the 25-year loan, what will his monthly mortgage payment savings be? (A) $101.22 (B) $145.50 (C) $519.80 (D) $564.08 Benny Fitz bought a house that costs $500,000 and appraised (was valued) at $495,000 Since the loan has at 92% LTV (Loan to Value), the lender demanded that Benny purchase private mortgage insurance (PMI) to insure the portion of the loan over 80% LTV. Suppose 5 years later, Benny's mortgage balance is $450,000. However, Benny defaults and his house sells for $385,000 in a foreclosure auction. How much will the PMI pay to Benny's lender? Assume PMI is still in place at the time of foreclosure. (A) $60,000 (B) $7,800 (C) $65,000 (D) $11,000 E) $59,400