Sienna has experienced a couple of profitable months and has over $20,600 in disposable income, however she is thinking that she should replace a

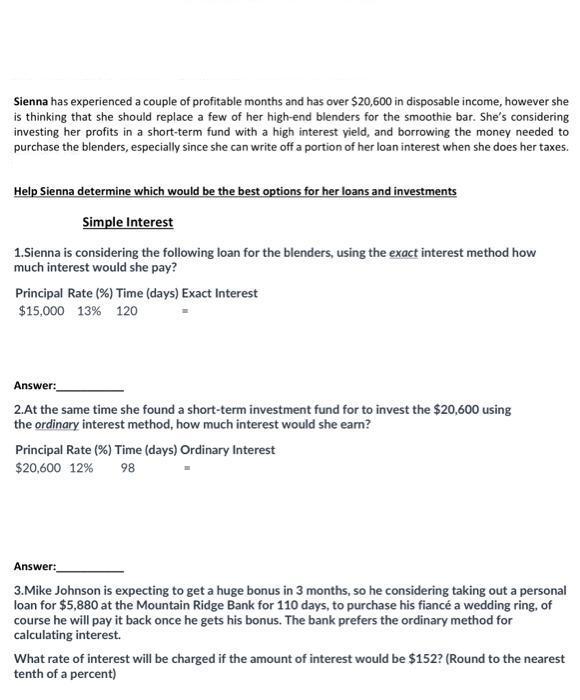

Sienna has experienced a couple of profitable months and has over $20,600 in disposable income, however she is thinking that she should replace a few of her high-end blenders for the smoothie bar. She's considering investing her profits in a short-term fund with a high interest yield, and borrowing the money needed to purchase the blenders, especially since she can write off a portion of her loan interest when she does her taxes. Help Sienna determine which would be the best options for her loans and investments Simple Interest 1.Sienna is considering the following loan for the blenders, using the exact interest method how much interest would she pay? Principal Rate (%) Time (days) Exact Interest $15,000 13 % 120 Answer: 2.At the same time she found a short-term investment fund for to invest the $20,600 using the ordinary interest method, how much interest would she earn? Principal Rate (%) Time (days) Ordinary Interest $20,600 12% 98 Answer: 3.Mike Johnson is expecting to get a huge bonus in 3 months, so he considering taking out a personal loan for $5,880 at the Mountain Ridge Bank for 110 days, to purchase his fianc a wedding ring, of course he will pay it back once he gets his bonus. The bank prefers the ordinary method for calculating interest. What rate of interest will be charged if the amount of interest would be $152? (Round to the nearest tenth of a percent)

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started