Question

Sienna received the items she ordered from her suppliers and now she need to determine how much she wants, or needs, to mark them up

Sienna received the items she ordered from her suppliers and now she need to determine how much she wants, or needs, to mark them up in-order-to make a profit. She also has some slow-moving items that she wants to discount, or mark down, so she can get them sold. Finally, she also overbought some perishable fruit items, for a special flavor of the month smoothie, but some of the fruit has spoiled, and she needs to account for the loss but still make a profit.?(Chapter 8)

Help Sienna determine her mark-up or Mark down Amounts and Percentages.

1.Sienna Health and Fitness LLC purchases gallon protein powers for for $47.50 each. A $34.00 markup is added to each one.

A. What is the selling price for each Protein Powder?

Answer:___________

B. What is the percent markup based on the cost, for each protein powder?

Answer:___________

C. Sienna already had 20 tubs of protein in her inventory and could not remember what she paid for them, but she wants to make sure she is still making a profit, so she decided to mark them up based on selling price instead of based on cost, What is the percent markup based on the selling price above, for each protein Power?

?

Answer:___________

2.Sienna is looking for some new weight belts to sell for $39.88, But she wants a 60% markup based on that selling price, what is the most that can be paid for the weight belts from her wholesaler so she can still get the desired markup?

Answer:___________

Mark Downs

3. Sienna health and fitness was selling a exercise bike for $888 But, marked it down by $200 for a store-wide sale. What is the sale price of the Bike?

Answer:___________

What is the markdown percent?

?

Answer:___________

4.What was the original selling price of a treadmill currently on sale for $2,484 after a 20% markdown?

Answer:___________

Chapter 9 Problems Payroll

There has also been a change's in working hours for some of the employees at Siena's Health and Fitness, and in Michael Smiths family situation, which will affect his payroll taxes and deductions, Sienna needs your help to figure out the new payroll tax rate and taxes that Michael will be paying. Use the percentage method of figuring payroll taxes.

1.Katrina Jackson is a retail salesclerk at Sienna's Health and Fitness. She earns $15.00 per hour for regular time up to 40 hours, time-and-a-half for overtime, and double time for the Sunday shift. If Katrina worked 56 hours last week, including 4 hours on the Sunday shift, how much were her gross earnings?

Answer:___________

2.Sienna sends Katrina Jackson to run a booth at a local Health and fitness conference. The goal is to sell as many of tubs their new all organic Protein Powder as possible. Sienna wants to give Katrina some incentive to sell and offers to give her a commission of $18.20 per tub sold for the first 14 tubs, $19.55 each for tub between 15-30, and $20.05 each for tub between 31-45, and $20.48 each for each tub 46 and up. If Katrina sold 52 tubs at the conference, what was her total commission pay?

Answer:___________

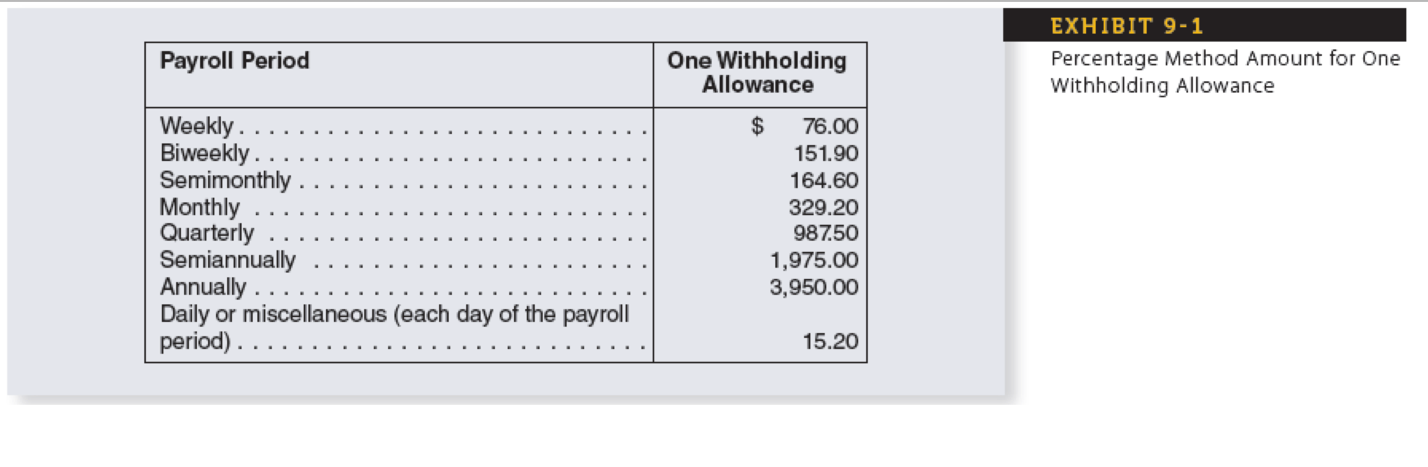

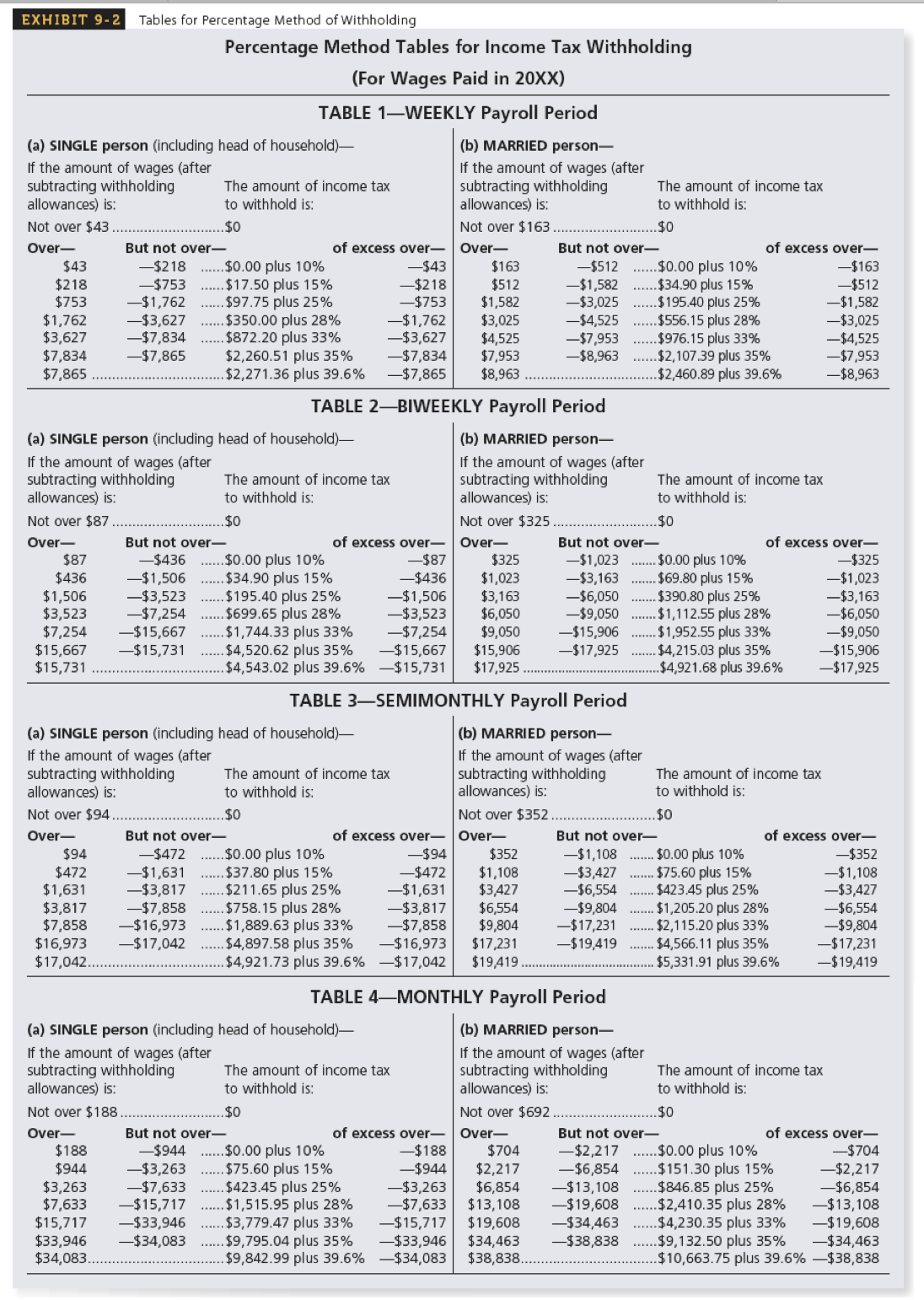

The Percentage Method. As an employer and employee its important you know how the federal taxes are calculated on your paycheck and what are the different items that you are taxed on, ultimately so you know what you paid in taxes, social security, Medicare etc. The percentage method uses standardized charts, that are annually updated, to assist you and figuring out your federal taxes.

Payroll Period Weekly. Biweekly. Semimonthly Monthly One Withholding Allowance $ 76.00 151.90 164.60 329.20 Quarterly 987.50 Semiannually 1,975.00 Annually 3,950.00 Daily or miscellaneous (each day of the payroll period). 15.20 EXHIBIT 9-1 Percentage Method Amount for One Withholding Allowance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started