Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sifan and Tabitha each contributed $500 to ST LLC, which is taxed as a partnership. The agreement contains all the necessary provisions to qualify

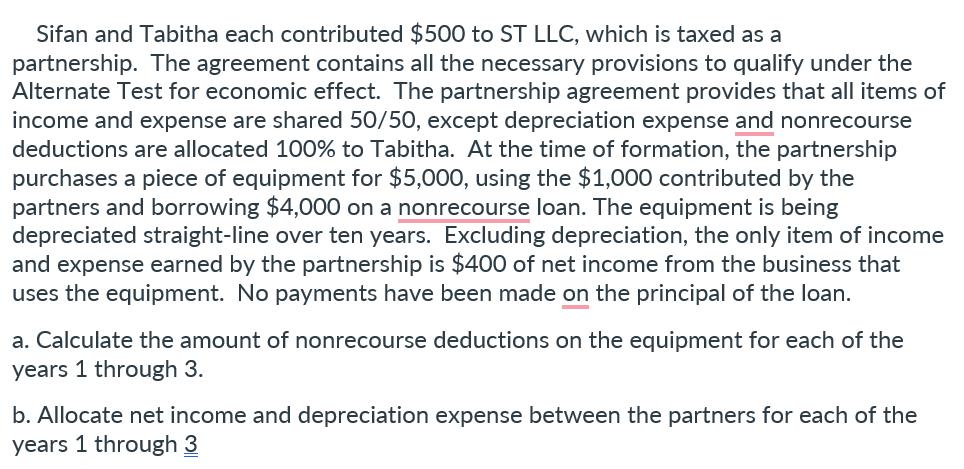

Sifan and Tabitha each contributed $500 to ST LLC, which is taxed as a partnership. The agreement contains all the necessary provisions to qualify under the Alternate Test for economic effect. The partnership agreement provides that all items of income and expense are shared 50/50, except depreciation expense and nonrecourse deductions are allocated 100% to Tabitha. At the time of formation, the partnership purchases a piece of equipment for $5,000, using the $1,000 contributed by the partners and borrowing $4,000 on a nonrecourse loan. The equipment is being depreciated straight-line over ten years. Excluding depreciation, the only item of income and expense earned by the partnership is $400 of net income from the business that uses the equipment. No payments have been made on the principal of the loan. a. Calculate the amount of nonrecourse deductions on the equipment for each of the years 1 through 3. b. Allocate net income and depreciation expense between the partners for each of the years 1 through 3

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Nonrecourse deductions on the equipment for each of the years 1 through 3 Year 1 The partnership purchased the equipment for 5000 using 1000 contributed by the partners and borrowing 4000 on a nonre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started