Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sigma Company has the following capital structure: 30% debt, 15% preferred stock and 55% common stock. The firm's 15-year 7% annual coupon bonds is

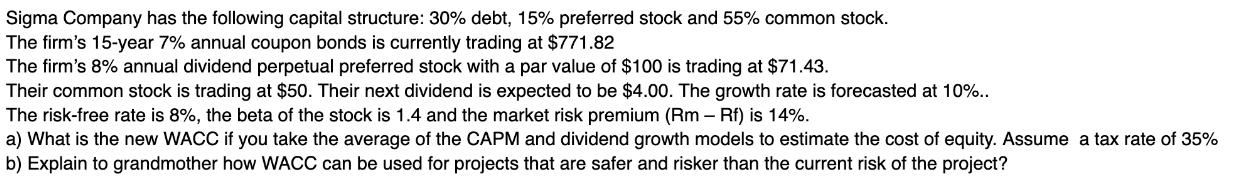

Sigma Company has the following capital structure: 30% debt, 15% preferred stock and 55% common stock. The firm's 15-year 7% annual coupon bonds is currently trading at $771.82 The firm's 8% annual dividend perpetual preferred stock with a par value of $100 is trading at $71.43. Their common stock is trading at $50. Their next dividend is expected to be $4.00. The growth rate is forecasted at 10%.. The risk-free rate is 8%, the beta of the stock is 1.4 and the market risk premium (Rm - Rf) is 14%. a) What is the new WACC if you take the average of the CAPM and dividend growth models to estimate the cost of equity. Assume a tax rate of 35% b) Explain to grandmother how WACC can be used for projects that are safer and risker than the current risk of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the new weighted average cost of capital WACC using the average of the CAPM and dividend growth models we need to calculate the cost of each component of the capital structure and then ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started