Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Significantly decreasing the number of stocks in a portfolio would almost certainly result in a(n) Multiple Choice decrease in the systematic risk of the portfolio

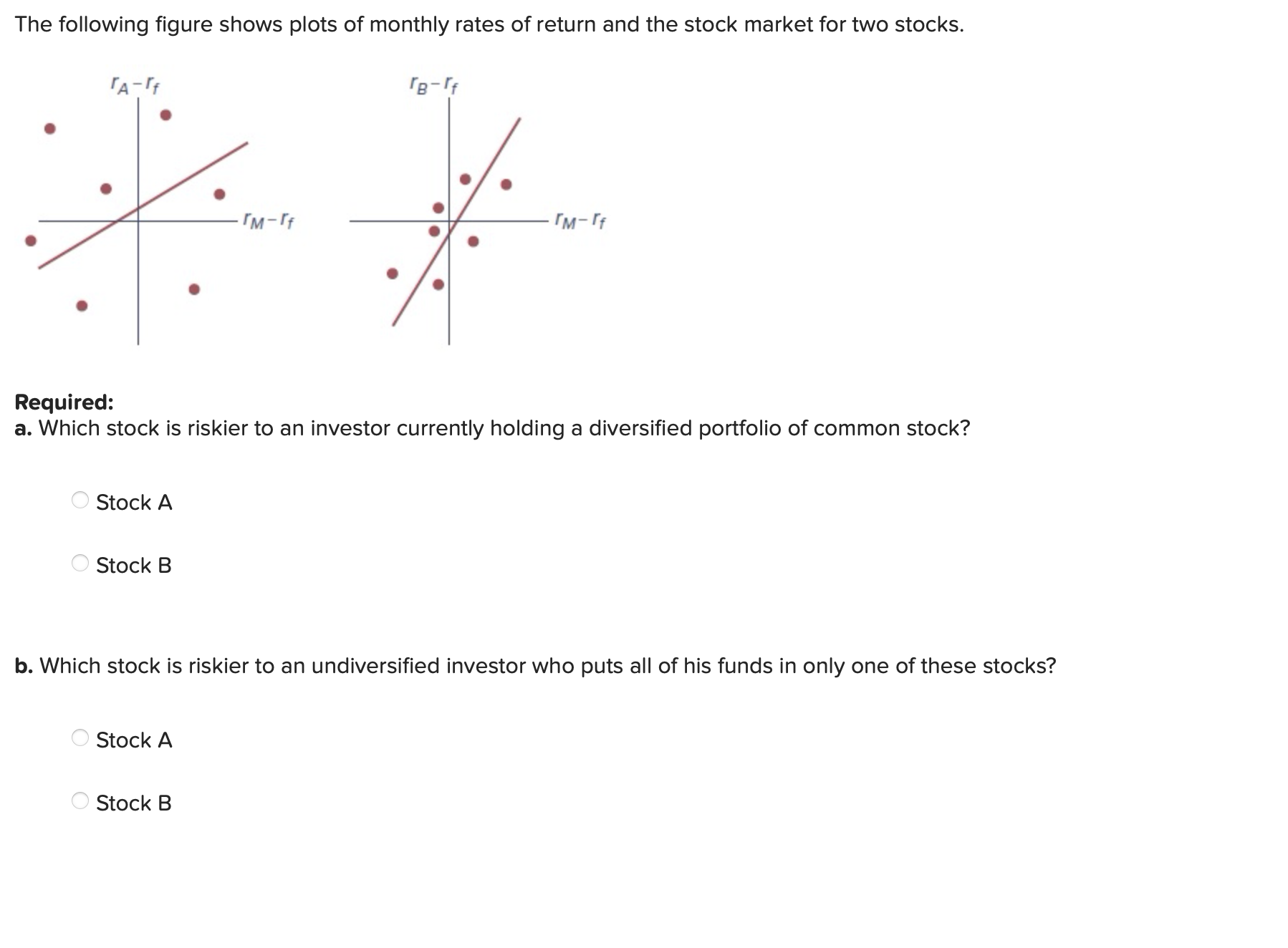

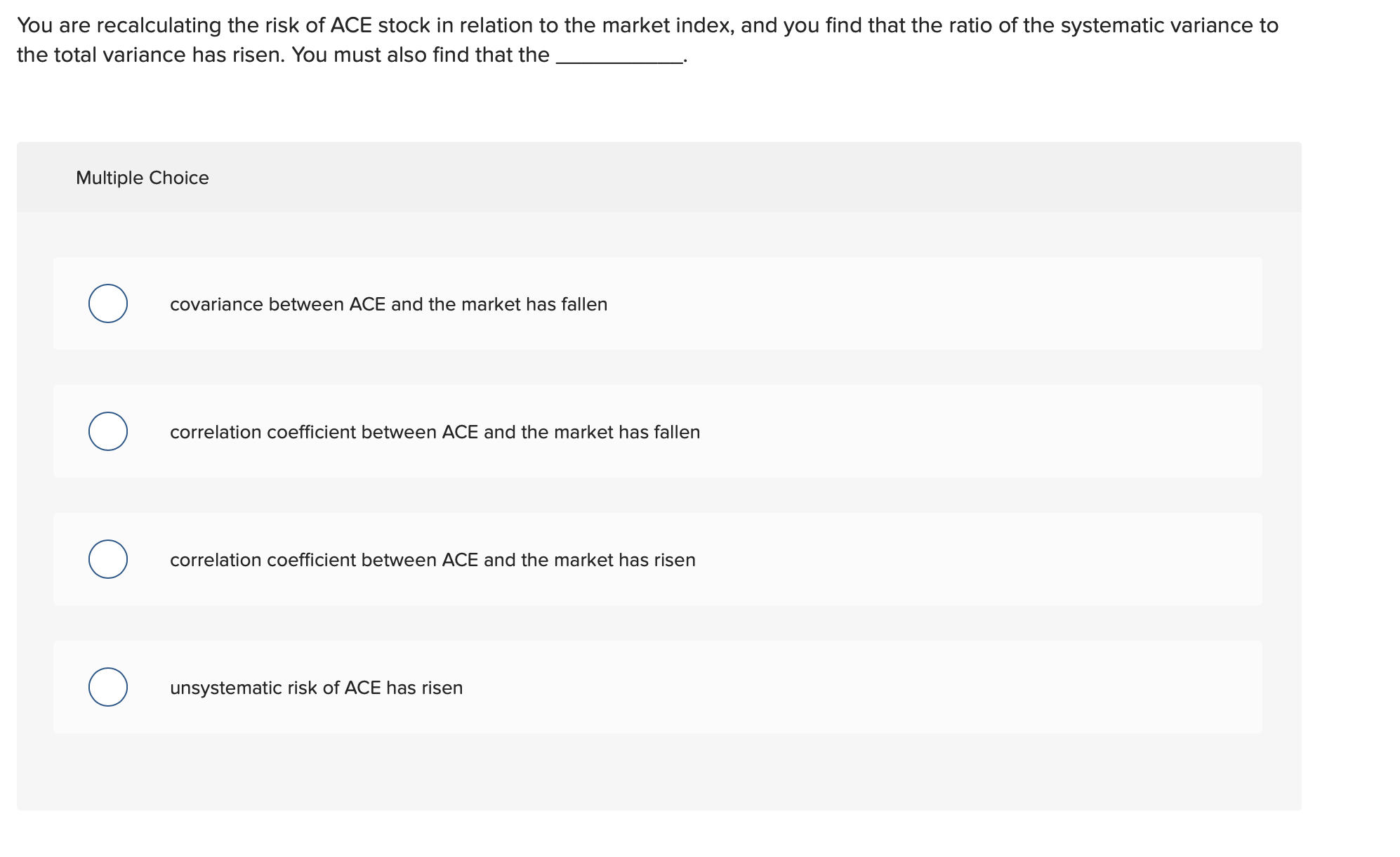

Significantly decreasing the number of stocks in a portfolio would almost certainly result in a(n) Multiple Choice decrease in the systematic risk of the portfolio increase in the unsystematic risk of the portfolio increase in the systematic risk of the portfolio decrease in the unsystematic risk of the portfolio In a CAPM world, investors require risk premium as compensation for bearing Multiple Choice firm-specific risk total risk systematic risk residual risk Stock A has a beta of 0.85 and an expected risk premium of 5%. Stock B has a beta of 1.50 and an expected risk premium of 8%. If the market risk premium is 5.5%, would a rational investor prefer to invest in stock A or stock B ? (hint: think in terms of alpha) Multiple Choice a rational investor would prefer Stock B over Stock A a rational investor would prefer Stock A over Stock B a rational investor would prefer each equally it would depend on the investor's level of risk aversion Going from 2 risky assets to 5 risky assets is most likely to shift the efficient frontier of risky portfolios and to the Multiple Choice up, right down, right up, left down, left The following figure shows plots of monthly rates of return and the stock market for two stocks. Required: a. Which stock is riskier to an investor currently holding a diversified portfolio of common stock? Stock A Stock B b. Which stock is riskier to an undiversified investor who puts all of his funds in only one of these stocks? Stock A Stock B You are recalculating the risk of ACE stock in relation to the market index, and you find that the ratio of the systematic variance to the total variance has risen. You must also find that the Multiple Choice covariance between ACE and the market has fallen correlation coefficient between ACE and the market has fallen correlation coefficient between ACE and the market has risen unsystematic risk of ACE has risen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started