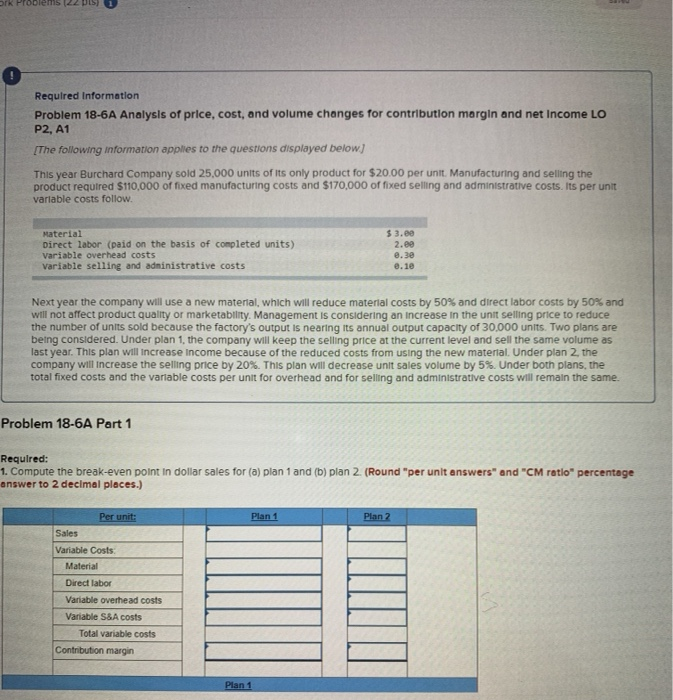

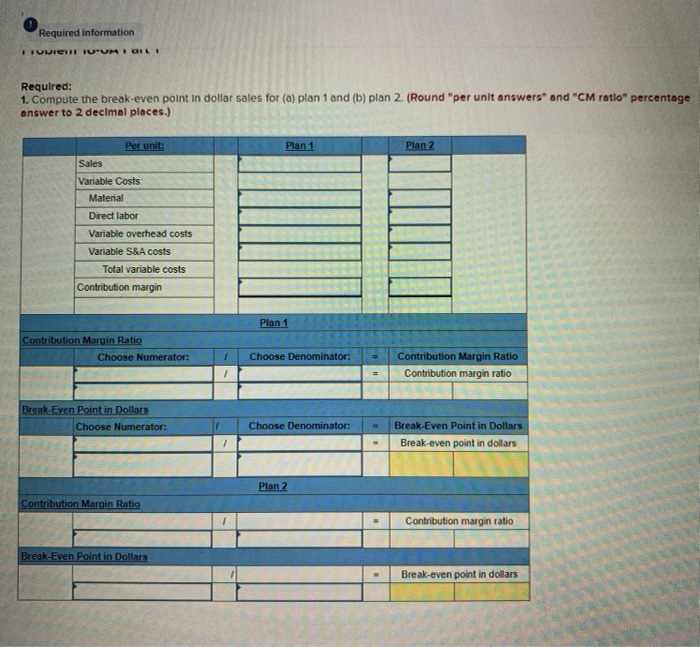

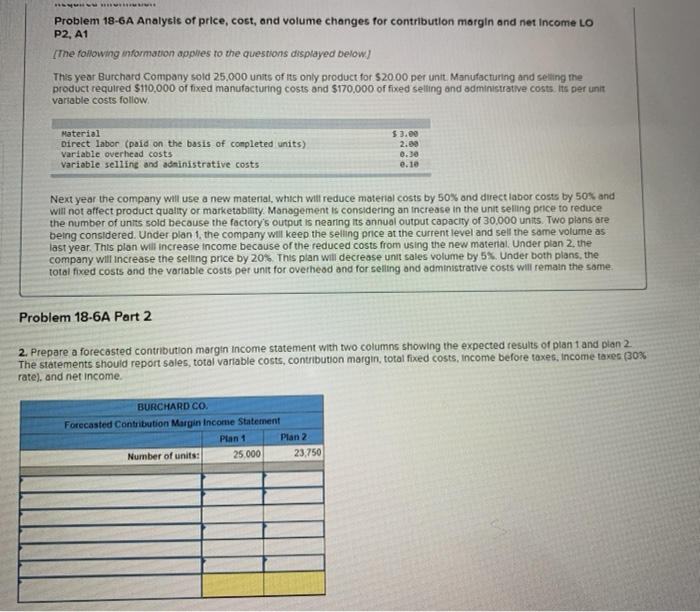

SIK Required Information Problem 18-6A Analysis of price, cost, and volume changes for contribution margin and net Income LO P2, A1 [The following information applies to the questions displayed below! This year Burchard Company sold 25,000 units of its only product for $20.00 per unit. Manufacturing and selling the product required $110,000 of fixed manufacturing costs and $170,000 of fixed selling and administrative costs. Its per unit variable costs follow. 2.ee Material Direct labor (paid on the basis of completed units) Variable overhead costs Variable selling and administrative costs e. 10 Next year the company will use a new material, which will reduce material costs by 50% and direct labor costs by 50% and will not affect product quality or marketability Management is considering an increase in the unit selling price to reduce the number of units sold because the factory's output is nearing its annual output capacity of 30.000 units. Two plans are being considered. Under plan 1, the company will keep the selling price at the current level and sell the same volume as last year. This plan will increase income because of the reduced costs from using the new material. Under plan 2. the company will increase the selling price by 20%. This plan will decrease unit sales volume by 5%. Under both plans, the total fixed costs and the variable costs per unit for overhead and for selling and administrative costs will remain the same. Problem 18-6A Part 1 Required: 1. Compute the break-even point in dollar sales for (a) plan 1 and (b) plan 2. (Round "per unit answers" and "CM ratlo" percentage answer to 2 decimal places.) Per unit: Plan 1 Plan 2 Sales Variable Costs Material Direct labor Variable overhead costs Variable S&A costs Total variable costs Contribution margin Plan 1 Required information IULIEI! TUUM OIL Required: 1. Compute the break-even point in dollar sales for (a) plan 1 and (b) plan 2. (Round "per unit answers" and "CM ratio" percentage answer to 2 decimal places.) Plan 1 Plan 2 Per unit: Sales Variable Costs Material Direct labor Variable overhead costs Variable S&A costs Total variable costs Contribution margin Plan 1 Contribution Margin Ratio Choose Numerator: 1 Choose Denominator: Contribution Margin Ratio Contribution margin ratio 1 Break Even Point in Dollars Choose Numerator: Choose Denominator: Break-Even Point in Dollars Break-even point in dollars 1 Plan 2 Contribution Margin Ratio Contribution margin ratio Break-Even Point in Dollars Break-even point in dollars Problem 18-6A Analysis of price, cost, and volume changes for contribution margin and net Income Lo P2, A1 (The following information applies to the questions displayed below] This year Burchard Company sold 25.000 units of its only product for $20.00 per unit Manufacturing and selling the product required $110,000 of fixed manufacturing costs and $170,000 of fixed selling and administrative costs. Its per unit variable costs follow Material Direct labor (paid on the basis of completed units) variable overhead costs variable selling and administrative costs $ 3.00 2.00 0.30 e. 10 Next year the company will use a new material, which will reduce material costs by 50% and direct labor costs by 50% and will not affect product quality or marketability Management is considering an increase in the unit selling price to reduce the number of units sold because the factory's output is nearing its annual output capacity of 30,000 units. Two plans are being considered. Under plan 1, the company will keep the selling price at the current level and sell the same volume as last year. This plan will increase income because of the reduced costs from using the new material. Under plan 2 the company will increase the selling price by 20%. This plan will decrease unit sales volume by 5%. Under both plans, the total fixed costs and the variable costs per unit for overhead and for selling and administrative costs will remain the same Problem 18-6A Part 2 2. Prepare a forecasted contribution margin Income statement with two columns showing the expected results of plant and plan 2. The statements should report sales, total variable costs, contribution margin, total fixed costs, income before taxes, Income taxes (30% rate), and net income BURCHARD CO. Forecasted Contribution Margin Income Statement Plan 1 Plan 2 Number of units: 25 000 23.750