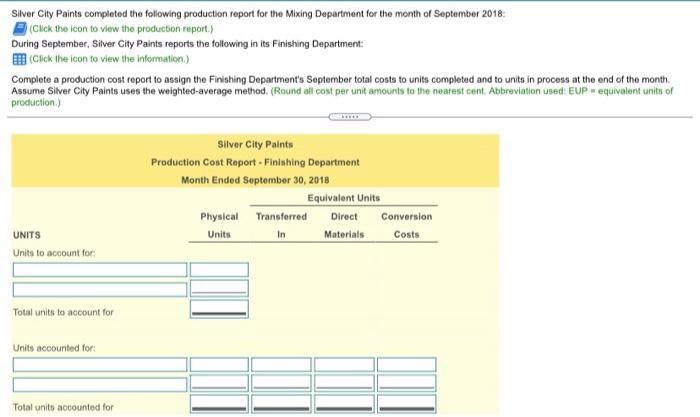

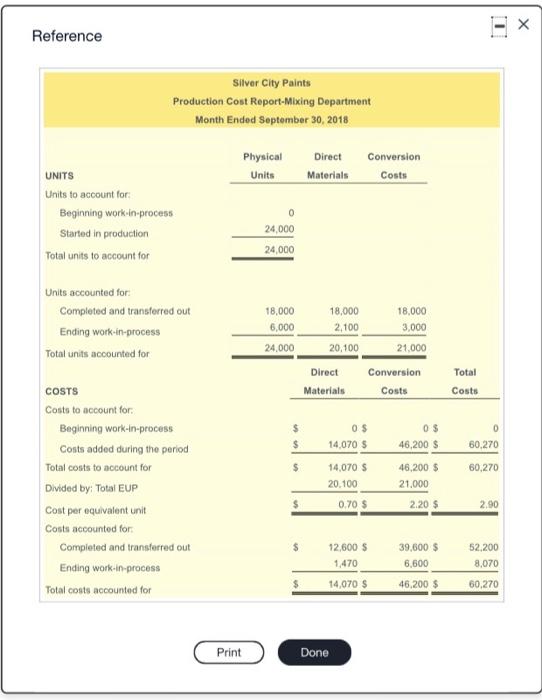

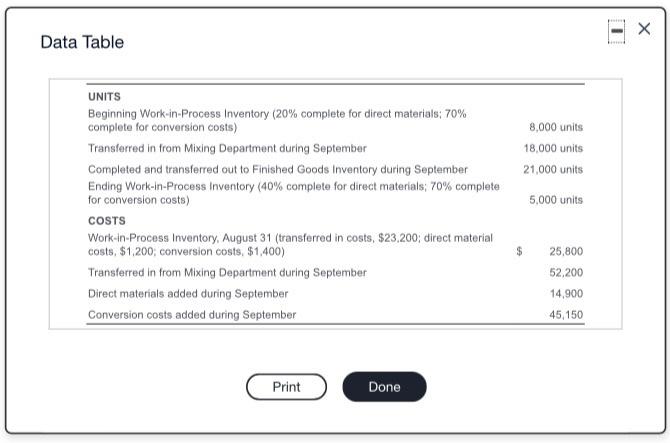

Silver City Paints completed the following production report for the Mixing Department for the month of September 2018 Click the Icon to view the production report.) During September, Silver City Paints reports the following in its Finishing Department: Click the icon to view the information). Complete a production cost report to assign the Finishing Department's September total costs to units completed and to units in process at the end of the month. Assume Silver City Paints uses the weighted average method. (Round all cost per unit amounts to the nearest cent. Abbreviation used: EUP equivalent units of production) Silver City Paints Production Cost Report - Finishing Department Month Ended September 30, 2018 Equivalent Units Physical Transferred Direct Conversion Units In Materials Costs UNITS Units to account for Total units to account for Units accounted for: Total units accounted for Reference Silver City Paints Production Cost Report-Mixing Department Month Ended September 30, 2018 Physical Units Direct Materials Conversion Costs UNITS Units to account for Beginning work in process Started in production Total units to account for 0 24,000 24,000 Units accounted for Completed and transferred out Ending work-in-process Total units accounted for 18,000 18,000 6,000 2.100 24,000 20,100 Direct Materials 18,000 3,000 21,000 Conversion Costs Total Costs 0 $ $ os 14.070 $ OS 46,200 $ 60.270 $ 60,270 COSTS Costs to account for Beginning work-in-process Costs added during the period Total costs to account for Divided by: Total EUP Cost per equivalent unit Costs accounted for Completed and transferred out Ending work-in-process Total costs accounted for 14.070 S 20.100 0.70 S 46,200 $ 21.000 2.20 $ 2.90 12,600 $ 1.470 14,070 39,600 $ 6,600 46,200 $ 52,200 8,070 60,270 Print Done Data Table 8,000 units 18,000 units 21,000 units UNITS Beginning Work-in-Process Inventory (20% complete for direct materials: 70% complete for conversion costs) Transferred in from Mixing Department during September Completed and transferred out to Finished Goods Inventory during September Ending Work-In-Process Inventory (40% complete for direct materials: 70% complete for conversion costs) COSTS Work-in-Process Inventory, August 31 (transferred in costs, $23.200; direct material costs, $1,200, conversion costs, $1,400) Transferred in from Mixing Department during September Direct materials added during September Conversion costs added during September 5,000 units $ 25,800 52,200 14,900 45,150 Print Done