Answered step by step

Verified Expert Solution

Question

1 Approved Answer

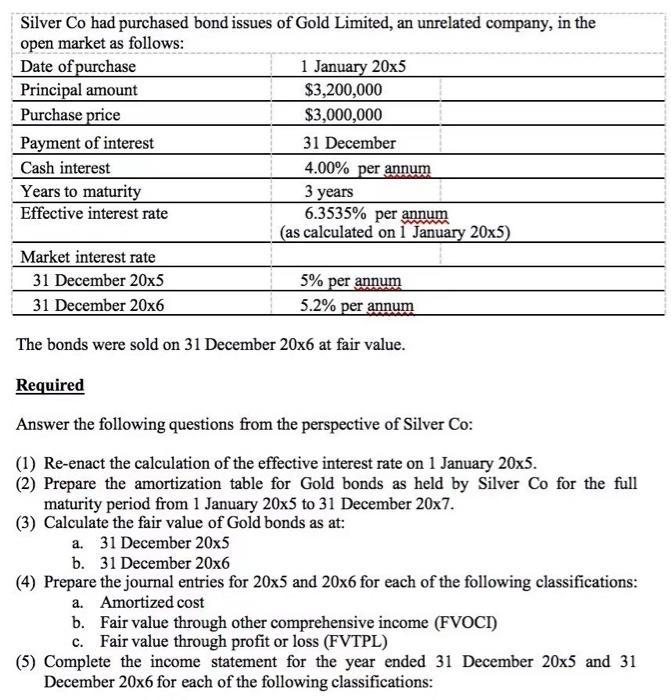

Silver Co had purchased bond issues of Gold Limited, an unrelated company, in the open market as follows: Date of purchase Principal amount Purchase

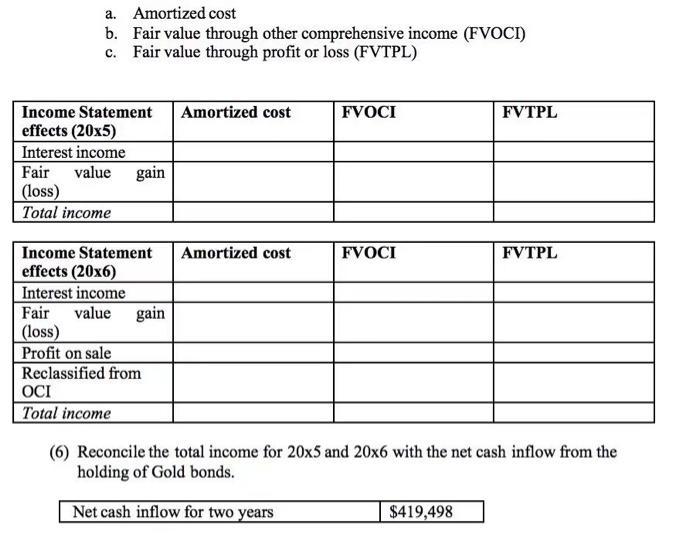

Silver Co had purchased bond issues of Gold Limited, an unrelated company, in the open market as follows: Date of purchase Principal amount Purchase price Payment of interest Cash interest Years to maturity Effective interest rate 1 January 20x5 $3,200,000 $3,000,000 31 December 4.00% per annum 3 years 6.3535% per annum (as calculated on 1 January 20x5) Market interest rate 31 December 20x5 5% per annum 31 December 20x6 5.2% per annum The bonds were sold on 31 December 20x6 at fair value. Required Answer the following questions from the perspective of Silver Co: (1) Re-enact the calculation of the effective interest rate on 1 January 20x5. (2) Prepare the amortization table for Gold bonds as held by Silver Co for the full maturity period from 1 January 20x5 to 31 December 20x7. (3) Calculate the fair value of Gold bonds as at: a. 31 December 20x5 b. 31 December 20x6 (4) Prepare the journal entries for 20x5 and 20x6 for each of the following classifications: a. Amortized cost b. Fair value through other comprehensive income (FVOCI) c. Fair value through profit or loss (FVTPL) (5) Complete the income statement for the year ended 31 December 20x5 and 31 December 20x6 for each of the following classifications: a. Amortized cost b. Fair value through other comprehensive income (FVOCI) c. Fair value through profit or loss (FVTPL) Income Statement effects (20x5) Interest income Fair value gain (loss) Total income Income Statement effects (20x6) Interest income Fair value gain (loss) Profit on sale Reclassified from OCI Total income Amortized cost Amortized cost FVOCI FVOCI FVTPL $419,498 FVTPL (6) Reconcile the total income for 20x5 and 20x6 with the net cash inflow from the holding of Gold bonds. Net cash inflow for two years

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Reenact the calculation of the effective interest rate on 1 January 20x5 3200000 x 63535 203120 3000000 3 1000000 203120 1000000 20312 2 Prepare the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started