Question

Silver Cup Berhad's current credit term to its suppliers is 2/15 net 60. If the company wishes to take the cash discount, the company

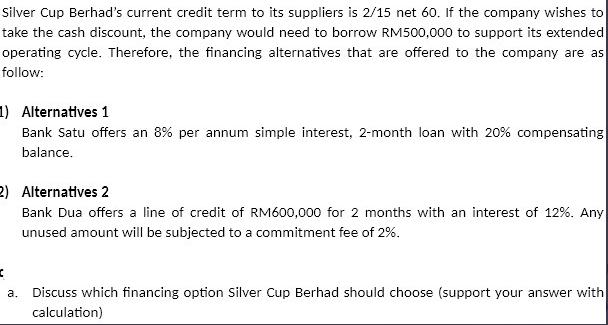

Silver Cup Berhad's current credit term to its suppliers is 2/15 net 60. If the company wishes to take the cash discount, the company would need to borrow RM500,000 to support its extended operating cycle. Therefore, the financing alternatives that are offered to the company are as follow: 1) Alternatives 1 Bank Satu offers an 8% per annum simple interest, 2-month loan with 20% compensating balance. 2) Alternatives 2 Bank Dua offers a line of credit of RM600,000 for 2 months with an interest of 12%. Any unused amount will be subjected to a commitment fee of 2%. x a. Discuss which financing option Silver Cup Berhad should choose (support your answer with calculation)

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine which financing option Silver Cup Berhad should choose lets compare the costs associate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Quantitative Methods For Business

Authors: David Anderson, Dennis Sweeney, Thomas Williams, Jeffrey Cam

11th Edition

978-0324651812, 324651813, 978-0324651751

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App