Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Silver Division and Gold Division are two divisions in the SG group of companies. Silver Division manufactures one type of component which it sells

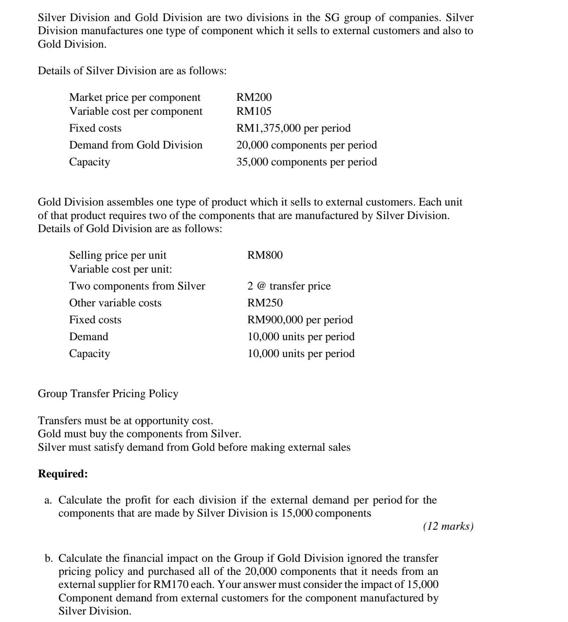

Silver Division and Gold Division are two divisions in the SG group of companies. Silver Division manufactures one type of component which it sells to external customers and also to Gold Division. Details of Silver Division are as follows: Market price per component RM200 RM105 Variable cost per component Fixed costs Demand from Gold Division Capacity RM1,375,000 per period 20,000 components per period 35,000 components per period Gold Division assembles one type of product which it sells to external customers. Each unit of that product requires two of the components that are manufactured by Silver Division. Details of Gold Division are as follows: Selling price per unit RM800 Variable cost per unit: Two components from Silver 2 @ transfer price RM250 Other variable costs Fixed costs RM900,000 per period Demand 10,000 units per period Capacity 10,000 units per period Group Transfer Pricing Policy Transfers must be at opportunity cost. Gold must buy the components from Silver. Silver must satisfy demand from Gold before making external sales Required: a. Calculate the profit for each division if the external demand per period for the components that are made by Silver Division is 15,000 components (12 marks) b. Calculate the financial impact on the Group if Gold Division ignored the transfer pricing policy and purchased all of the 20,000 components that it needs from an external supplier for RM170 each. Your answer must consider the impact of 15,000 Component demand from external customers for the component manufactured by Silver Division. c. The Organisation for Economic Co-operation and Development (OECD) produced guidelines with the aim of standardising national approaches to transfer pricing. The guidelines state that where necessary transfer prices should be adjusted using an "arm's length" price. i. Explain an "arm's length" price ii. Explain the THREE (3) methods that tax authorities can use to determine an "arm's length" price (7 marks)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Silver Division Revenue 15000 RM200 RM3000000 Variable costs 15000 RM105 RM1575000 Fixed costs RM1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started