Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Silver Mines has a December 31 year end, and records depreciation annually. Silver Mines acquired a big mining truck on Jan 2018. Transactions related

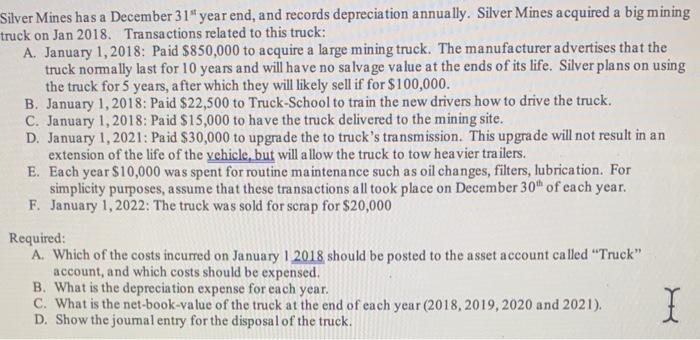

Silver Mines has a December 31" year end, and records depreciation annually. Silver Mines acquired a big mining truck on Jan 2018. Transactions related to this truck: A. January 1, 2018: Paid $850,000 to acquire a large mining truck. The manufacturer advertises that the truck normally last for 10 years and will have no salvage value at the ends of its life. Silver plans on using the truck for 5 years, after which they will likely sell if for $100,000. B. January 1, 2018: Paid $22,500 to Truck-School to train the new drivers how to drive the truck. C. January 1, 2018: Paid $15,000 to have the truck delivered to the mining site. D. January 1, 2021: Paid $30,000 to upgrade the to truck's transmission. This upgrade will not result in an extension of the life of the vehicle, but will allow the truck to tow heavier trailers. E. Each year $10,000 was spent for routine maintenance such as oil changes, filters, lubrication. For simplicity purposes, assume that these transactions all took place on December 30th of each year. F. January 1, 2022: The truck was sold for scrap for $20,000 Required: A. Which of the costs incurred on January 1 2018 should be posted to the asset account called "Truck" account, and which costs should be expensed. B. What is the depreciation expense for each year. C. What is the net-book-value of the truck at the end of each year (2018, 2019, 2020 and 2021). X D. Show the joumal entry for the disposal of the truck.

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Costs incurred on January 1 2018 850000 to a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started