Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SilverBell Limited entered into a contract with Agoda Limited for the lease of four floors of an office building. The exact floors are specified

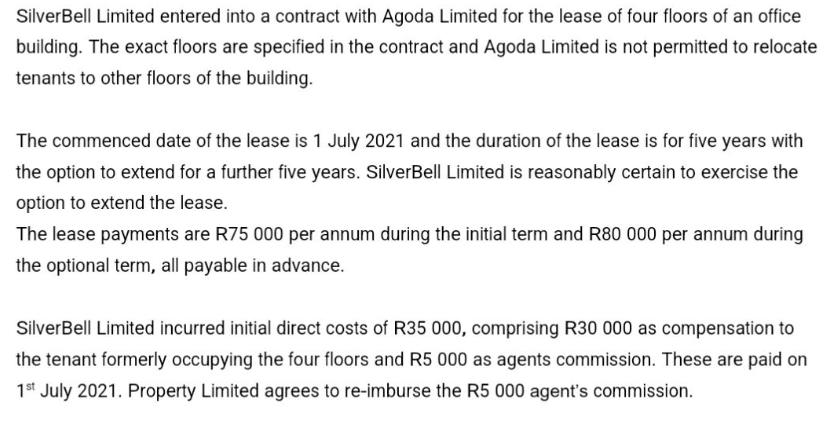

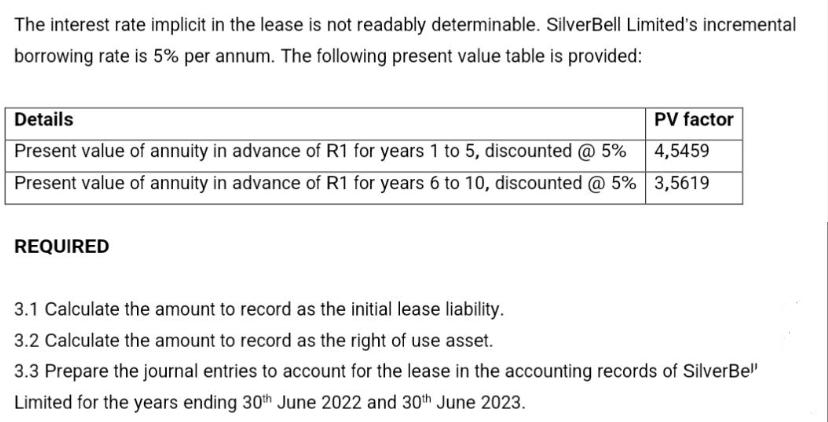

SilverBell Limited entered into a contract with Agoda Limited for the lease of four floors of an office building. The exact floors are specified in the contract and Agoda Limited is not permitted to relocate tenants to other floors of the building. The commenced date of the lease is 1 July 2021 and the duration of the lease is for five years with the option to extend for a further five years. SilverBell Limited is reasonably certain to exercise the option to extend the lease. The lease payments are R75 000 per annum during the initial term and R80 000 per annum during the optional term, all payable in advance. SilverBell Limited incurred initial direct costs of R35 000, comprising R30 000 as compensation to the tenant formerly occupying the four floors and R5 000 as agents commission. These are paid on 1st July 2021. Property Limited agrees to re-imburse the R5 000 agent's commission. The interest rate implicit in the lease is not readably determinable. SilverBell Limited's incremental borrowing rate is 5% per annum. The following present value table is provided: Details Present value of annuity in advance of R1 for years 1 to 5, discounted @ 5% Present value of annuity in advance of R1 for years 6 to 10, discounted @ 5% REQUIRED PV factor 4,5459 3,5619 3.1 Calculate the amount to record as the initial lease liability. 3.2 Calculate the amount to record as the right of use asset. 3.3 Prepare the journal entries to account for the lease in the accounting records of SilverBe" Limited for the years ending 30th June 2022 and 30th June 2023.

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided we can calculate the amounts required for the lease accounting treatment under the IFRS 16 standard which requires lessees to recognize a lease liability and correspo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started