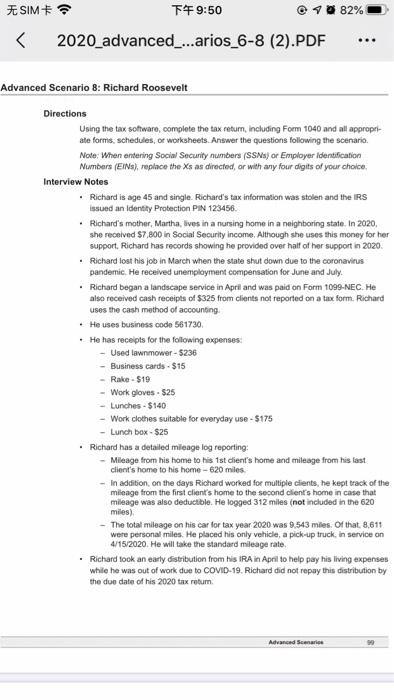

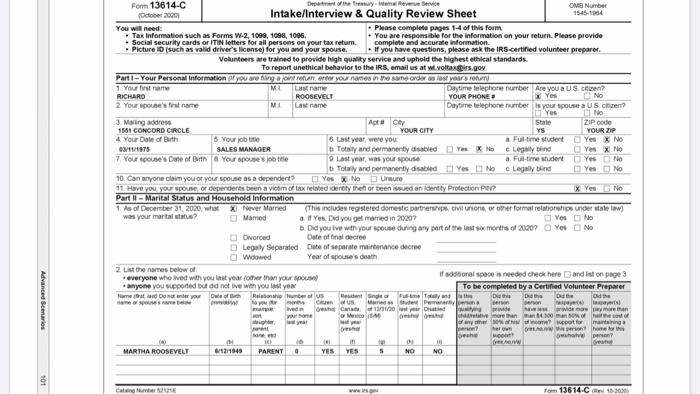

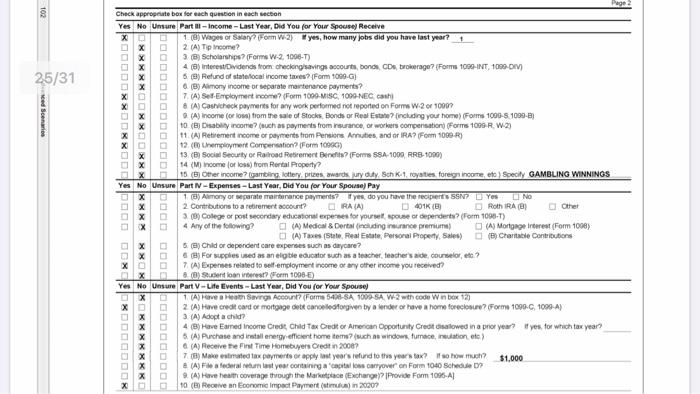

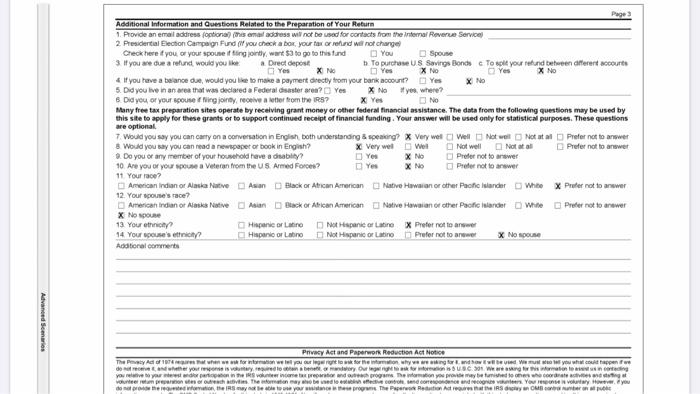

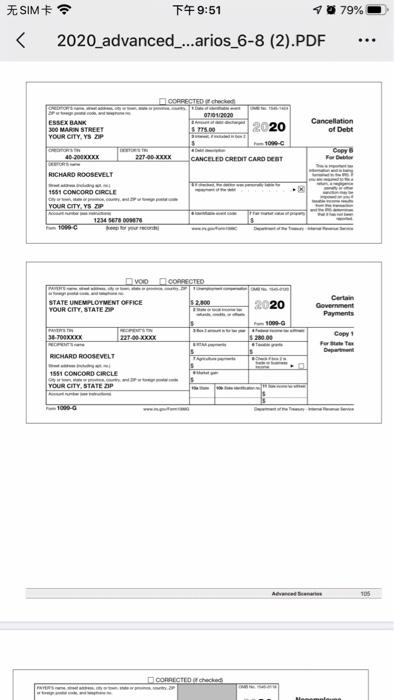

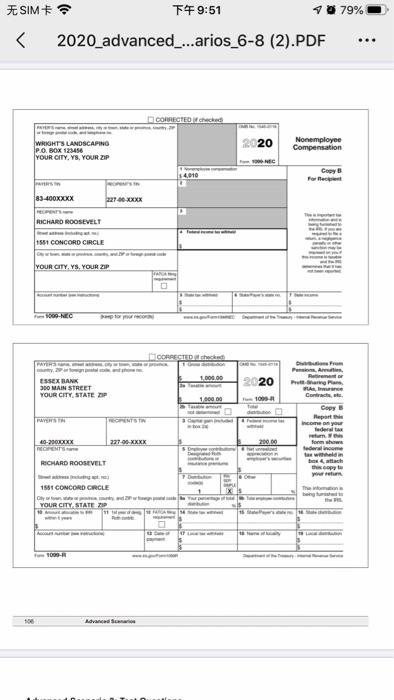

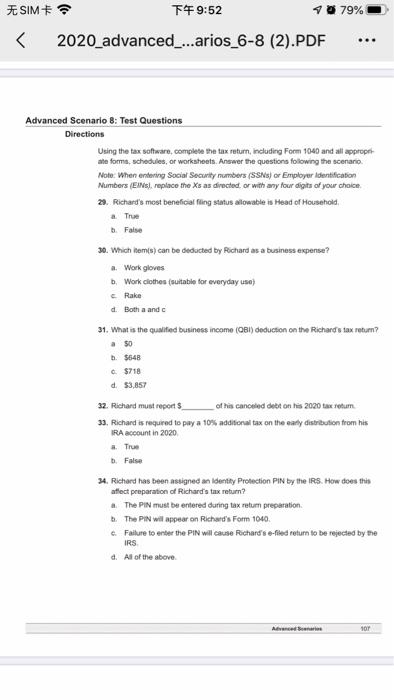

SIM T#9:50 82% 2020_advanced_...arios_6-8 (2).PDF ... Advanced Scenario 8: Richard Roosevelt Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario Note: When entering Social Security numbers (SSN) or Employer identification Numbers (EIN), replace the Xs as directed, or with any four digits of your choice. Interview Notes Richard is age 45 and single. Richard's tax information was stolen and the IRS issued an Identity Protection PIN 123456 Richard's mother, Martha, lives in a nursing home in a neighboring state. In 2020, she received $7,800 in Social Security income. Although she uses this money for her support, Richard has records showing he provided over half of her support in 2020 Richard lost his job in March when the state shut down due to the coronavirus pandemic. He received unemployment compensation for June and July Richard began a landscape service in April and was paid on Form 1099-NEC. He also received cash receipts of $325 from clients not reported on a tax form. Richard uses the cash method of accounting. He uses business code 561730 . He has receipts for the following expenses - Used lawnmower - $236 Business cards - $15 - Rake. $19 - Work gloves - $25 Lunches - $140 - Work clothes suitable for everyday use - 5175 - Lunch box- $25 Richard has a detailed mileage log reporting: Mileage from his home to his 1st client's home and mileage from his last client's home to his home - 620 miles In addition on the days Richard worked for multiple clients, he kept track of the mileage from the first client's home to the second client's home in case that mileage was also deductible. He logged 312 miles (not included in the 620 miles) The total mileage on his car for tax year 2020 was 9,543 miles. Of that. 8.611 were personal miles. He placed his only vehicle, a pick-up truck. in service on 4/15/2020. He will take the standard mileage rate Richard took an early distribution from his IRA in April to help pay his living expenses while he was out of work due to COVID-19. Richard did not repay this distribution by the due date of his 2020 tax ratum Advanced Scenario # SIM # T#9:50 70 82%