Answered step by step

Verified Expert Solution

Question

1 Approved Answer

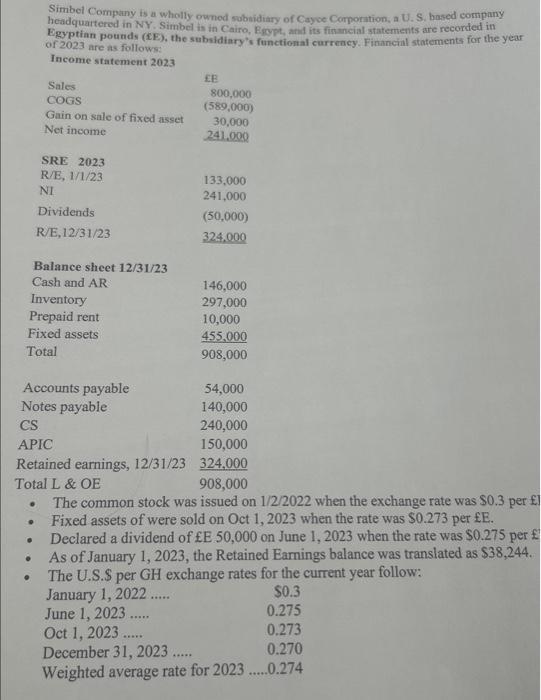

Simbel Company is a wholly owned subsidiary of Cayce Corporation, a U. S. based company headquartered in NY. Simbel is in Cairo, Egypt, and

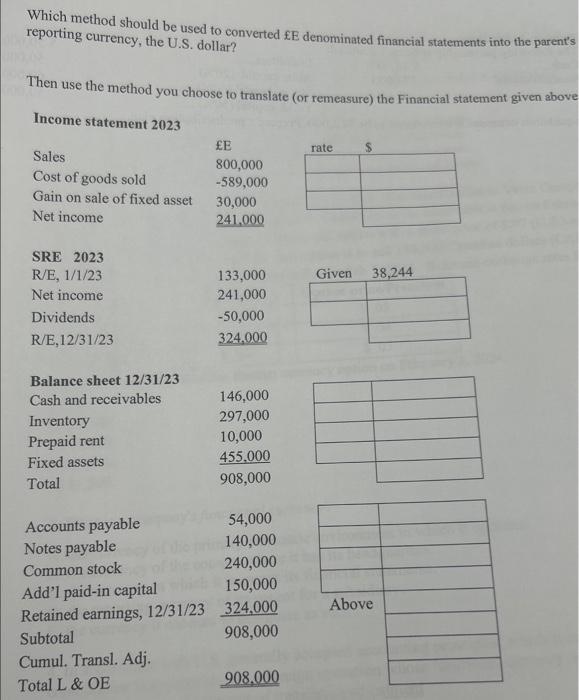

Simbel Company is a wholly owned subsidiary of Cayce Corporation, a U. S. based company headquartered in NY. Simbel is in Cairo, Egypt, and its financial statements are recorded in Egyptian pounds (EE), the subsidiary's functional currency. Financial statements for the year of 2023 are as follows: Income statement 2023 Inventory Prepaid rent Fixed assets Total . Sales COGS Gain on sale of fixed asset Net income Balance sheet 12/31/23 Cash and AR . SRE 2023 R/E, 1/1/23 NI Dividends R/E,12/31/23 B Accounts payable 54,000 Notes payable 140,000 CS 240,000 APIC 150,000 Retained earnings, 12/31/23 324,000 800,000 (589,000) Total L & OE 908,000 The common stock was issued on 1/2/2022 when the exchange rate was $0.3 per Fixed assets of were sold on Oct 1, 2023 when the rate was $0.273 per E. Declared a dividend of E 50,000 on June 1, 2023 when the rate was $0.275 per As of January 1, 2023, the Retained Earnings balance was translated as $38,244. The U.S.S per GH exchange rates for the current year follow: January 1, 2022..... $0.3 0.275 June 1, 2023..... Oct 1, 2023 0.273 December 31, 2023. 0.270 ***** Weighted average rate for 2023.....0.274 30,000 241.000 133,000 241,000 (50,000) 324,000 146,000 297,000 10,000 455,000 908,000 Which method should be used to converted E denominated financial statements into the parent's reporting currency, the U.S. dollar? Then use the method you choose to translate (or remeasure) the Financial statement given above Income statement 2023 Sales Cost of goods sold Gain on sale of fixed asset Net income SRE 2023 R/E, 1/1/23 Net income Dividends R/E,12/31/23 Balance sheet 12/31/23 Cash and receivables Inventory Prepaid rent Fixed assets Total Accounts payable Notes payable Common stock Add'l paid-in capital Retained earnings, 12/31/23 Subtotal Cumul. Transl. Adj. Total L & OE E 800,000 -589,000 30,000 241,000 133,000 241,000 -50,000 324,000 146,000 297,000 10,000 455.000 908,000 54,000 140,000 240,000 150,000 324,000 908,000 908.000 rate $ Given 38,244 Above

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided Simbel Company the subsidiary is located in Egypt and uses the Egyptian pound EE as its functional currency The pare...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started