Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Simian Valley Corp. owns both the land and building that it uses for a banana plantation. The original cost of the building was $412,500

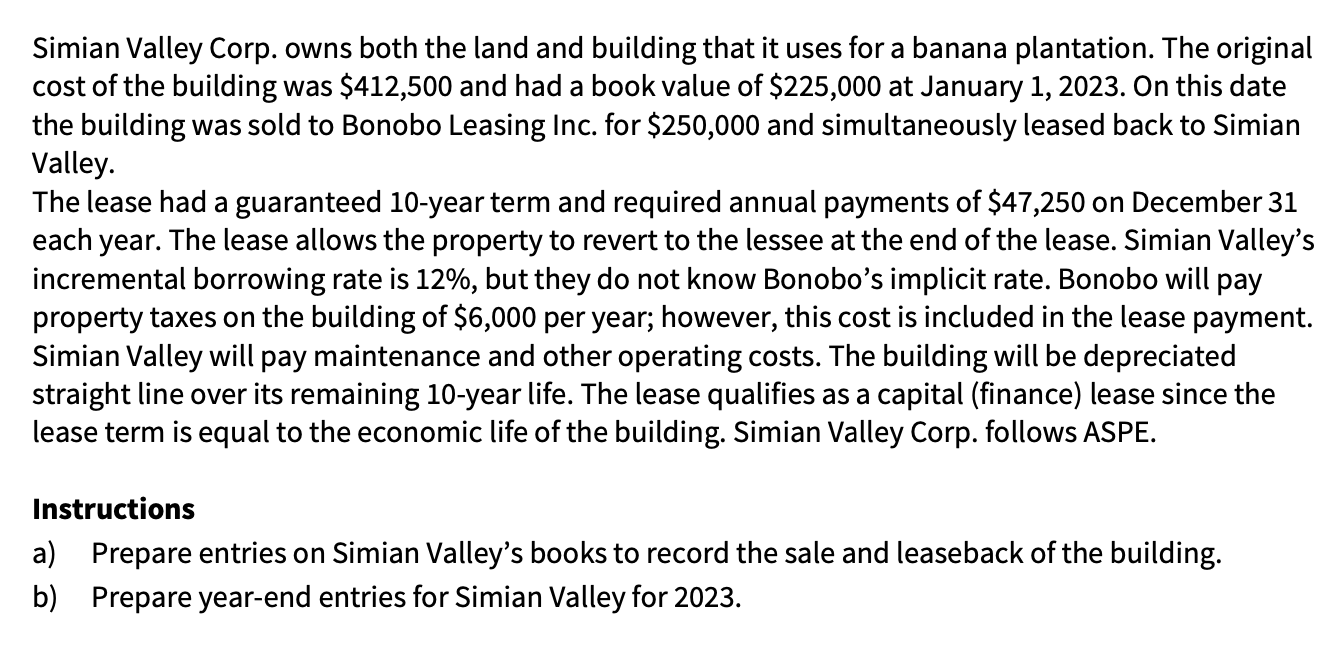

Simian Valley Corp. owns both the land and building that it uses for a banana plantation. The original cost of the building was $412,500 and had a book value of $225,000 at January 1, 2023. On this date the building was sold to Bonobo Leasing Inc. for $250,000 and simultaneously leased back to Simian Valley. The lease had a guaranteed 10-year term and required annual payments of $47,250 on December 31 each year. The lease allows the property to revert to the lessee at the end of the lease. Simian Valley's incremental borrowing rate is 12%, but they do not know Bonobo's implicit rate. Bonobo will pay property taxes on the building of $6,000 per year; however, this cost is included in the lease payment. Simian Valley will pay maintenance and other operating costs. The building will be depreciated straight line over its remaining 10-year life. The lease qualifies as a capital (finance) lease since the lease term is equal to the economic life of the building. Simian Valley Corp. follows ASPE. Instructions a) Prepare entries on Simian Valley's books to record the sale and leaseback of the building. b) Prepare year-end entries for Simian Valley for 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started