Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SIMMONS MAINTENANCE COMPANY Balance Sheet Assets Cash Acts. Receivable Inventory Current Assets Liabilities $ 15,000 Accounts Payable 22,000 Notes Payable 30,000 Acorued Expenses 67,000

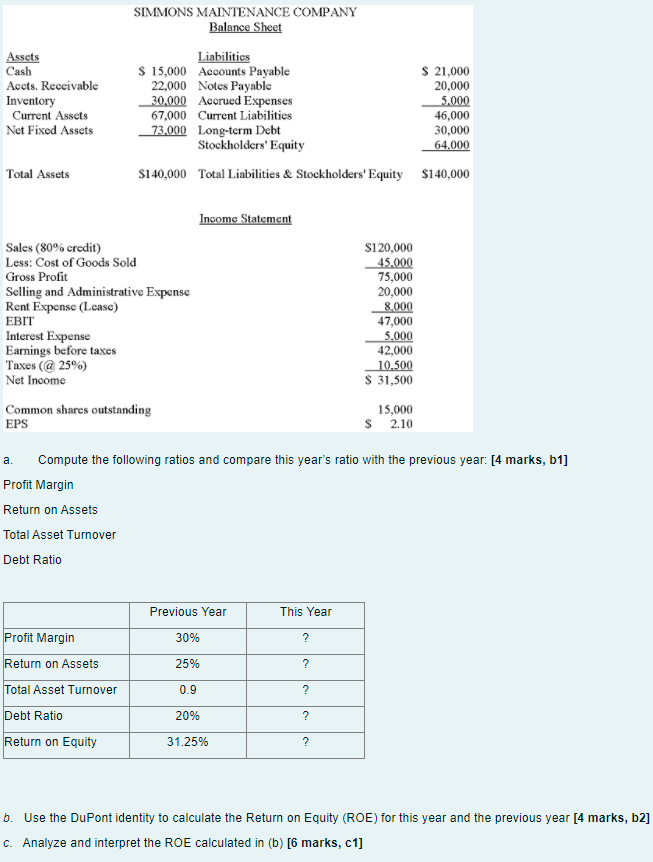

SIMMONS MAINTENANCE COMPANY Balance Sheet Assets Cash Acts. Receivable Inventory Current Assets Liabilities $ 15,000 Accounts Payable 22,000 Notes Payable 30,000 Acorued Expenses 67,000 Current Liabilities 73,000 Long-term Debt Stockholders' Equity $ 21,000 20,000 5.000 46,000 Net Fixed Assets 30,000 64.000 Total Assets $140,000 Total Liabilities & Stockholders' Equity $140,000 Income Statement Sales (80% credit) Less: Cost of Goods Sold $120,000 45.000 75,000 20,000 8,000 47,000 5,000 42,000 Gross Profit Selling and Administrative Expense Rent Expense (Lease) EBIT Interest Expense Earnings before taxes Taxes (@ 25%) Net Income 10.500 $ 31,500 Common shares outstanding PS 15,000 $ 2.10 a. Compute the following ratios and compare this year's ratio with the previous year: [4 marks, b1] Profit Margin Return on Assets Total Asset Turnover Debt Ratio Previous Year This Year Profit Margin 30% ? Return on Assets 25% ? Total Asset Turnover 0.9 Debt Ratio 20% ? Return on Equity 31.25% ? b. Use the DuPont identity to calculate the Return on Equity (ROE) for this year and the previous year [4 marks, b2] c. Analyze and interpret the ROE calculated in (b) [6 marks, c1] SIMMONS MAINTENANCE COMPANY Balance Sheet Assets Cash Acts. Receivable Inventory Current Assets Liabilities $ 15,000 Accounts Payable 22,000 Notes Payable 30,000 Acorued Expenses 67,000 Current Liabilities 73,000 Long-term Debt Stockholders' Equity $ 21,000 20,000 5.000 46,000 Net Fixed Assets 30,000 64.000 Total Assets $140,000 Total Liabilities & Stockholders' Equity $140,000 Income Statement Sales (80% credit) Less: Cost of Goods Sold $120,000 45.000 75,000 20,000 8,000 47,000 5,000 42,000 Gross Profit Selling and Administrative Expense Rent Expense (Lease) EBIT Interest Expense Earnings before taxes Taxes (@ 25%) Net Income 10.500 $ 31,500 Common shares outstanding PS 15,000 $ 2.10 a. Compute the following ratios and compare this year's ratio with the previous year: [4 marks, b1] Profit Margin Return on Assets Total Asset Turnover Debt Ratio Previous Year This Year Profit Margin 30% ? Return on Assets 25% ? Total Asset Turnover 0.9 Debt Ratio 20% ? Return on Equity 31.25% ? b. Use the DuPont identity to calculate the Return on Equity (ROE) for this year and the previous year [4 marks, b2] c. Analyze and interpret the ROE calculated in (b) [6 marks, c1] SIMMONS MAINTENANCE COMPANY Balance Sheet Assets Cash Acts. Receivable Inventory Current Assets Liabilities $ 15,000 Accounts Payable 22,000 Notes Payable 30,000 Acorued Expenses 67,000 Current Liabilities 73,000 Long-term Debt Stockholders' Equity $ 21,000 20,000 5.000 46,000 Net Fixed Assets 30,000 64.000 Total Assets $140,000 Total Liabilities & Stockholders' Equity $140,000 Income Statement Sales (80% credit) Less: Cost of Goods Sold $120,000 45.000 75,000 20,000 8,000 47,000 5,000 42,000 Gross Profit Selling and Administrative Expense Rent Expense (Lease) EBIT Interest Expense Earnings before taxes Taxes (@ 25%) Net Income 10.500 $ 31,500 Common shares outstanding PS 15,000 $ 2.10 a. Compute the following ratios and compare this year's ratio with the previous year: [4 marks, b1] Profit Margin Return on Assets Total Asset Turnover Debt Ratio Previous Year This Year Profit Margin 30% ? Return on Assets 25% ? Total Asset Turnover 0.9 Debt Ratio 20% ? Return on Equity 31.25% ? b. Use the DuPont identity to calculate the Return on Equity (ROE) for this year and the previous year [4 marks, b2] c. Analyze and interpret the ROE calculated in (b) [6 marks, c1]

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Fixed Char...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started