Answered step by step

Verified Expert Solution

Question

1 Approved Answer

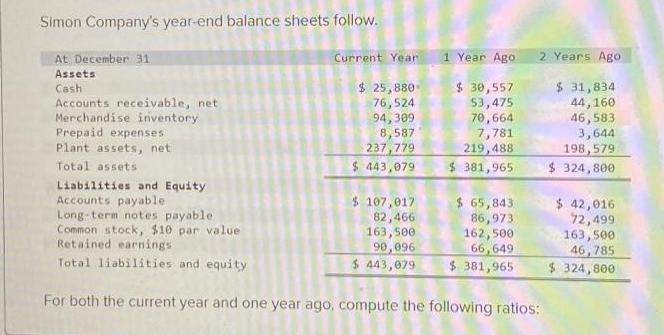

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities

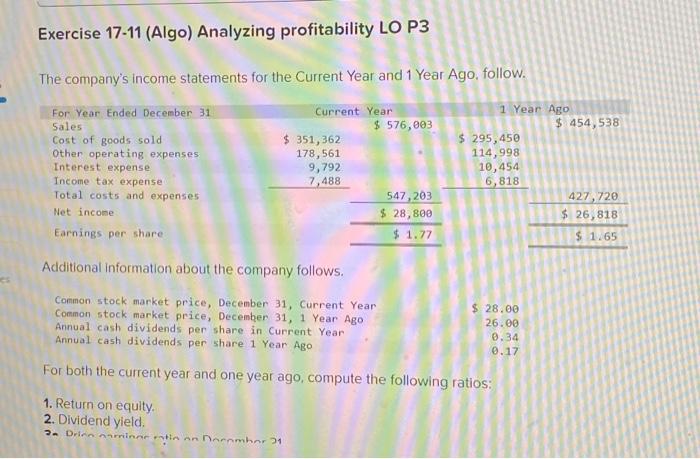

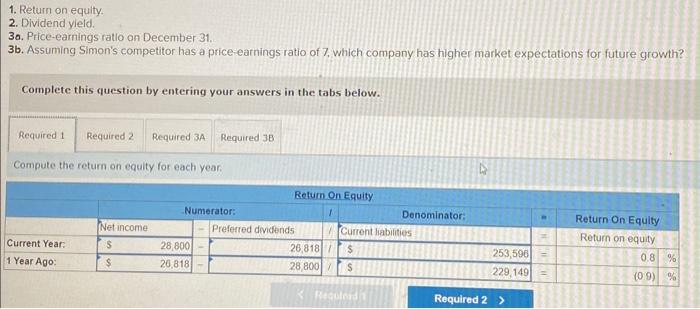

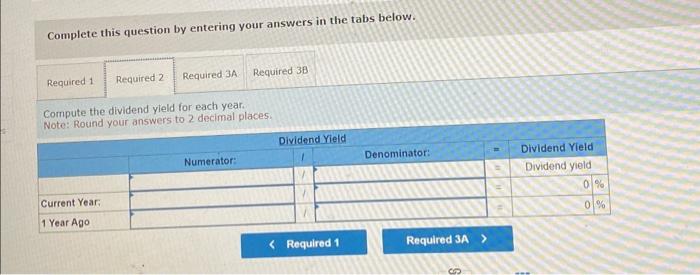

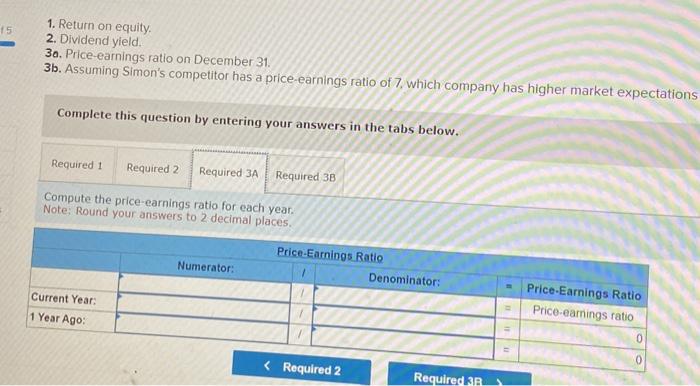

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Current Year 1 Year Ago 2 Years Ago $ 30,557 53,475 $ 31,834 $ 25,880 76,524 94,309 8,587 237,779 $ 443,079 82,466 163,500 90,096 $ 107,017 Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity 70,664 7,781 219,488 $ 381,965 $ 65,843 86,973 162,500 44,160 46,583 3,644 198,579 $ 324,800 $ 42,016 72,499 163,500 46,785 66,649 $ 443,079 $ 381,965 $ 324,800 For both the current year and one year ago, compute the following ratios: $ 454,538 427,720 $ 26,818 $1.65 Exercise 17-11 (Algo) Analyzing profitability LO P3 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income. Earnings per share: Current Year 1 Year Ago $ 576,003 $ 351,362 178,561 $ 295,450 114,998 10,454 6,818 9,792 7,488 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago 547,203 $ 28,800 $ 1.77 $ 28.00 26.00 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3. Drinn minne ntin on December 21 0.34 0.17 1. Return on equity. 2. Dividend yield. 30. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the return on equity for each year. 4 Return On Equity Numerator: Denominator: Return On Equity Net income -Preferred dividends Current liabilities Return on equity Current Year: $ 28,800- 26,818/ $ 253,596= 0.8 % 1 Year Ago: $ 26,818 28,800 / $ 229,149 (0.9) % Regulerd Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the dividend yield for each year. Note: Round your answers to 2 decimal places. Current Year: 1 Year Ago Numerator: Dividend Yield Denominator: Dividend Yield Dividend yield 0% 0% 1. Return on equity. 15 2. Dividend yield. 30. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the price-earnings ratio for each year. Note: Round your answers to 2 decimal places. Current Year: 1 Year Ago: Numerator: Price-Earnings Ratio Denominator: Price-Earnings Ratio Price-earnings ratio 0 < Required 2 Required 3R 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started