Answered step by step

Verified Expert Solution

Question

1 Approved Answer

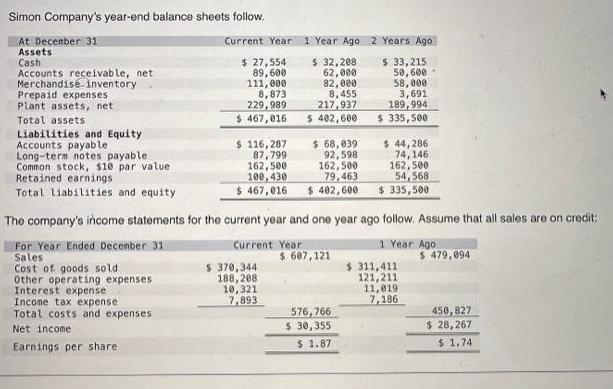

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Cost

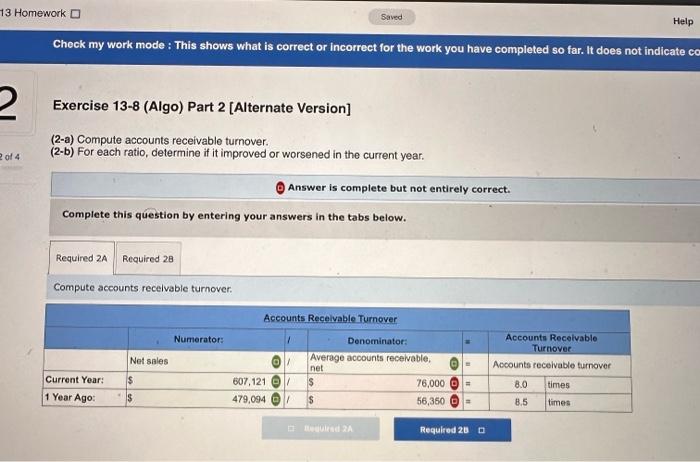

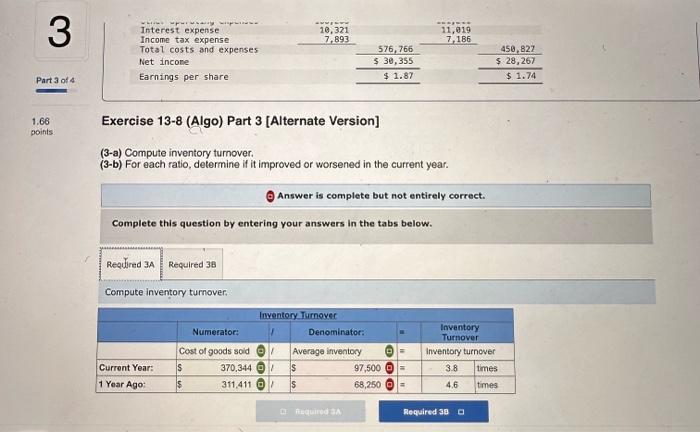

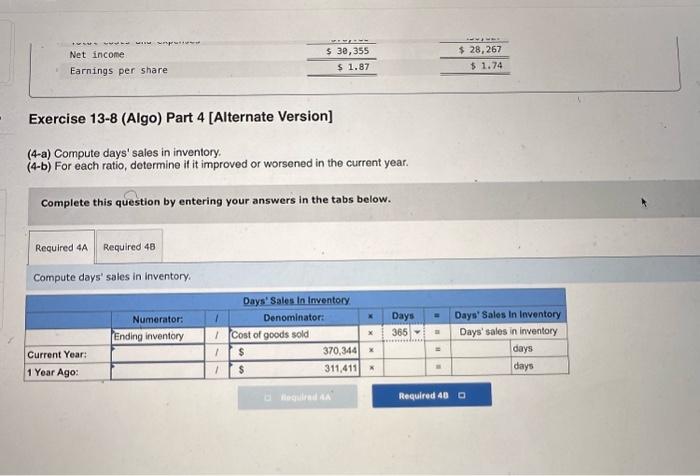

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Cost of goods sold. Other operating expenses Interest expense Current Year 1 Year Ago 2 Years Ago $ 27,554 89,600 111,000 8,873 229,989 $ 467,016. Income tax expense Total costs and expenses. Net income Earnings per share. Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: For Year Ended December 31 Current Year 1 Year Ago Sales $116,287 87,799 162,500 100,430 $ 467,016 $ 370,344 188,208 $ 32,208 62,000 82,000 8,455 217,937 $ 402,600 10,321 7,893 $ 68,039 92,598 162,500 79,463 $ 402,600 $ 607,121 $33,215 50,600 58,000 3,691 189,994 $ 335,500 576,766 $ 30,355 $ 1.87 $ 44,286 74,146 162,500 54,568 $335,500 $ 311,411 121,211 11,019 7,186 $ 479,094 450,827 $ 28,267 $ 1.74 13 Homework 2 2 of 4 Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate com Exercise 13-8 (Algo) Part 2 [Alternate Version] (2-a) Compute accounts receivable turnover. (2-b) For each ratio, determine if it improved or worsened in the current year. Required 2A Required 28 Compute accounts receivable turnover. Complete this question by entering your answers in the tabs below. Current Year: 1 Year Ago: Net sales $ S Numerator: Saved Answer is complete but not entirely correct. Accounts Receivable Turnover O/ Denominator: Average accounts receivable, net 607,121/ $ 479,094/ $ Required 2A 76,000 = 56,350 Required 28 Accounts Receivable Turnover Accounts receivable turnover 8.0 8.5 Help times times 3 Part 3 of 4 1.66 points www. Interest expense Income tax expense Total costs and expenses Net income Earnings per share Required 3A Required 38 Exercise 13-8 (Algo) Part 3 [Alternate Version] (3-a) Compute inventory turnover. (3-b) For each ratio, determine if it improved or worsened in the current year. Compute inventory turnover. Current Year: 1 Year Ago: AVVERTE 10,321 7,893 Complete this question by entering your answers in the tabs below. Numerator: Cost of goods sold/ S $ Inventory Turnover 1 370,344 / 311,411/ 576,766 $ 30,355 $ 1.87 Answer is complete but not entirely correct. Denominator: Average inventory $ $ suajuae 11,019 7,186 Required 3A 97,500- 68,250 Inventory Turnover 458,827 $ 28,267 $ 1.74 Inventory turnover 3.8 4.6 Required 380 times times Net income. Earnings per share Exercise 13-8 (Algo) Part 4 [Alternate Version] (4-a) Compute days' sales in inventory. (4-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Required 4A Required 48 Compute days' sales in inventory. Current Year: 1 Year Ago: Numerator: Ending inventory $ 30,355 $ 1.87 1 /Cost of goods sold $ $ 1 1 Days' Sales In Inventory Denominator: X Required AA x 370,344 x 311,411 X Days 365 D $ 28,267 $ 1.74 Days' Sales In Inventory Days' sales in inventory Required 40 D days days

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Ratio Analysis It is the relationship between two or more items of financial statements which tell about the profitability efficiency liquidity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started