Answered step by step

Verified Expert Solution

Question

1 Approved Answer

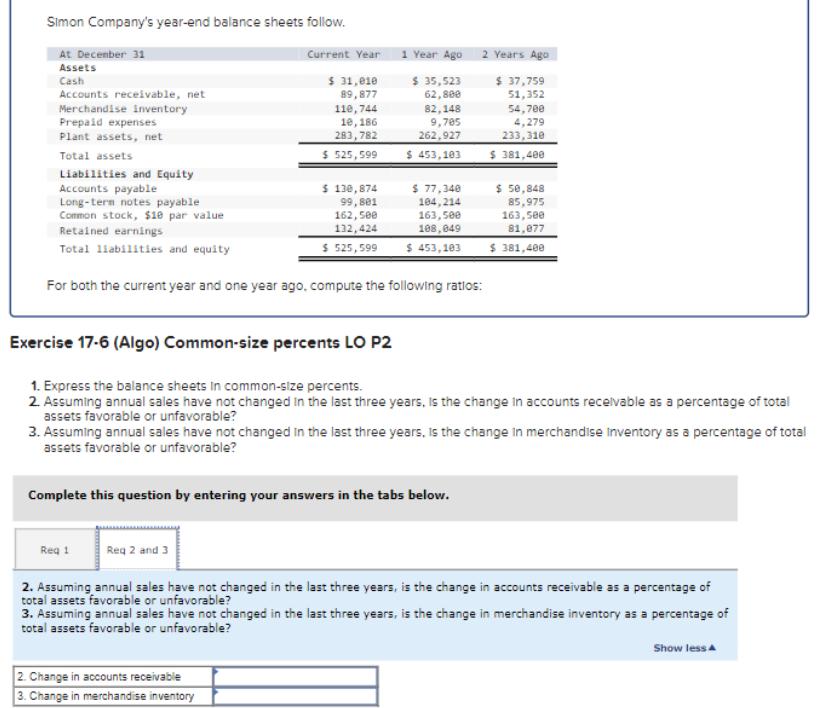

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Current Year 1 Year Ago 2 Years Ago $31,010 89,877 110,744 10,186 283,782 $ 525,599 $ 35,523 62,800 82,148 9,705 262,927 $ 453,103 $ 37,759 51,352 54,700 4,279 233,310 $ 381,400 $ 130,874 Long-term notes payable 99,801 Common stock, $10 par value 162,500 Retained earnings Total liabilities and equity 132,424 $525,599 $ 77,340 104,214 163,500 108,049 $ 50,848 85,975 163,500 81,077 $ 453,103 $ 381,400 For both the current year and one year ago, compute the following ratios: Exercise 17-6 (Algo) Common-size percents LO P2 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise Inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? 2. Change in accounts receivable 3. Change in merchandise inventory Show less

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Simon Company Ratio Analysis Req 1 CommonSize Balance Sheets Year Asset Percentage Liability Equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started