Answered step by step

Verified Expert Solution

Question

1 Approved Answer

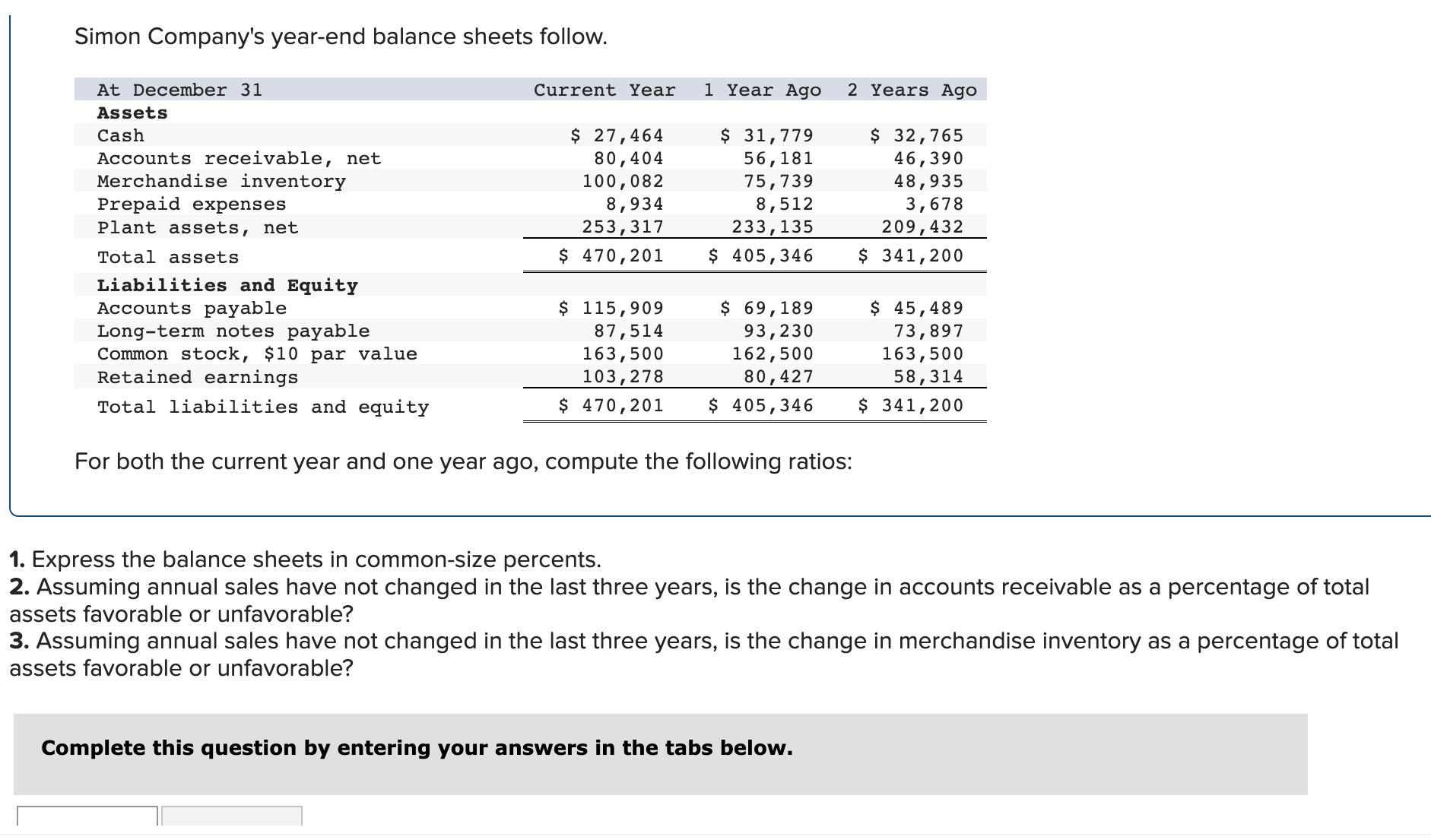

Simon Company's year-end balance sheets follow. At December 31 Assets Current Year 1 Year Ago 2 Years Ago Cash Accounts receivable, net $ 27,464

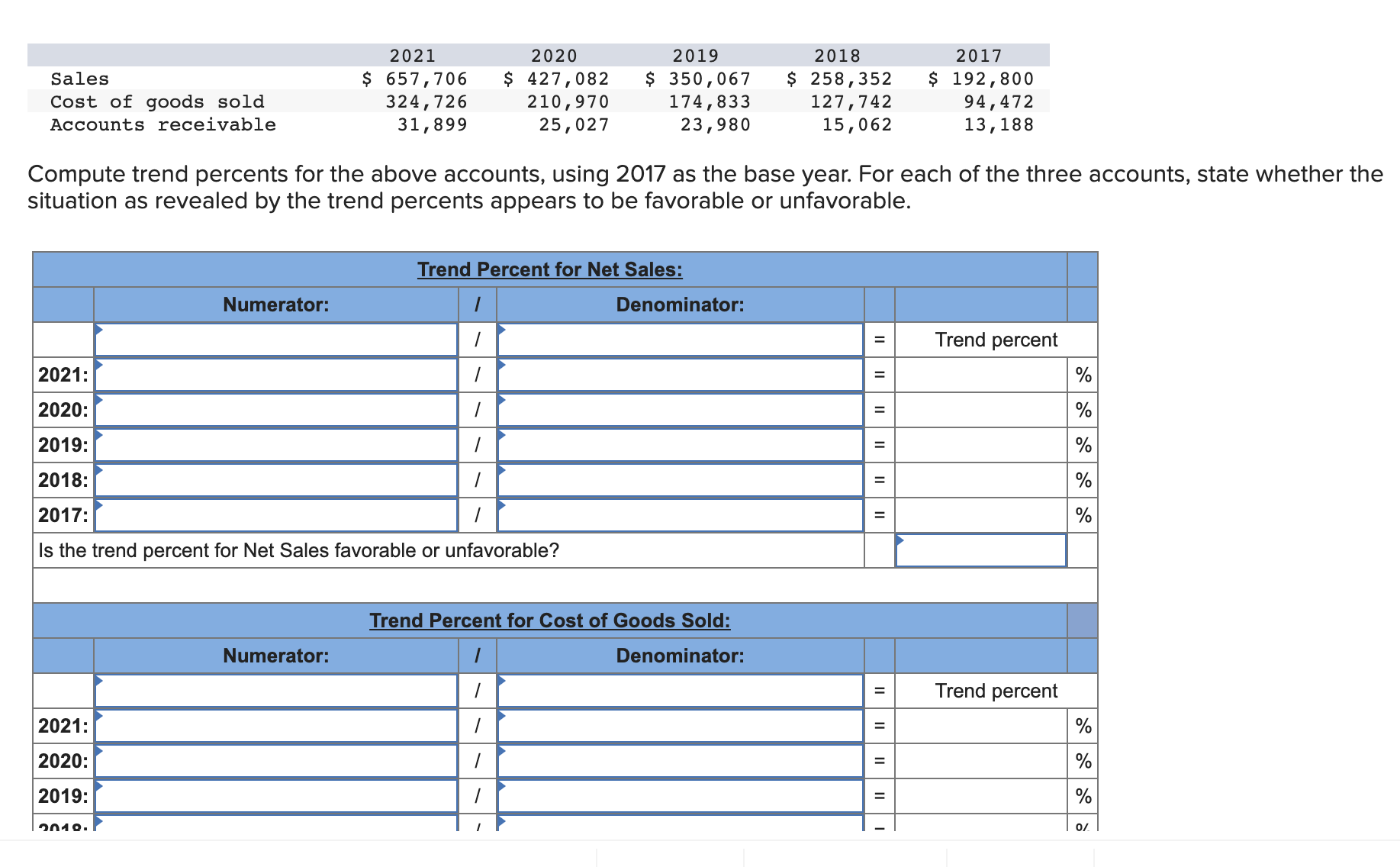

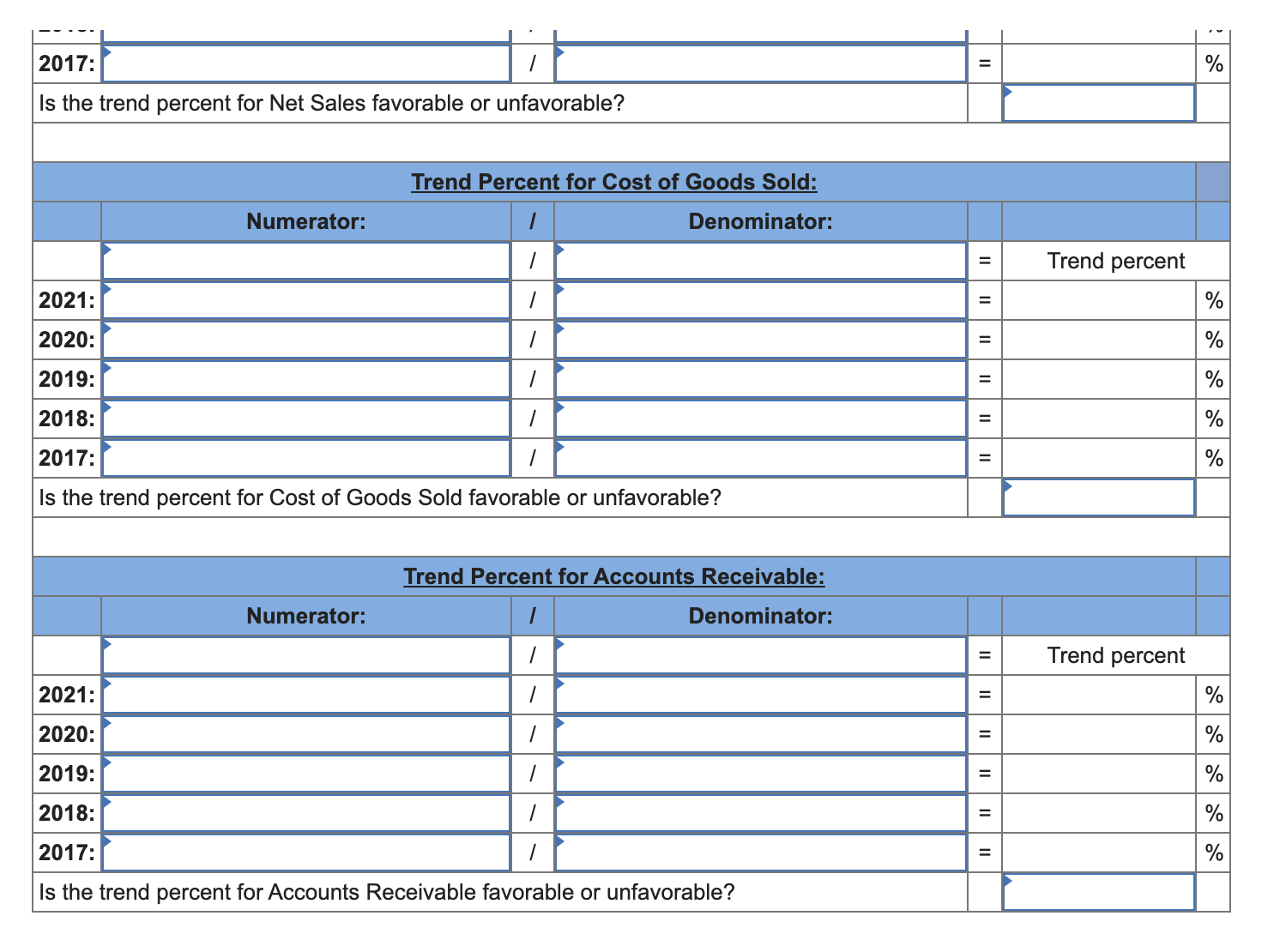

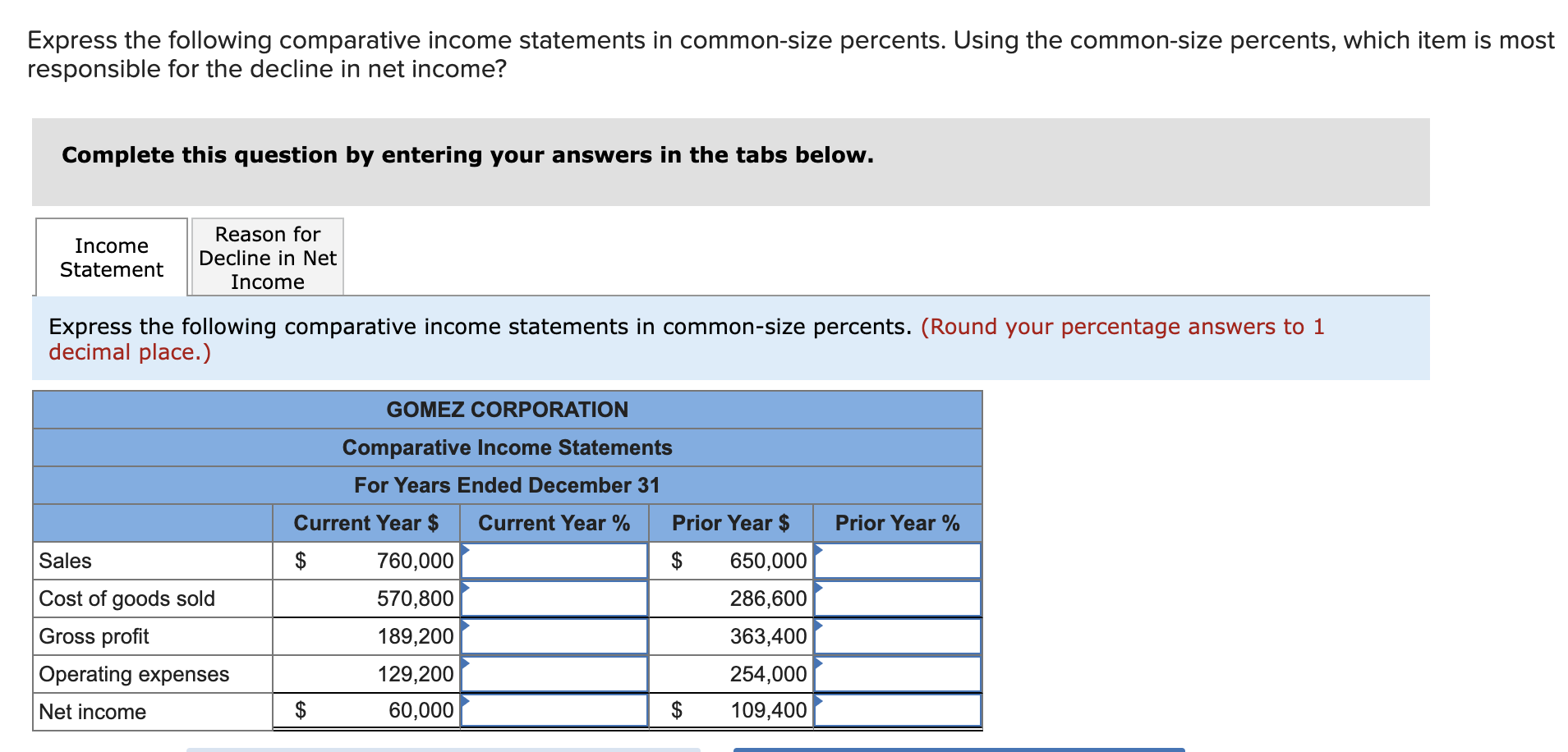

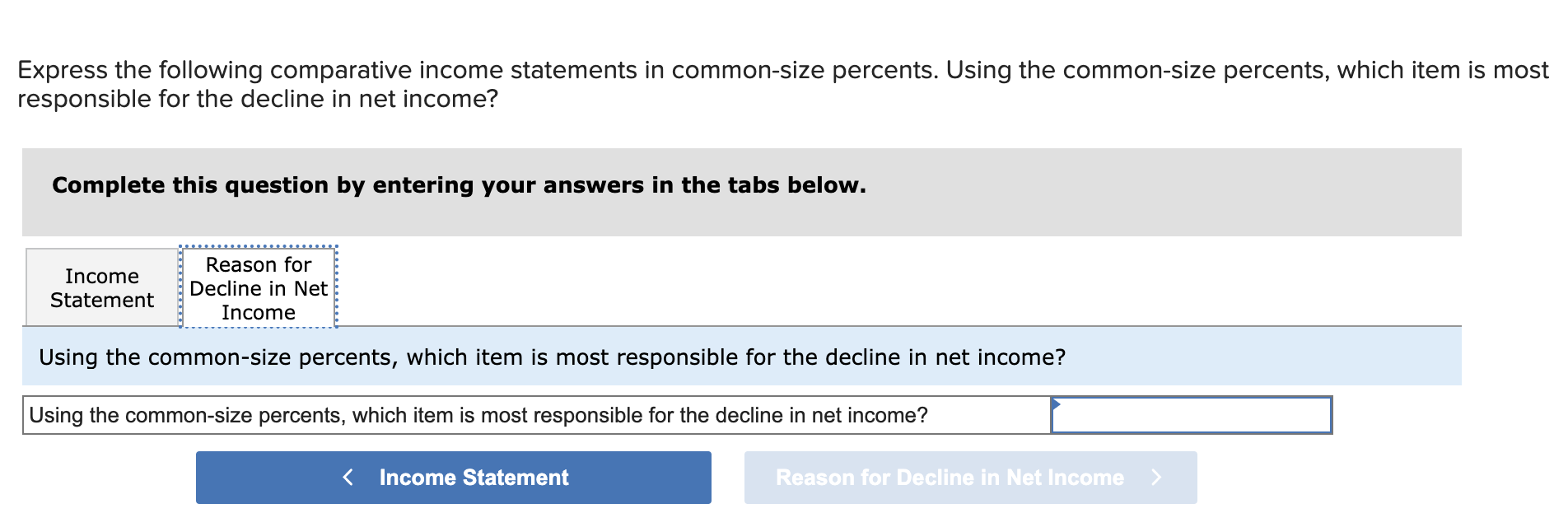

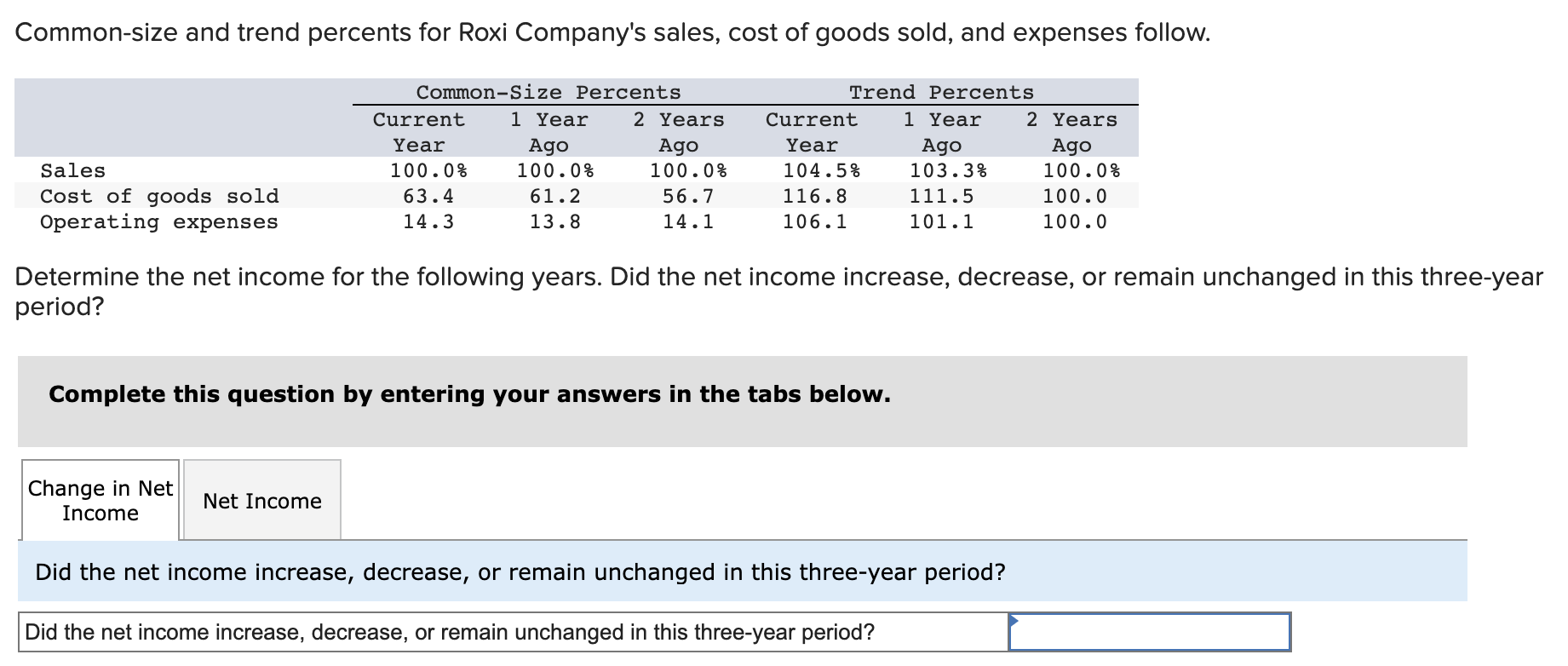

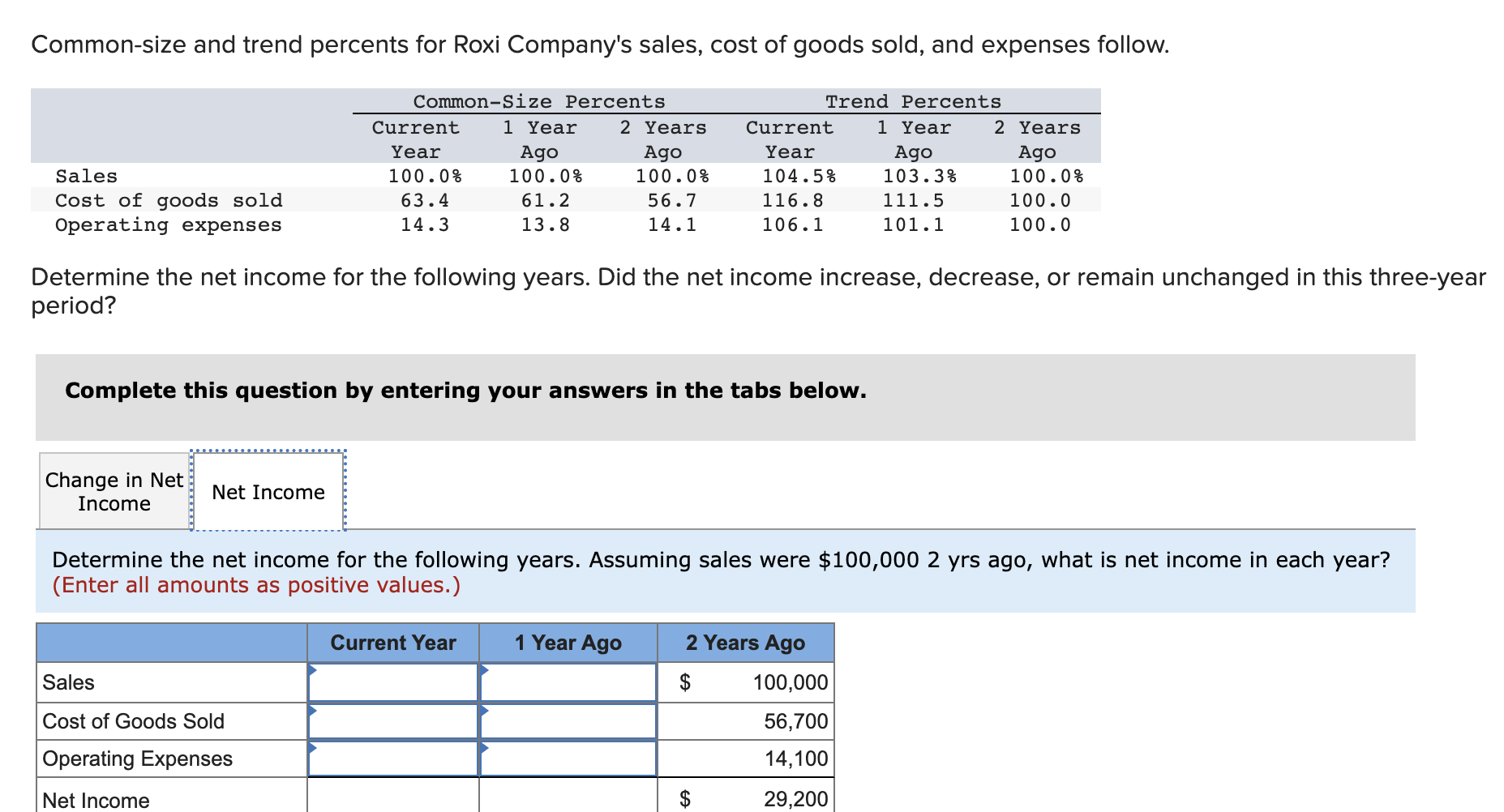

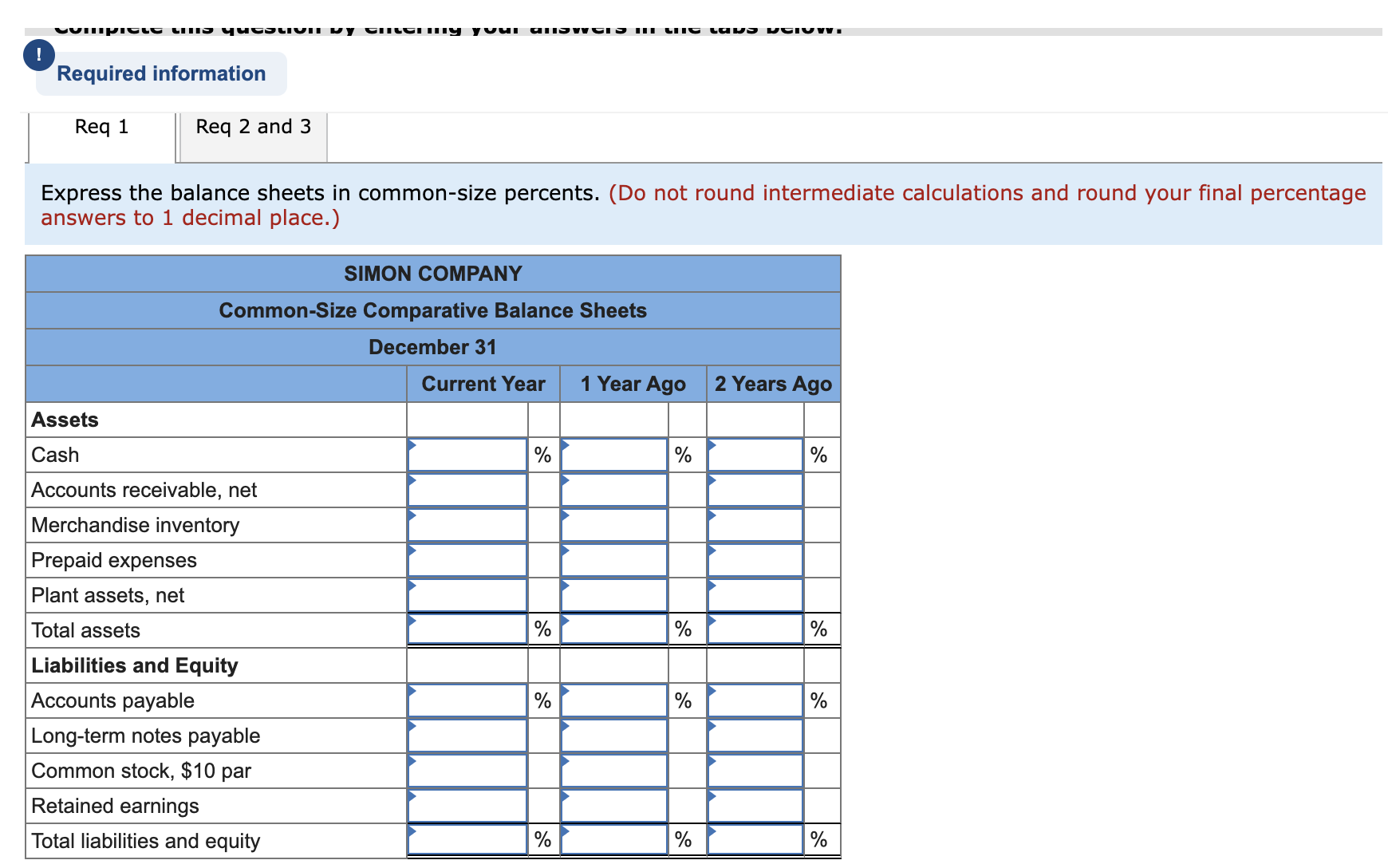

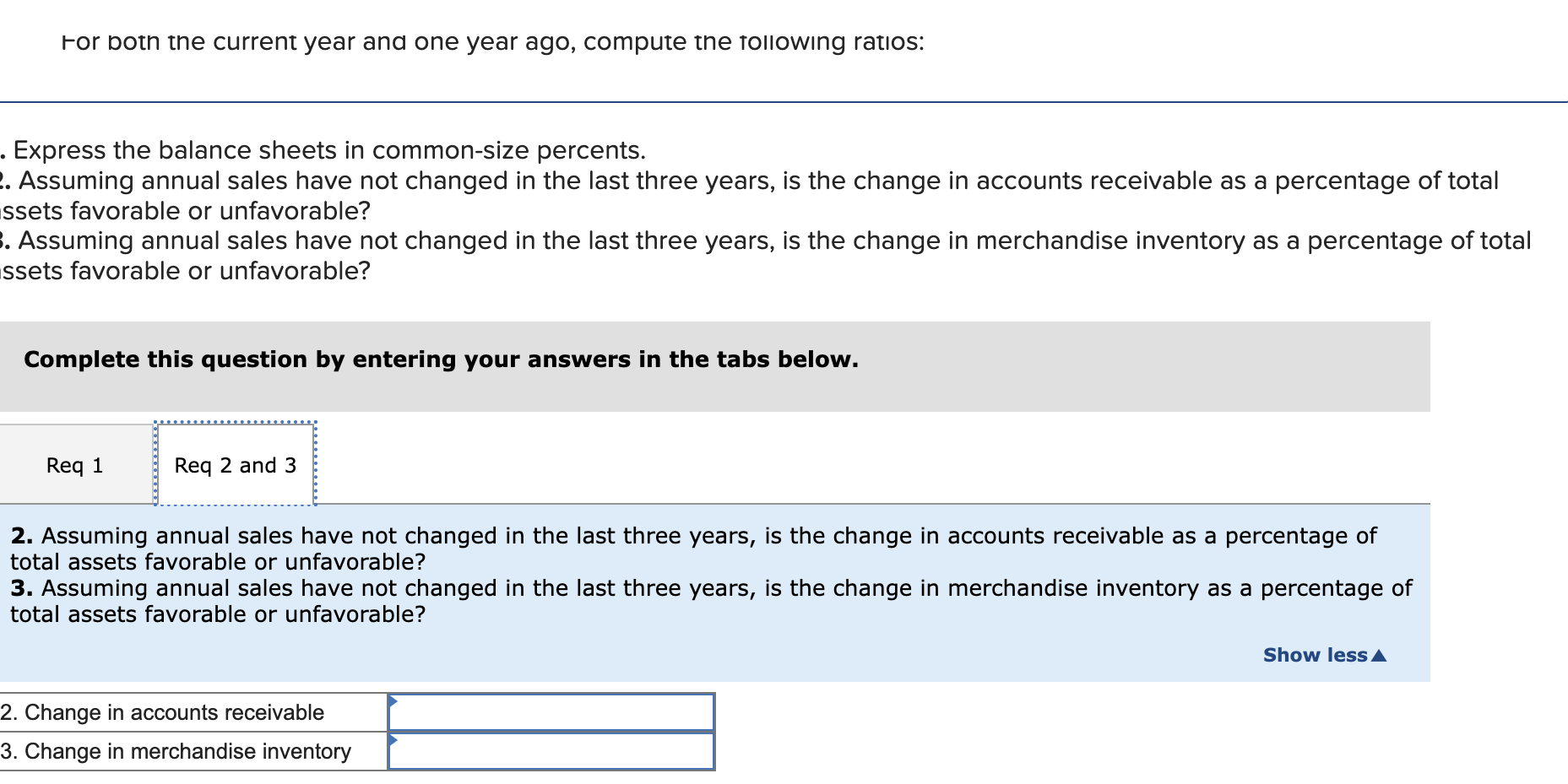

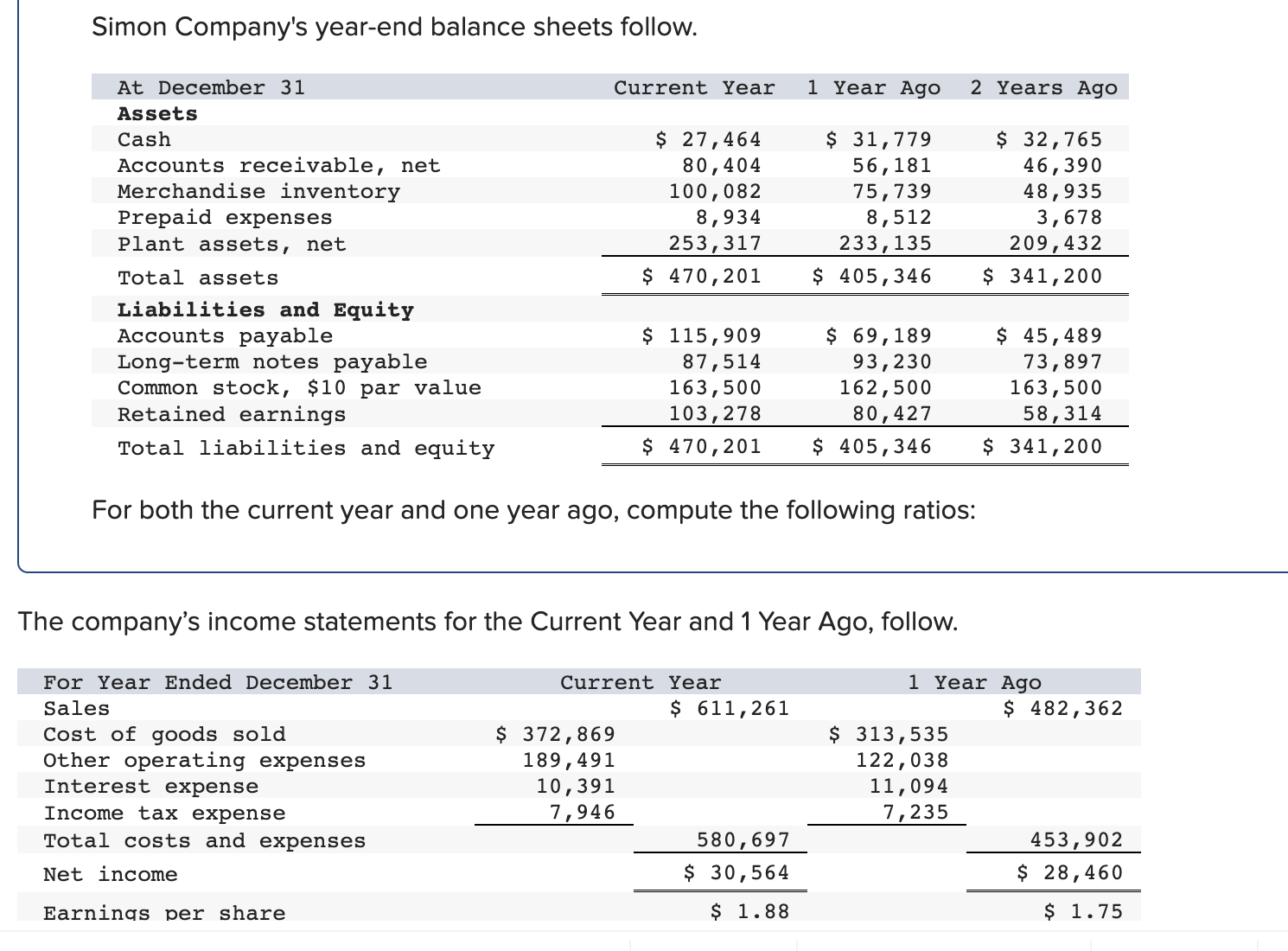

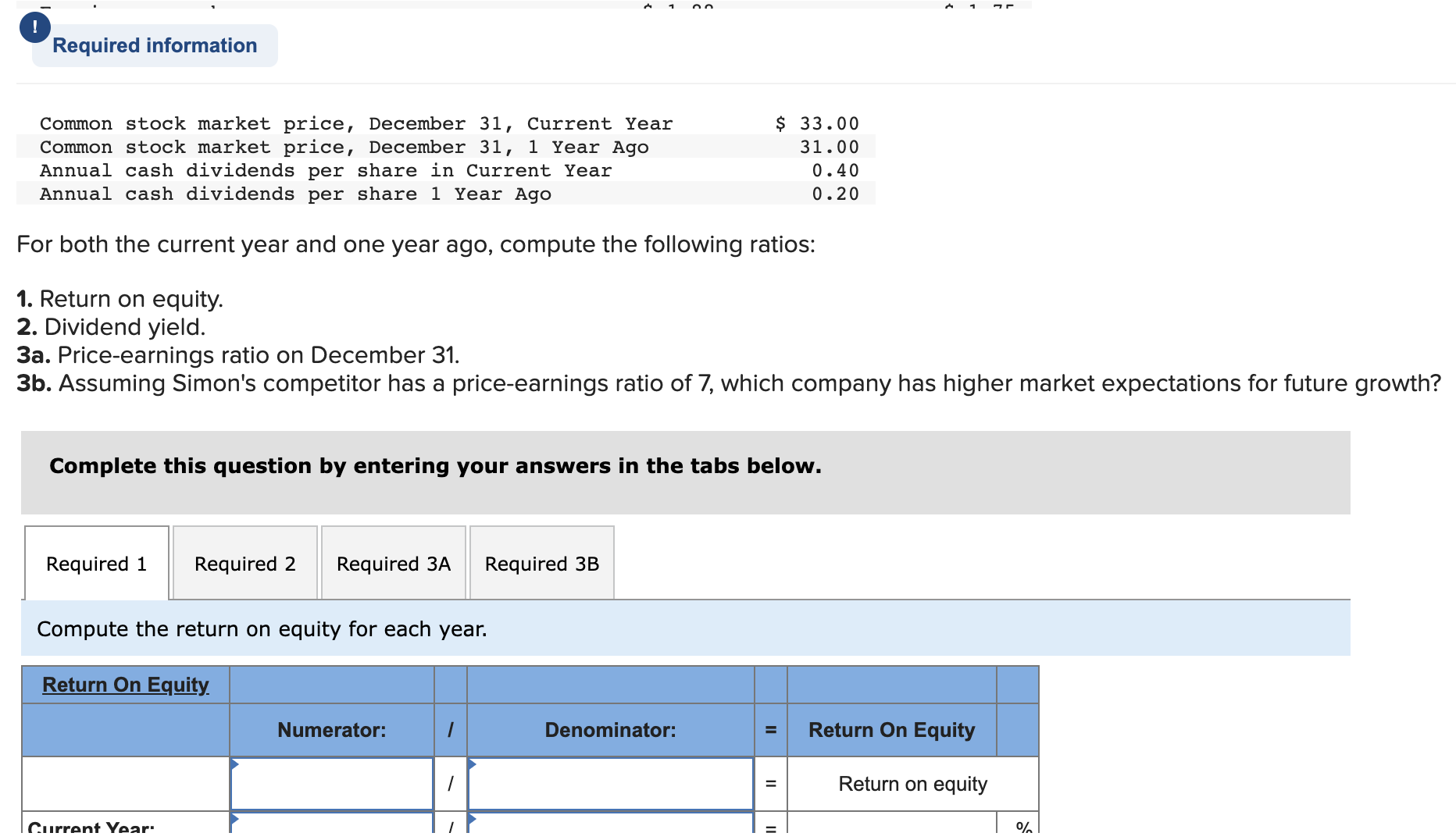

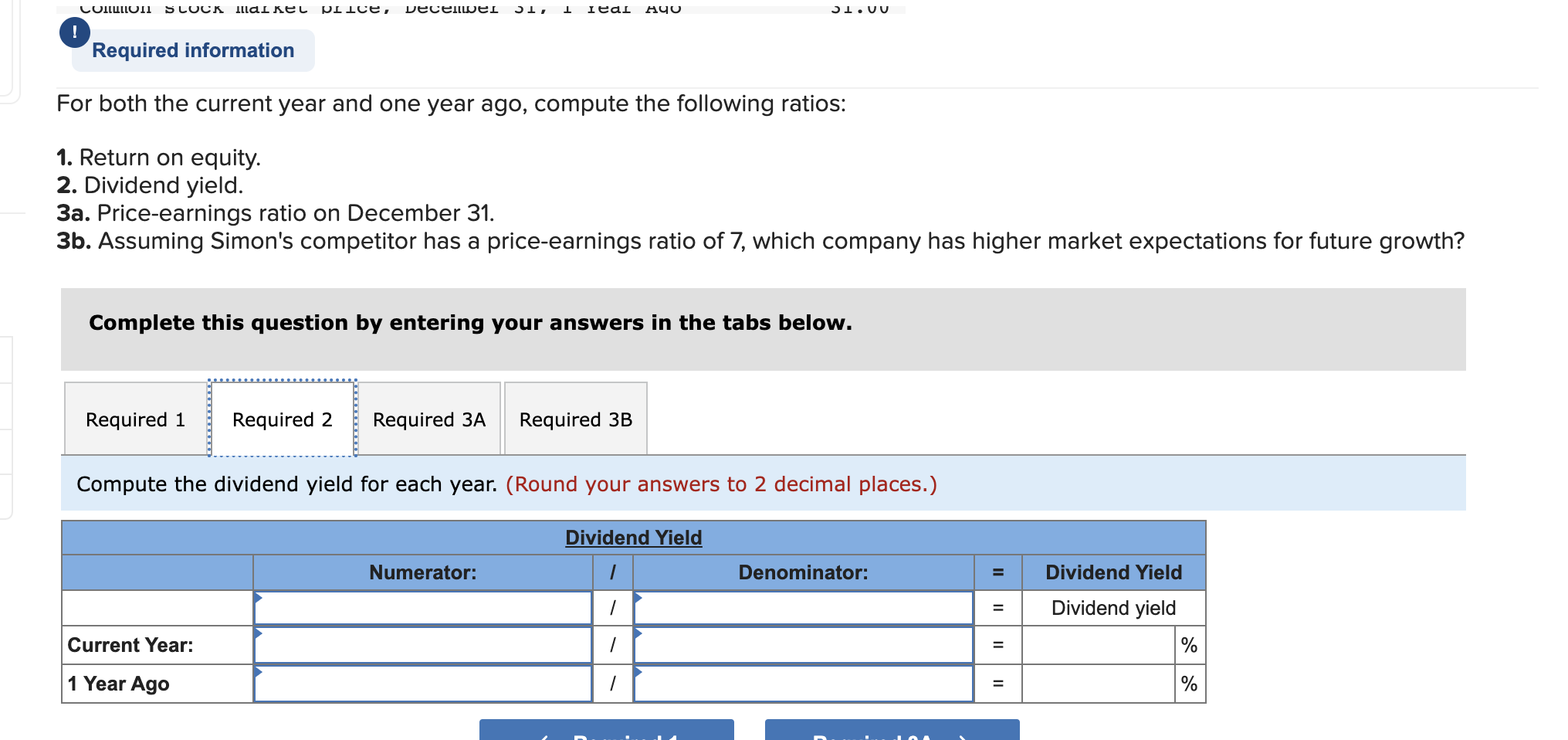

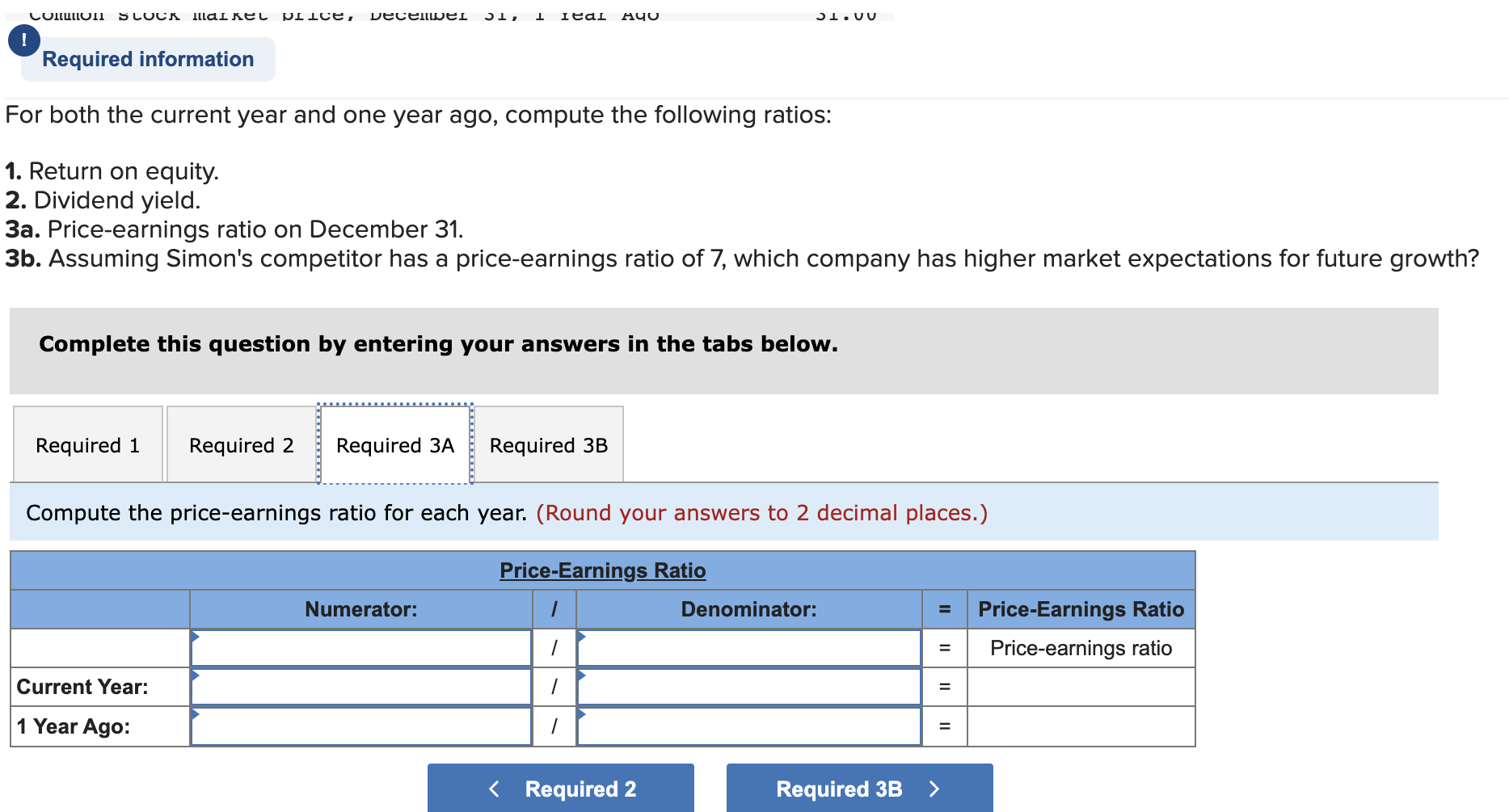

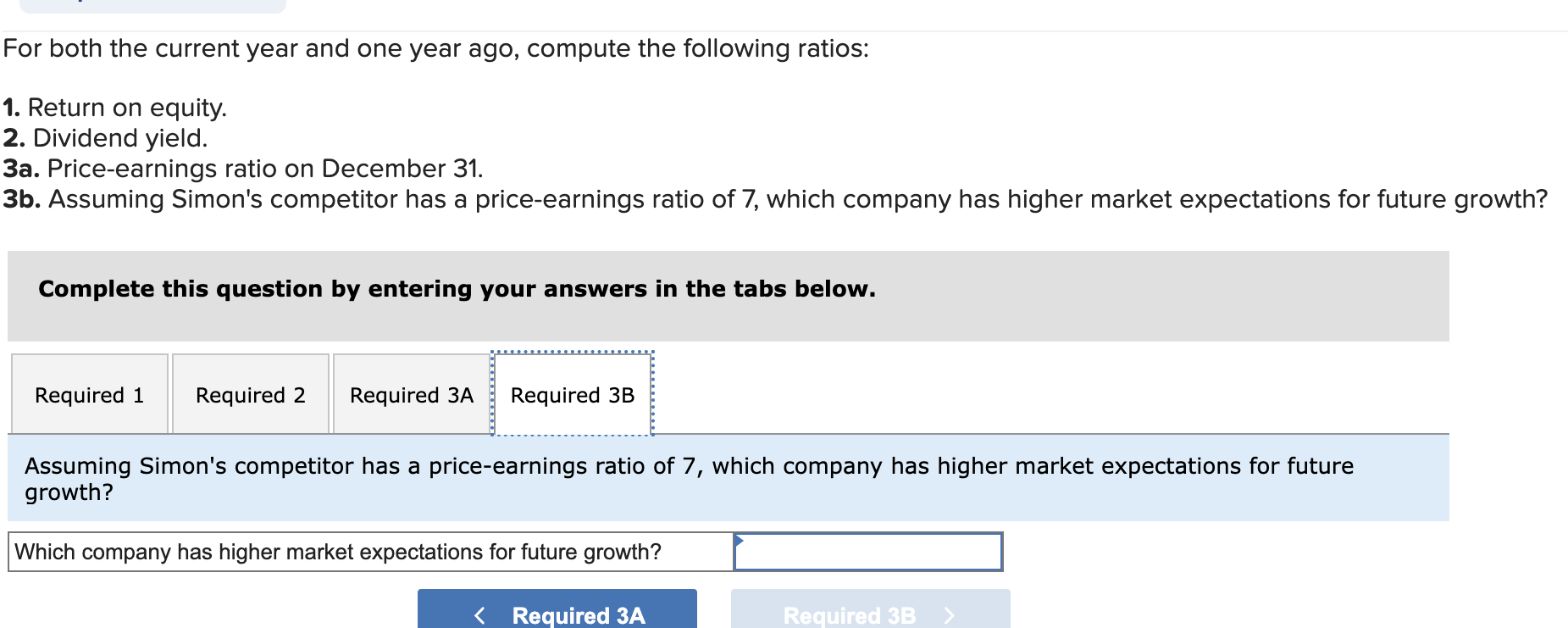

Simon Company's year-end balance sheets follow. At December 31 Assets Current Year 1 Year Ago 2 Years Ago Cash Accounts receivable, net $ 27,464 80,404 $ 31,779 56,181 $ 32,765 Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity 100,082 8,934 253,317 $ 470,201 $ 115,909 87,514 163,500 103,278 75,739 8,512 233,135 $ 405,346 $ 69,189 93,230 162,500 80,427 $ 470,201 $ 405,346 For both the current year and one year ago, compute the following ratios: 46,390 48,935 3,678 209,432 $ 341,200 $ 45,489 73,897 163,500 58,314 $ 341,200 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. 2021 2020 2019 2018 Sales Cost of goods sold Accounts receivable $ 657,706 324,726 31,899 $ 427,082 $ 350,067 210,970 25,027 $ 258,352 127,742 15,062 174,833 23,980 2017 $ 192,800 94,472 13,188 Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. 2021: 2020: 2019: 2018: Numerator: Trend Percent for Net Sales: Denominator: = Trend percent = % II % = % 2017: Is the trend percent for Net Sales favorable or unfavorable? 2021: 2020: 2019: 2018. Trend Percent for Cost of Goods Sold: Numerator: Denominator: I || | || % % II Trend percent = % | || = % | || || | = % 0/ 2017: Is the trend percent for Net Sales favorable or unfavorable? 2021: 2020: 2019: 2018: Numerator: Trend Percent for Cost of Goods Sold: 1 Denominator: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? 2021: 2020: 2019: 2018: Numerator: Trend Percent for Accounts Receivable: Denominator: 2017: Is the trend percent for Accounts Receivable favorable or unfavorable? = II || ||| = = II = || | || Trend percent = Trend percent = % % % % % % do do do % = II % = % II = % = % Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales $ 760,000 $ 650,000 Cost of goods sold 570,800 286,600 Gross profit 189,200 363,400 Operating expenses 129,200 254,000 Net income $ 60,000 109,400 Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Using the common-size percents, which item is most responsible for the decline in net income? Using the common-size percents, which item is most responsible for the decline in net income? < Income Statement Reason for Decline in Net Income Common-size and trend percents for Roxi Company's sales, cost of goods sold, and expenses follow. Common-Size Percents Trend Percents Current 1 Year Year Sales 100.0% Cost of goods sold Operating expenses 63.4 14.3 Ago 100.0% 61.2 2 Years Ago 100.0% Current 1 Year 2 Years 13.8 56.7 14.1 Year 104.5% 116.8 106.1 Ago Ago 103.3% 100.0% 111.5 101.1 100.0 100.0 Determine the net income for the following years. Did the net income increase, decrease, or remain unchanged in this three-year period? Complete this question by entering your answers in the tabs below. Change in Net Income Net Income Did the net income increase, decrease, or remain unchanged in this three-year period? Did the net income increase, decrease, or remain unchanged in this three-year period? Common-size and trend percents for Roxi Company's sales, cost of goods sold, and expenses follow. Common-Size Percents Trend Percents Current 1 Year 2 Years Current 1 Year 2 Years Year Sales 100.0% Cost of goods sold Operating expenses 63.4 14.3 Ago 100.0% 61.2 13.8 Ago 100.0% 56.7 14.1 Year Ago Ago 104.5% 103.3% 100.0% 116.8 106.1 111.5 101.1 100.0 100.0 Determine the net income for the following years. Did the net income increase, decrease, or remain unchanged in this three-year period? Complete this question by entering your answers in the tabs below. Change in Net Income Net Income Determine the net income for the following years. Assuming sales were $100,000 2 yrs ago, what is net income in each year? (Enter all amounts as positive values.) Sales Cost of Goods Sold Operating Expenses Net Income Current Year 1 Year Ago 2 Years Ago $ 100,000 56,700 14,100 $ 29,200 Complete uns quesuivi by enemy you answCES MIT GING LADS DCIOWI ! Required information Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par December 31 Current Year 1 Year Ago 2 Years Ago % % % % % % % Retained earnings Total liabilities and equity % % % For both the current year and one year ago, compute the following ratios: . Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total ssets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total ssets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? 2. Change in accounts receivable 3. Change in merchandise inventory Show less Simon Company's year-end balance sheets follow. At December 31 Assets Current Year 1 Year Ago 2 Years Ago Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 27,464 80,404 100,082 8,934 253,317 $ 470,201 $ 115,909 87,514 163,500 103,278 $ 31,779 56,181 75,739 8,512 233,135 $ 405,346 $ 69,189 93,230 162,500 80,427 $ 470,201 $ 405,346 For both the current year and one year ago, compute the following ratios: $ 32,765 46,390 48,935 3,678 209,432 $ 341,200 $ 45,489 73,897 163,500 58,314 $ 341,200 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Year $ 611,261 $ 372,869 1 Year Ago $ 482,362 189,491 10,391 7,946 580,697 $ 30,564 $ 313,535 122,038 11,094 7,235 453,902 $ 28,460 $ 1.75 $ 1.88 ! Required information } Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $ 33.00 31.00 0.40 0.20 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the return on equity for each year. Return On Equity Current Year' Numerator: Denominator: II = Return On Equity Return on equity % COI Stock Market price, December 51, 1 Ital Required information 51.00 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Current Year: 1 Year Ago Numerator: Dividend Yield Denominator: II = Dividend Yield = Dividend yield = % = % Colo STOCK Market price, December 51, 1 real Ao 51.00 ! Required information For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Current Year: 1 Year Ago: Numerator: Price-Earnings Ratio Denominator: 1 < Required 2 Required 3B = Price-Earnings Ratio Price-earnings ratio = For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Which company has higher market expectations for future growth? < Required 3A Required 3B >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started