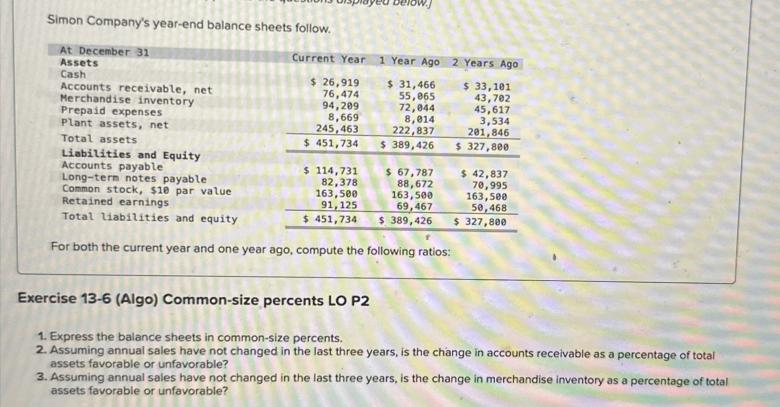

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year 1 Year Ago 2 Years Ago $ 26,919 76,474 $ 31,466 55,065 $ 33,101 94,209 8,669 245,463 $ 451,734 $ 114,731 82,378 163,500 91,125 72,044 8,014 222,837 $389,426 $ 67,787 88,672 163,500 69,467 $ 451,734 $ 389,426 For both the current year and one year ago, compute the following ratios: Exercise 13-6 (Algo) Common-size percents LO P2 1. Express the balance sheets in common-size percents. 43,702 45,617 3,534 201,846 $ 327,800 $ 42,837 70,995 163,500 50,468 $ 327,800 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable?

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

CommonSize Percentages Current Year Account Amount CommonSize Percentage Assets Cash 26919 596 Accounts Receivable Net 76474 1693 Merchandise Inventor...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dd350b5a09_961856.pdf

180 KBs PDF File

663dd350b5a09_961856.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started