Answered step by step

Verified Expert Solution

Question

1 Approved Answer

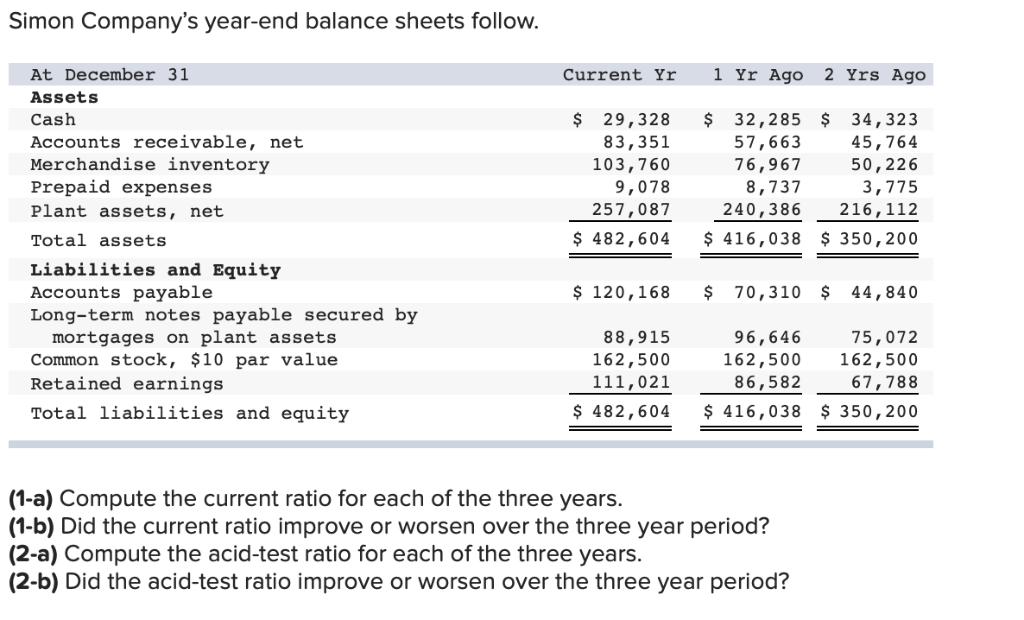

Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets $ 29,328 83,351 103,760 9,078 257,087

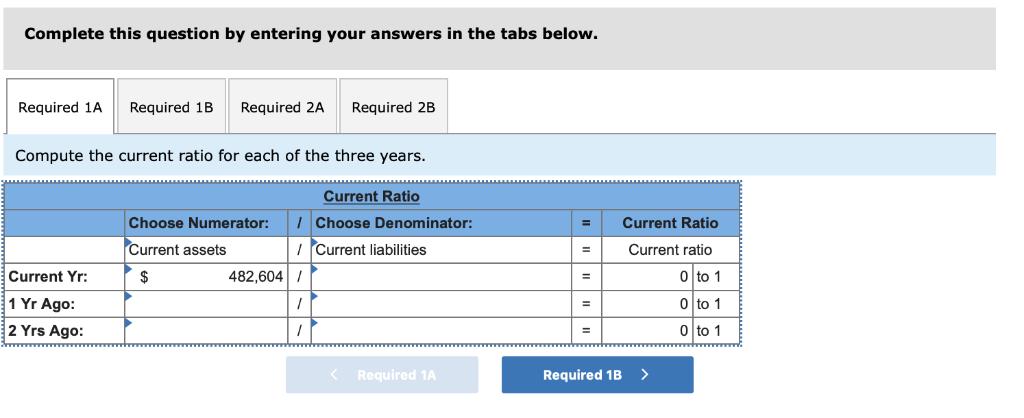

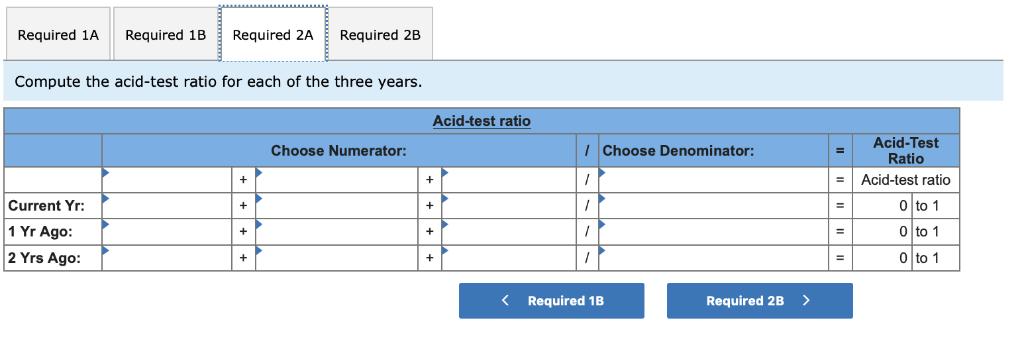

Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets $ 29,328 83,351 103,760 9,078 257,087 $ 32,285 $ 34,323 57,663 76,967 8,737 240,386 Cash 45,764 50,226 Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 3,775 216,112 Total assets $ 482,604 $ 416,038 $ 350,200 Liabilities and Equity Accounts payable $ 120,168 $ 70,310 $ 44,840 Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings 88,915 162,500 96,646 162,500 75,072 162,500 67,788 111,021 86,582 Total liabilities and equity $ 482,604 $ 416,038 $ 350,200 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Compute the current ratio for each of the three years. Current Ratio Choose Numerator: I Choose Denominator: Current Ratio %3D Current assets I Current liabilities Current ratio Current Yr: $ 482,604 / 0 to 1 %3D 1 Yr Ago: 0 to 1 %3D 2 Yrs Ago: 0 to 1 %3D < Required 1A Required 1B > Required 1A Required 1B Required 2A Required 2B Compute the acid-test ratio for each of the three years. Acid-test ratio I Choose Denominator: Acid-Test Ratio Choose Numerator: %3D Acid-test ratio + %3D Current Yr: O to 1 %3D 1 Yr Ago: 0 to 1 + %3D 2 Yrs Ago: o to 1 + + Required 1B Required 2B

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started