Question

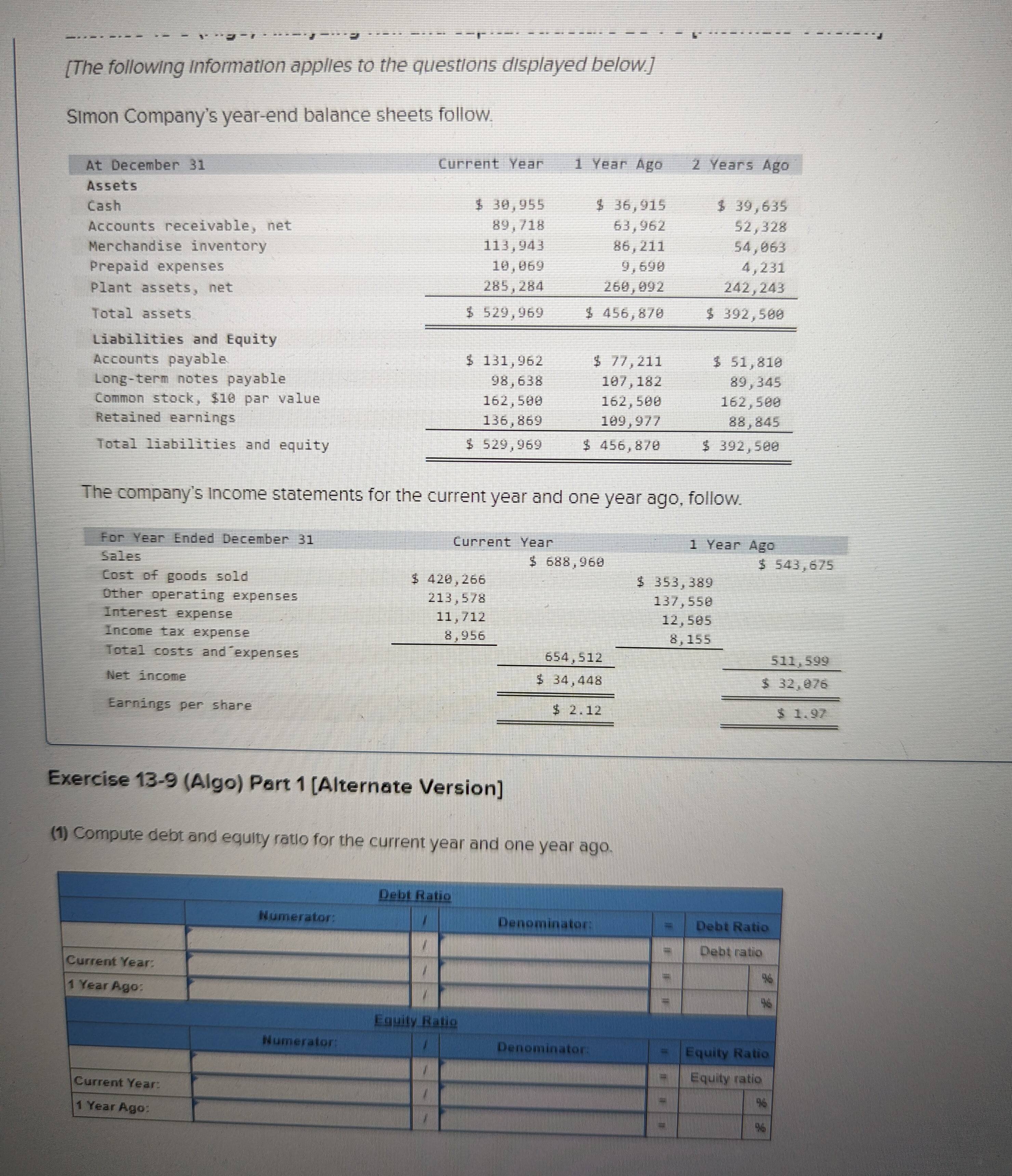

Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash $30,955 89,718 113,943 Accounts receivable, net

Simon Company's year-end balance sheets follow.

Current Year

1 Year Ago

2 Years Ago

At December 31

Assets

Cash

$30,955

89,718 113,943

Accounts receivable, net

$36,915

63,962

86,211

9,698

Merchandise inventory

Prepaid expenses

Plant assets, net

$39,635

52,328

54,863

4,231

242,243

10,869

285,284

268,892

Total assets

$529,969

$ 456,878

$392,588

$131,962

$ 77,211

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value Retained earnings

107,182

98,638

162,500

136,869

$ 51,818

89,345

162,500

162,500

199,977

88,845

Total liabilities and equity

$529,969

$ 456,878

$ 392,500

The company's Income statements for the current year and one year ago, follow.

For Year Ended December 31

Sales

Current Year

$ 588,960

420,266

213,578

1 Year Ago

$543,675

$353,389

137,558

Cost of goods sold

Other operating expenses

Interest expense

Income tax expense Totel costs and "expenses

11,712 8,956

12,50s

8,155

654,512

511,599

Net income

$ 34,448

$ 32,876

Earnings per share

$2.12

$1.97

Exercise 13-9 (Algo) Part 1 [Alternate Version]

(1) Compute debt and equity ratio for the current year and one year ago.

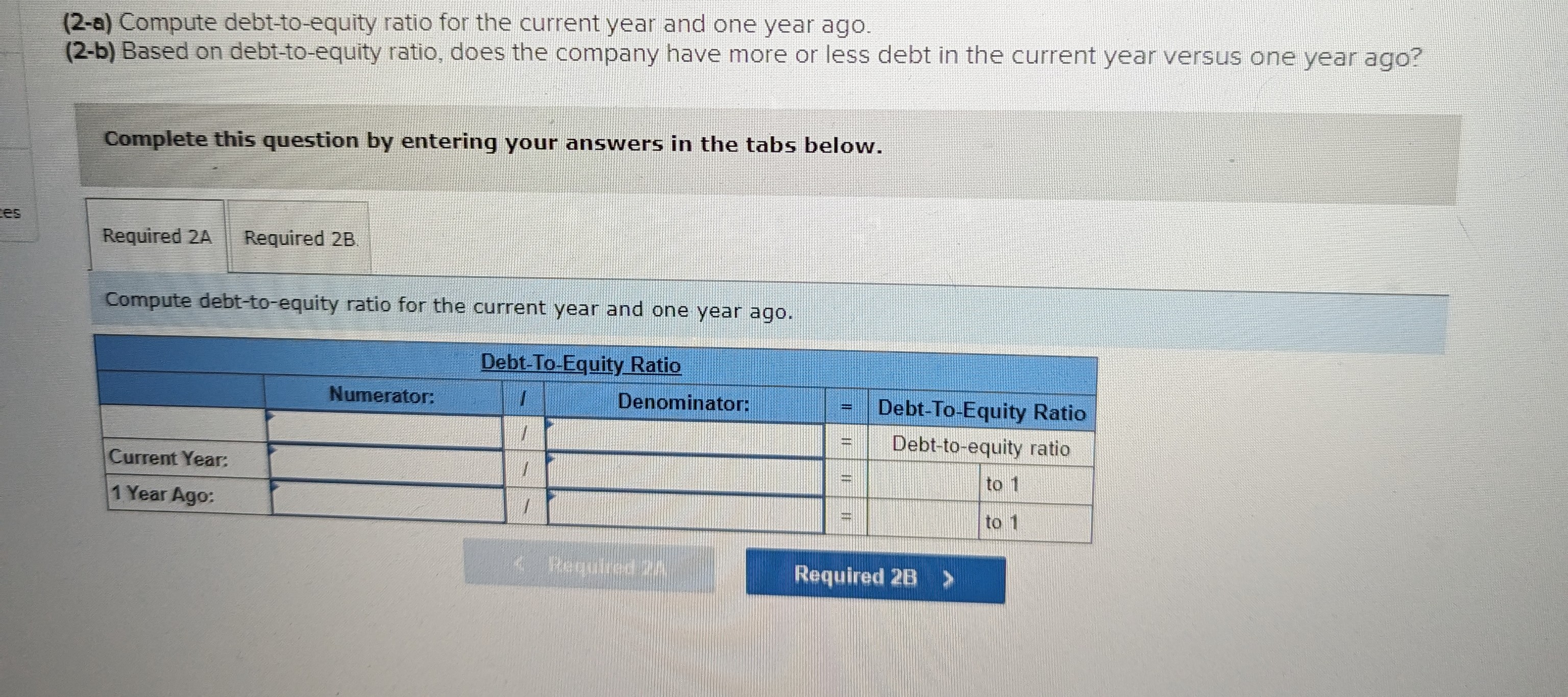

(2-a) Compute debt-to-equity ratio for the current year and one year ago.

(2-b) Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago?

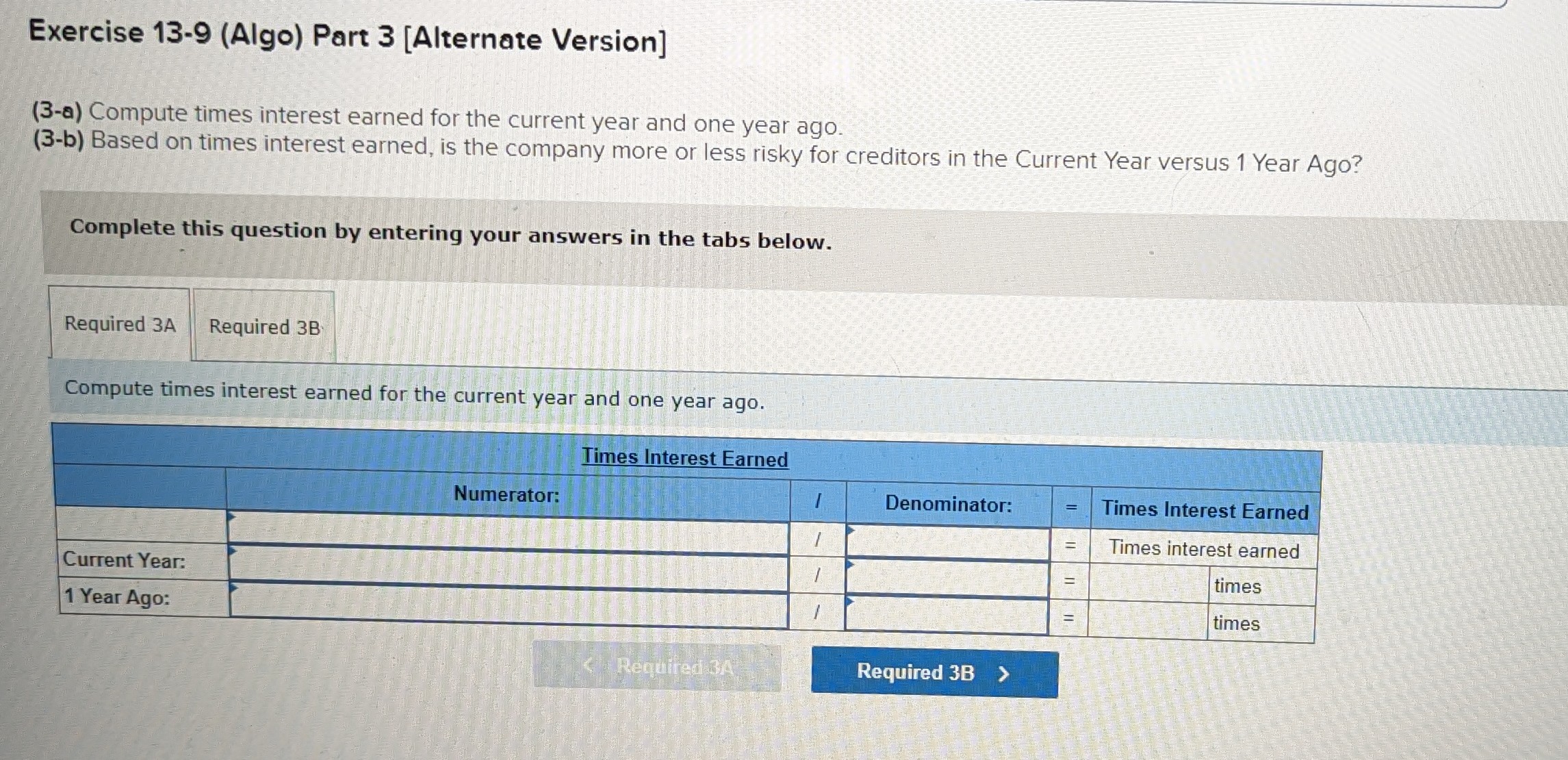

(3-a) Compute times interest earned for the current year and one year ago.

(3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started